18+ Hmrc money laundering risk assessment information

Home » money laundering Info » 18+ Hmrc money laundering risk assessment informationYour Hmrc money laundering risk assessment images are available. Hmrc money laundering risk assessment are a topic that is being searched for and liked by netizens now. You can Get the Hmrc money laundering risk assessment files here. Get all royalty-free photos.

If you’re searching for hmrc money laundering risk assessment images information linked to the hmrc money laundering risk assessment keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

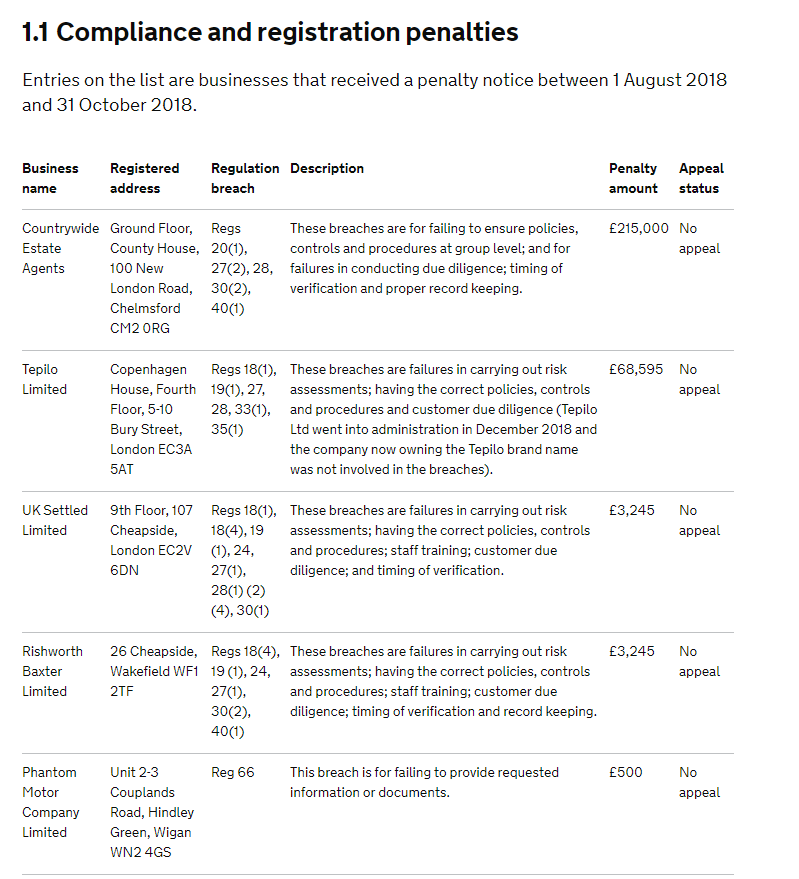

Hmrc Money Laundering Risk Assessment. When you assess the risks of money laundering that apply to your business you need to consider. Any accountant worth their salt and licence will complete anti-money laundering ID checks credit screens and a risk assessment for all new clients. Make assessing risk an ongoing process at your firm. Failing to adequately train staff.

Fine Or Fine Taxcalc From taxcalc.com

Fine Or Fine Taxcalc From taxcalc.com

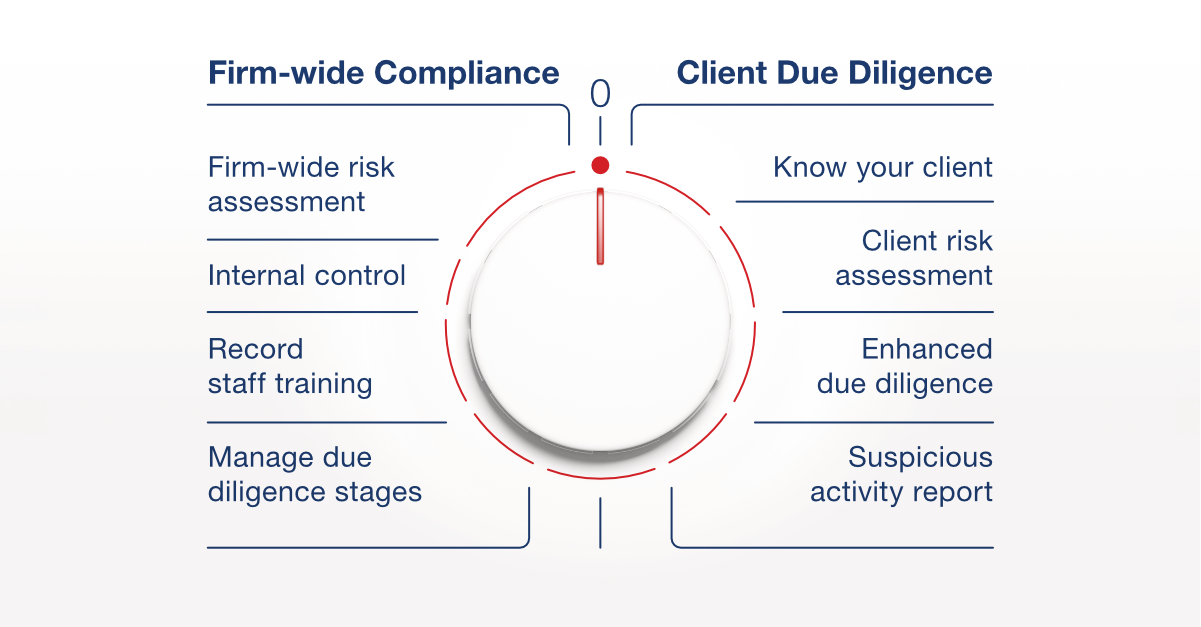

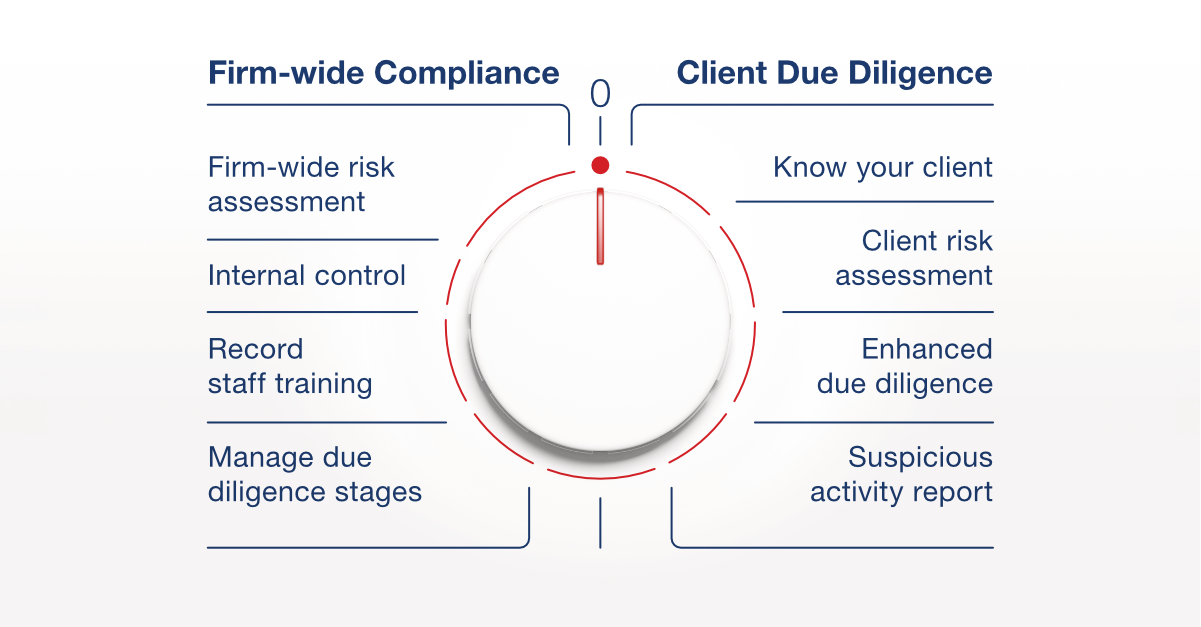

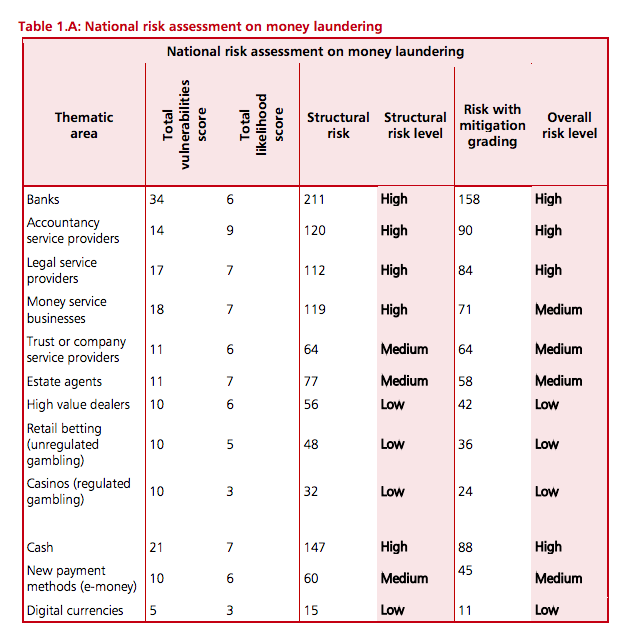

Make assessing risk an ongoing process at your firm. When you assess the risks of money laundering that apply to your business you need to consider. In its first risk assessment HMRC has identified the key areas where AMPs are most at risk of becoming involved in money laundering and also where they are at risk of breaching the Money. It also covers many of the supervisory authority requirements for the FCA and HMRC. HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments. Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering.

The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing.

As the supervisor for AMPs HMRC is obliged to share up-to-date information on money laundering with AMPs including information from its own risk assessment where appropriate any indicators of money laundering and details of circumstances which HMRC considers to be at high risk of money laundering. You are best placed to. Carry out a detailed risk assessment of. Basically the risk assessment document is a some sort of form no special format that is a list of things to look out for and ranking them all together to give you an idea if the client is low to high risk for potential money laundering activity. Money laundering supervision. Anti-money laundering risk assessments.

Source:

Enforcement measures - detailed guidance to enable businesses to have written risk assessment policies controls and procedures in place to prevent others using them to launder money or finance terrorism. When you assess the risks of money laundering that apply to your business you need to consider. The Money Laundering Regulations say about risk assessment. Money laundering supervision. Basically the risk assessment document is a some sort of form no special format that is a list of things to look out for and ranking them all together to give you an idea if the client is low to high risk for potential money laundering activity.

Source: vinciworks.com

Source: vinciworks.com

HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments. National risk assessment of money laundering and terrorist financing 2020. Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering. Put in place policies controls and procedures to reduce any risks of money laundering as identified. AML Risk Assessment Template AML Policy Template.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

When you assess the risks of money laundering that apply to your business you need to consider. AML Risk Assessment Template AML Policy Template. Not having the correct policies controls and procedures. National risk assessment of money laundering and terrorist financing 2020. The Money Laundering Regulations say about risk assessment.

Source: praxisifm.com

Source: praxisifm.com

National risk assessment of money laundering and terrorist financing 2020. Put in place policies controls and procedures to reduce any risks of money laundering as identified. National risk assessment of money laundering and terrorist financing 2020. See how your anti-money laundering risk assessment policies controls and procedures work have access to all the records and paperwork relating to your procedures speak to the right people. HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments.

Source: researchgate.net

Source: researchgate.net

Enforcement measures - detailed guidance to enable businesses to have written risk assessment policies controls and procedures in place to prevent others using them to launder money or finance terrorism. AML Risk Assessment Template AML Policy Template. National risk assessment of money laundering and terrorist financing 2020. Have you looked at the HMRC website. Businesses are also required to report suspicious transactions to the National Crime Agency NCA meet their obligations.

Source: taxcalc.com

Source: taxcalc.com

Hope the link works. The conclusion should include a short narrative in support of the conclusion. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17. It also covers many of the supervisory authority requirements for the FCA and HMRC. Enforcement measures - detailed guidance to enable businesses to have written risk assessment policies controls and procedures in place to prevent others using them to launder money or finance terrorism.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

The supervisory authorities advise that once a firm has completed their money laundering risk assessment they will then need to. HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments. Put in place policies controls and procedures to reduce any risks of money laundering as identified. National risk assessment of money laundering and terrorist financing 2020. The Money Laundering Regulations say about risk assessment.

Source: youtube.com

Source: youtube.com

In its first risk assessment HMRC has identified the key areas where AMPs are most at risk of becoming involved in money laundering and also where they are at risk of breaching the Money. But the risk of money laundering doesnt just go away after onboarding. How to carry out a risk assessment. The Money Laundering Regulations say about risk assessment. Make assessing risk an ongoing process at your firm.

Source: fcscompliance.co.uk

Source: fcscompliance.co.uk

Make assessing risk an ongoing process at your firm. IMAS Guidance to Assessing Money Laundering and Financing of Terrorism MLFT. But the risk of money laundering doesnt just go away after onboarding. When you assess the risks of money laundering that apply to your business you need to consider. The supervisory authorities advise that once a firm has completed their money laundering risk assessment they will then need to.

Source: getpropertycompliant.co.uk

Source: getpropertycompliant.co.uk

Hope the link works. The types of customer you have. Businesses are also required to report suspicious transactions to the National Crime Agency NCA meet their obligations. AML Risk Assessment Template AML Policy Template. Not having the correct policies controls and procedures.

Source: twitter.com

Source: twitter.com

Put in place policies controls and procedures to reduce any risks of money laundering as identified. Anti-money laundering risk assessments. Put in place policies controls and procedures to reduce any risks of money laundering as identified. Businesses need to do about identifying and assessing risk. Carry out a detailed risk assessment of.

Source: service.betterregulation.com

Source: service.betterregulation.com

National risk assessment of money laundering and terrorist financing 2020. You are best placed to. Basically the risk assessment document is a some sort of form no special format that is a list of things to look out for and ranking them all together to give you an idea if the client is low to high risk for potential money laundering activity. See how your anti-money laundering risk assessment policies controls and procedures work have access to all the records and paperwork relating to your procedures speak to the right people. The Money Laundering Risk Assessment Template is included with our AML Policy Template MLRO form.

Source: legislation.gov.uk

Source: legislation.gov.uk

Failing to undertake adequate customer due diligence. Any accountant worth their salt and licence will complete anti-money laundering ID checks credit screens and a risk assessment for all new clients. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17. The Money Laundering Regulations say about risk assessment. Not having the correct policies controls and procedures.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hmrc money laundering risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas