10+ How to become a kyc analyst ideas in 2021

Home » money laundering Info » 10+ How to become a kyc analyst ideas in 2021Your How to become a kyc analyst images are ready. How to become a kyc analyst are a topic that is being searched for and liked by netizens now. You can Get the How to become a kyc analyst files here. Download all royalty-free photos and vectors.

If you’re searching for how to become a kyc analyst pictures information linked to the how to become a kyc analyst interest, you have pay a visit to the right site. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

How To Become A Kyc Analyst. Guide the recruiter to the conclusion that you are the best candidate for the kyc analyst job. What is important however is a good command of English and Dutch or French. Finally certain soft skills are highly sought after such as rigour analytical mindset and good interpersonal skills. The AML Operations Career Path Upon entry you will likely have accepted a.

Microsoft Excel Masterclass For Business Managers Microsoft Excel Learning Microsoft Master Class From pinterest.com

Microsoft Excel Masterclass For Business Managers Microsoft Excel Learning Microsoft Master Class From pinterest.com

Or you must have a more than one year experience in other companies that are related to financing business. Finally certain soft skills are highly sought after such as rigour analytical mindset and good interpersonal skills. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. CAMS or any other KYC registration agency and the knowledge of the jurisdictional specifics a good KYC analyst should be a. Upon successfully completing this programme KYC analysts can conduct moderately complex KYC investigations and determine ML risk profiles with limited supervision. An introduction to CDD frameworks and an overview of the practical components of working with in the KYC environment.

The ICA Certificate in KYC and CDD is an online training course provides a foundation knowledge of core know your customer KYC and customer due diligence CDD concepts an introduction to CDD frameworks and an overview of the key components of working in the KYC environment.

Or you must have a more than one year experience in other companies that are related to financing business. Upon successfully completing this programme KYC analysts can conduct moderately complex KYC investigations and determine ML risk profiles with limited supervision. Your law degree is a good asset to your portfolio and you should go beyond. This role involves a lot of data integration and analysis work so someone with these abilities is essential. When applying a risk-based approach to KYC - a key ingredient in all KYC Policies - there is often space for an Analyst to develop creative alternatives to overcome obstacles that are blocking progress. Apart from withholding the relevant education Accounting Finance or Business Administration or certification e.

Source: walterspeople.be

Source: walterspeople.be

Intermediate KYC Skills Programme a two-week programme for KYC analysts with 6-12 months of junior analyst experience that focuses on deepening practical KYC and ML risk assessment skills. Sound analytical problem solving and organizational skills It would also help to have some kind of AML vendor knowledge. KYC Analysts in Tampa Florida and Jacksonville Florida report salaries of 65000 and 60000 respectively. Here is what the general landscape looks like from the perspective of a 16 year career AML practitioner. The day to day activities of an analyst depends on which role you have but generally you would be involved in the collating of risk factors associated with a customer and assessing the risk to the bank.

Source: pinterest.com

Source: pinterest.com

The ICA Certificate in KYC and CDD is an online training course provides a foundation knowledge of core know your customer KYC and customer due diligence CDD concepts an introduction to CDD frameworks and an overview of the key components of working in the KYC environment. Intermediate analysts - those with 1 - 3 years of practical experience and Level 3. The ICA Certificate in KYC and CDD is an online training course provides a foundation knowledge of core know your customer KYC and customer due diligence CDD concepts an introduction to CDD frameworks and an overview of the key components of working in the KYC environment. CAMS or any other KYC registration agency and the knowledge of the jurisdictional specifics a good KYC analyst should be a. This role involves a lot of data integration and analysis work so someone with these abilities is essential.

Source: youtube.com

Source: youtube.com

KYC Analysts in Tampa Florida and Jacksonville Florida report salaries of 65000 and 60000 respectively. Finally certain soft skills are highly sought after such as rigour analytical mindset and good interpersonal skills. This way you can position yourself in the best way to get hired. An introduction to CDD frameworks and an overview of the practical components of working with in the KYC environment. Good reporting and observational skills are also required as are time management communication and decision-making.

Source: pinterest.com

Source: pinterest.com

Educational Requirements of a KYC Analyst To be able to be qualified as a KYC Analyst heshe should graduate a bachelor degree. KYC Analysts in New York City have reported salaries as high as 103000. Good reporting and observational skills are also required as are time management communication and decision-making. Finally certain soft skills are highly sought after such as rigour analytical mindset and good interpersonal skills. Starters to analysts with approximately 1 year of practical experience.

Source: fr.pinterest.com

Source: fr.pinterest.com

This can be across high risk relationships industrys etc. KYC Analysts in Tampa Florida and Jacksonville Florida report salaries of 65000 and 60000 respectively. Courses that are related to the job of KYC Analyst. The day to day activities of an analyst depends on which role you have but generally you would be involved in the collating of risk factors associated with a customer and assessing the risk to the bank. This role involves a lot of data integration and analysis work so someone with these abilities is essential.

Source: acamstoday.org

Source: acamstoday.org

According to online resources the national average salary of a KYC Analyst is 49679 and a maximum average salary for this occupation is about 67000. KYC Analysts in Tampa Florida and Jacksonville Florida report salaries of 65000 and 60000 respectively. Upon successfully completing this programme KYC analysts can conduct moderately complex KYC investigations and determine ML risk profiles with limited supervision. Top skills for KYC Analysts listed on the most successful example resumes are business flair marketing expertise research skills multitasking time management presentation and communication skills and computer competencies. Senior analysts - your experienced KYC risk sentinels whose task it is to provide day-to-day guidance to the team based on thorough subject matter knowledge with a focus on leadership skills.

Source: pinterest.com

Source: pinterest.com

What skills does a KYC Analyst need. What skills does a KYC Analyst need. Top skills for KYC Analysts listed on the most successful example resumes are business flair marketing expertise research skills multitasking time management presentation and communication skills and computer competencies. What is important however is a good command of English and Dutch or French. Your law degree is a good asset to your portfolio and you should go beyond.

Source: youtube.com

Source: youtube.com

Sound analytical problem solving and organizational skills It would also help to have some kind of AML vendor knowledge. Senior analysts - your experienced KYC risk sentinels whose task it is to provide day-to-day guidance to the team based on thorough subject matter knowledge with a focus on leadership skills. The AML Operations Career Path Upon entry you will likely have accepted a. The ICA Certificate in KYC and CDD is an online training course provides a foundation knowledge of core know your customer KYC and customer due diligence CDD concepts an introduction to CDD frameworks and an overview of the key components of working in the KYC environment. A great KYC Analyst will regularly apply a dose of pragmatism and demonstrate a realistic approach to issues based on practical considerations.

Source: pinterest.com

Source: pinterest.com

When applying a risk-based approach to KYC - a key ingredient in all KYC Policies - there is often space for an Analyst to develop creative alternatives to overcome obstacles that are blocking progress. When applying a risk-based approach to KYC - a key ingredient in all KYC Policies - there is often space for an Analyst to develop creative alternatives to overcome obstacles that are blocking progress. Senior analysts - your experienced KYC risk sentinels whose task it is to provide day-to-day guidance to the team based on thorough subject matter knowledge with a focus on leadership skills. Good reporting and observational skills are also required as are time management communication and decision-making. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments.

Source: pinterest.com

Source: pinterest.com

This role involves a lot of data integration and analysis work so someone with these abilities is essential. The AML Operations Career Path Upon entry you will likely have accepted a. Apart from withholding the relevant education Accounting Finance or Business Administration or certification e. What is important however is a good command of English and Dutch or French. Sound analytical problem solving and organizational skills It would also help to have some kind of AML vendor knowledge.

Source: pinterest.com

Source: pinterest.com

Good reporting and observational skills are also required as are time management communication and decision-making. This way you can position yourself in the best way to get hired. What skills does a KYC Analyst need. Apart from withholding the relevant education Accounting Finance or Business Administration or certification e. Its actually very simple.

Source: pinterest.com

Source: pinterest.com

Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. Your law degree is a good asset to your portfolio and you should go beyond. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. Senior analysts - your experienced KYC risk sentinels whose task it is to provide day-to-day guidance to the team based on thorough subject matter knowledge with a focus on leadership skills. According to online resources the national average salary of a KYC Analyst is 49679 and a maximum average salary for this occupation is about 67000.

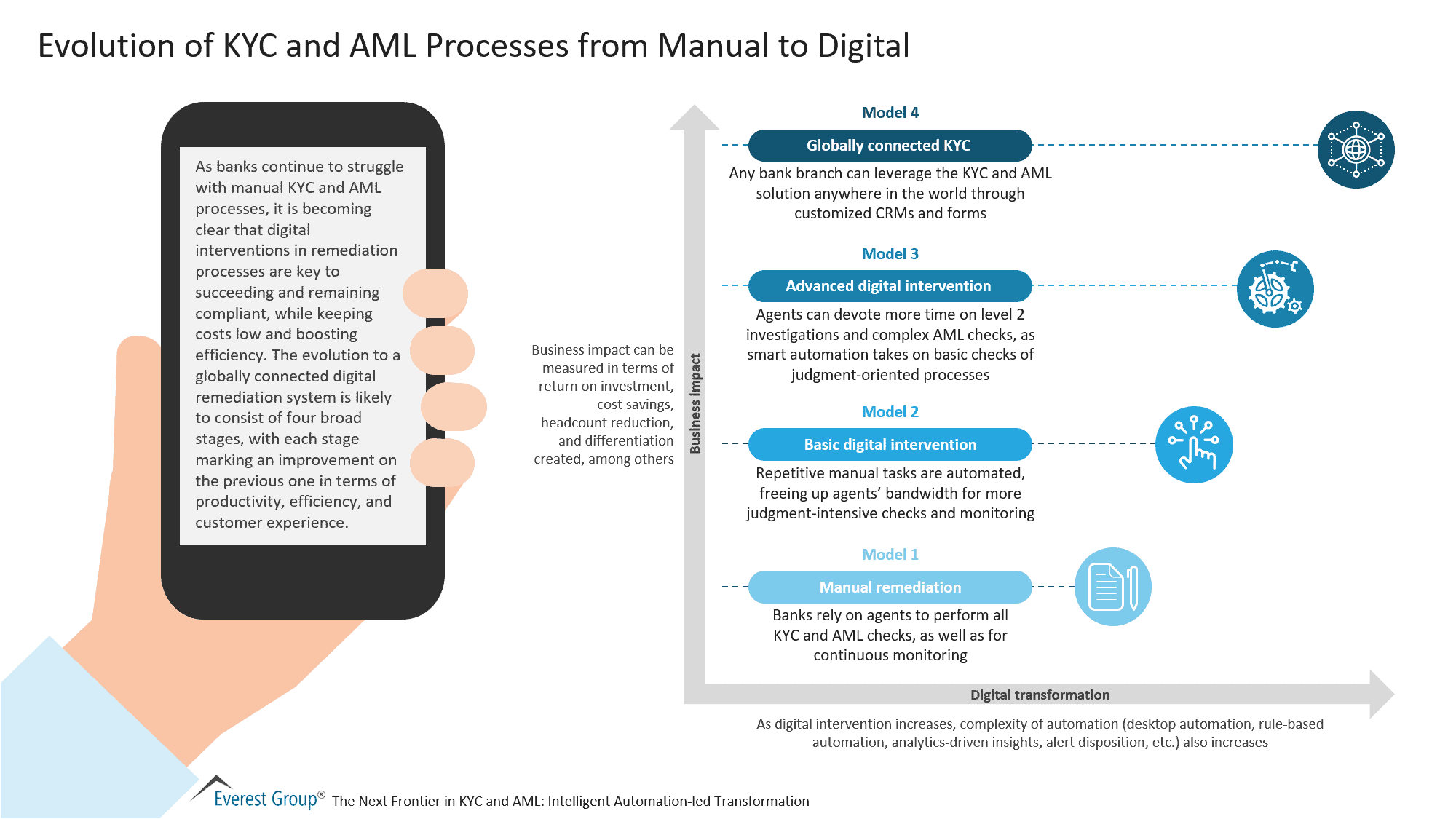

Source: everestgrp.com

Source: everestgrp.com

Educational Requirements of a KYC Analyst To be able to be qualified as a KYC Analyst heshe should graduate a bachelor degree. Or you must have a more than one year experience in other companies that are related to financing business. CAMS or any other KYC registration agency and the knowledge of the jurisdictional specifics a good KYC analyst should be a. The course is suitable for new entrants compliance professionals. This role involves a lot of data integration and analysis work so someone with these abilities is essential.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to become a kyc analyst by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas