18+ How to control money laundering in pakistan info

Home » money laundering idea » 18+ How to control money laundering in pakistan infoYour How to control money laundering in pakistan images are ready in this website. How to control money laundering in pakistan are a topic that is being searched for and liked by netizens now. You can Find and Download the How to control money laundering in pakistan files here. Find and Download all free photos and vectors.

If you’re searching for how to control money laundering in pakistan images information connected with to the how to control money laundering in pakistan interest, you have visit the ideal site. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

How To Control Money Laundering In Pakistan. The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO. The Anti-Money Laundering Act 2010 the Act is the primary law governing the prevention of money laundering and combatting the financing of terrorism. 11 What is the legal authority to prosecute money laundering at the national level. In order to curb money laundering the regulatory authorities of Pakistan also introduced anti-money laundering measures in the shape of regulations.

Pdf Anti Money Laundering Regulations And Its Effectiveness From researchgate.net

Pdf Anti Money Laundering Regulations And Its Effectiveness From researchgate.net

A brief on Anti Money Laundering. This page provides a thematic compilation of information relating to measures taken by States parties to prevent money laundering. Make thorough checks on the identity of a client trading partner or anyone else involved in moving money into out of or around your company. Pakistan has implemented many of the domestic rules ie. In 2003 the State Bank of Pakistan SBP which is the regulator of monetary and credit system in Pakistan issued its Prudential Regulations M1 to M5 to safeguard the banksfinancial institutions from the threat of money laundering. There needs to be reputable law and order particularly when it comes to the prevention of financial crime like money laundering so as to give confidence to overseas investors and.

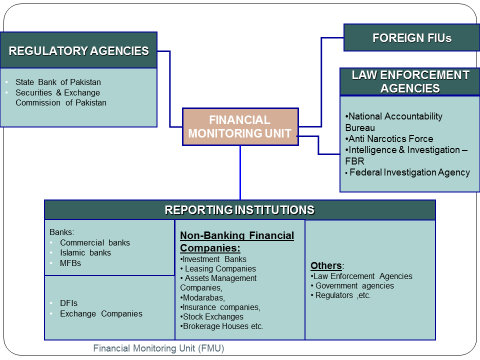

The FMU serves as Pakistans FIU and is in charge of handling Suspicious Transaction Reports STRs.

This page provides a thematic compilation of information relating to measures taken by States parties to prevent money laundering. The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO. 1170 12018 dated 1st October 2018. The FMU serves as Pakistans FIU and is in charge of handling Suspicious Transaction Reports STRs. Narcotics Money laundering Law Criminalizes Terrorist Financing KYC Know Your Customer Regulation Large Currency Transaction Reporting Suspicion Transaction Reporting Bank Record Retention Cross Border Currency transaction requirements the main reason is to tighten its policies against money laundering and terrorist financing and also to strengthen its financial sector to some extent Pakistani. Effective Steps Taken By FBR Customs Operations to Curb Money Laundering The Operations arm of Pakistan Customs has taken vigorous actions to counter illicit movement of currency which is the primary tool used for money laundering and moving proceeds of crime in and out of the country.

Source:

Pressure by FATF to Convert Ordinance. But since then it has improved. In June 2018 Pakistan was again placed under the watch-list due to the gaps in its Anti Money Laundering AML Counter Terrorist Financing CFT compliance regimes. There needs to be reputable law and order particularly when it comes to the prevention of financial crime like money laundering so as to give confidence to overseas investors and. Under the Ordinance the Financial Monitoring Unit FMU is created.

Source: researchgate.net

Source: researchgate.net

The information provided below was produced in the context of the meetings of the Open-ended Intergovernmental Working Group on Prevention and is drawn from official reports produced by the Secretariat of the Working. 770 12018 dated 13 June 2018 Regulations and subsequently amended vide SRO. 1170 12018 dated 1st October 2018. The information provided below was produced in the context of the meetings of the Open-ended Intergovernmental Working Group on Prevention and is drawn from official reports produced by the Secretariat of the Working. In 2007 Pakistan enacted the AML Ordinance establishing regulations for AML and combating the financing of terrorism and criminalizing money laundering.

Source: bi.go.id

Source: bi.go.id

Effective Steps Taken By FBR Customs Operations to Curb Money Laundering The Operations arm of Pakistan Customs has taken vigorous actions to counter illicit movement of currency which is the primary tool used for money laundering and moving proceeds of crime in and out of the country. The State Bank of Pakistan SBP has directed all the exchange companies EC to meticulously follow the requirements of Anti-Money Laundering AML Countering Financing of Terrorism CFT regime by submitting Suspicious Transaction Reports STRs and Currency Transaction Reports CTRs manually or electronically as per Section 7 of AML Act 2010 directly to the Financial Monitoring Unit FMU. In 2003 the State Bank of Pakistan SBP which is the regulator of monetary and credit system in Pakistan issued its Prudential Regulations M1 to M5 to safeguard the banksfinancial institutions from the threat of money laundering. The incumbent Pakistan government is attaching due importance to controlling and eliminating money laundering. In 2007 Pakistan enacted the AML Ordinance establishing regulations for AML and combating the financing of terrorism and criminalizing money laundering.

Source: jamapunji.pk

Source: jamapunji.pk

The incumbent Pakistan government is attaching due importance to controlling and eliminating money laundering. Another novel way to launder money is to convert Pakistani rupees received as bribe into foreign currency of higher value such as US Dollars or Euros. The incumbent Pakistan government is attaching due importance to controlling and eliminating money laundering. The Anti-Money Laundering Act 2010 the Act is the primary law governing the prevention of money laundering and combatting the financing of terrorism. Under the Ordinance the Financial Monitoring Unit FMU is created.

Source: intosaijournal.org

Source: intosaijournal.org

The Act thereby replaces the 2007 AML Ordinance. In 2003 the State Bank of Pakistan SBP which is the regulator of monetary and credit system in Pakistan issued its Prudential Regulations M1 to M5 to safeguard the banksfinancial institutions from the threat of money laundering. In June 2018 Pakistan was again placed under the watch-list due to the gaps in its Anti Money Laundering AML Counter Terrorist Financing CFT compliance regimes. There needs to be reputable law and order particularly when it comes to the prevention of financial crime like money laundering so as to give confidence to overseas investors and. The information provided below was produced in the context of the meetings of the Open-ended Intergovernmental Working Group on Prevention and is drawn from official reports produced by the Secretariat of the Working.

Source: archive.pakistantoday.com.pk

Source: archive.pakistantoday.com.pk

In 2003 the State Bank of Pakistan SBP which is the regulator of monetary and credit system in Pakistan issued its Prudential Regulations M1 to M5 to safeguard the banksfinancial institutions from the threat of money laundering. The Act as federal legislation is applicable all over Pakistan. In June 2018 Pakistan was again placed under the watch-list due to the gaps in its Anti Money Laundering AML Counter Terrorist Financing CFT compliance regimes. The Anti-Money Laundering Act 2010 the Act is the primary law governing the prevention of money laundering and combatting the financing of terrorism. In 2019 the regional partner of FATF identified problems in Pakistans anti-money laundering measures.

Source: dailytimes.com.pk

Source: dailytimes.com.pk

The Act as federal legislation is applicable all over Pakistan. The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO. Another novel way to launder money is to convert Pakistani rupees received as bribe into foreign currency of higher value such as US Dollars or Euros. The Anti-Money Laundering Act 2010 the Act is the primary law governing the prevention of money laundering and combatting the financing of terrorism. The State Bank of Pakistan SBP has directed all the exchange companies EC to meticulously follow the requirements of Anti-Money Laundering AML Countering Financing of Terrorism CFT regime by submitting Suspicious Transaction Reports STRs and Currency Transaction Reports CTRs manually or electronically as per Section 7 of AML Act 2010 directly to the Financial Monitoring Unit FMU.

Source: dailytimes.com.pk

Source: dailytimes.com.pk

Pressure by FATF to Convert Ordinance. Narcotics Money laundering Law Criminalizes Terrorist Financing KYC Know Your Customer Regulation Large Currency Transaction Reporting Suspicion Transaction Reporting Bank Record Retention Cross Border Currency transaction requirements the main reason is to tighten its policies against money laundering and terrorist financing and also to strengthen its financial sector to some extent Pakistani. In June 2018 Pakistan was again placed under the watch-list due to the gaps in its Anti Money Laundering AML Counter Terrorist Financing CFT compliance regimes. Oct 12 2013 Ordinance was passed further amendments The Financial Action Task Force FATF has given timeframe till June 2014 to Pakistan to amend further the money laundering laws as well as Anti-Terrorism Act to incorporate the content of the ordinance before the February 2014 meetings. Pakistan was first placed on a list of jurisdictions with strategic deficiencies also known as the grey list in 2008 and thereafter from 2012 to 2015.

Source: slideshare.net

Source: slideshare.net

There remains risk of money laundering. Another novel way to launder money is to convert Pakistani rupees received as bribe into foreign currency of higher value such as US Dollars or Euros. There needs to be reputable law and order particularly when it comes to the prevention of financial crime like money laundering so as to give confidence to overseas investors and. Make thorough checks on the identity of a client trading partner or anyone else involved in moving money into out of or around your company. The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO.

Source: dawn.com

Source: dawn.com

Under the Ordinance the Financial Monitoring Unit FMU is created. The Act thereby replaces the 2007 AML Ordinance. 1170 12018 dated 1st October 2018. The FMU serves as Pakistans FIU and is in charge of handling Suspicious Transaction Reports STRs. The Act as federal legislation is applicable all over Pakistan.

Source: iclg.com

Source: iclg.com

Make thorough checks on the identity of a client trading partner or anyone else involved in moving money into out of or around your company. Pressure by FATF to Convert Ordinance. The Act as federal legislation is applicable all over Pakistan. The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO. Narcotics Money laundering Law Criminalizes Terrorist Financing KYC Know Your Customer Regulation Large Currency Transaction Reporting Suspicion Transaction Reporting Bank Record Retention Cross Border Currency transaction requirements the main reason is to tighten its policies against money laundering and terrorist financing and also to strengthen its financial sector to some extent Pakistani.

Source: researchgate.net

Source: researchgate.net

770 12018 dated 13 June 2018 Regulations and subsequently amended vide SRO. The Act as federal legislation is applicable all over Pakistan. Devise a clear anti-money laundering policy and appoint an anti-money laundering officer who is aware of the companys legal obligations to report anything suspicious to the authorities. A brief on Anti Money Laundering. Pakistan has implemented many of the domestic rules ie.

Source: voanews.com

Source: voanews.com

This page provides a thematic compilation of information relating to measures taken by States parties to prevent money laundering. Pakistan has implemented many of the domestic rules ie. Oct 12 2013 Ordinance was passed further amendments The Financial Action Task Force FATF has given timeframe till June 2014 to Pakistan to amend further the money laundering laws as well as Anti-Terrorism Act to incorporate the content of the ordinance before the February 2014 meetings. The Act as federal legislation is applicable all over Pakistan. 770 12018 dated 13 June 2018 Regulations and subsequently amended vide SRO.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to control money laundering in pakistan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information