17++ How to identify suspicious activity money laundering information

Home » money laundering idea » 17++ How to identify suspicious activity money laundering informationYour How to identify suspicious activity money laundering images are ready in this website. How to identify suspicious activity money laundering are a topic that is being searched for and liked by netizens now. You can Download the How to identify suspicious activity money laundering files here. Download all royalty-free images.

If you’re searching for how to identify suspicious activity money laundering pictures information related to the how to identify suspicious activity money laundering keyword, you have pay a visit to the right site. Our website frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

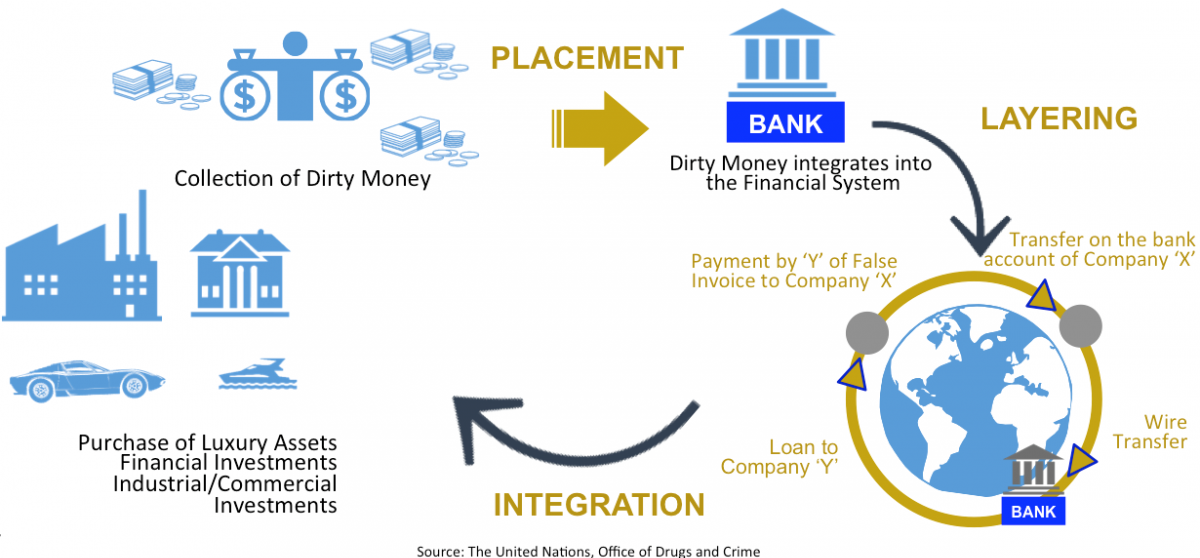

How To Identify Suspicious Activity Money Laundering. Consider the SAFE approach which. A SAR is required when there is knowledge or suspicion of money laundering or there are reasonable grounds to know or suspect that money laundering activities are taking place. Its well-known that money laundering can often involve foreign banks and legitimate businessesso how do banks actively prevent money laundering from happening. The new course takes the user on a scenario-based journey to learning to identify suspicious activity.

How To Identify Unusual Or Suspicious Transactions From piranirisk.com

How To Identify Unusual Or Suspicious Transactions From piranirisk.com

In monitoring and detecting any suspicious money laundering activities FIs are benefitting from data analytics technology. The investigation and Suspicious Activity Reports showed the target structured 500000 in third-party and payroll checks into two of his personal accounts and subsequently wire transferred. The intention was to provide an investigator with a series of predetermined tests or analyses that visualize a subset of transactions. A SAR is required when there is knowledge or suspicion of money laundering or there are reasonable grounds to know or suspect that money laundering activities are taking place. Proceeds of these. Unjustified large cash deposits or constantly large balances.

Consider the SAFE approach which.

1960 Unlicensed Money Service Business and 18 USC. In monitoring and detecting any suspicious money laundering activities FIs are benefitting from data analytics technology. Following on from the success of our flagship AML training suite VinciWorks has recently released a new course on anti-money laundering. By identifying the financial transactions of the victim law enforcement may be able to identify the individuals higher up in the criminal organization who are laundering the proceeds of the human. A prototype application AML 2 ink was developed to explore visualization techniques for identifying suspicious money transactions. Proceeds of these.

Source: researchgate.net

Source: researchgate.net

Using data visualization to identify suspicious activity Annually money laundering activities threaten the global economy. A SAR is required when there is knowledge or suspicion of money laundering or there are reasonable grounds to know or suspect that money laundering activities are taking place. Its well-known that money laundering can often involve foreign banks and legitimate businessesso how do banks actively prevent money laundering from happening. Unusual transactions or activity compared to their normal dealings. FIs are expected to conduct strict and effective control processes ensuring their internal validation procedures work properly and their alert mechanisms run smoothly in detecting any suspicious activity.

An effective systemic approach to identify suspicious financial activity may safeguard you and your institution business or profession from the risk of being involved with terrorist financing and money laundering crimes. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the financial intelligence gathered from SARs. By identifying the financial transactions of the victim law enforcement may be able to identify the individuals higher up in the criminal organization who are laundering the proceeds of the human. FIs are expected to conduct strict and effective control processes ensuring their internal validation procedures work properly and their alert mechanisms run smoothly in detecting any suspicious activity. Anti-money laundering is a way for banks and other financial institutions to detect suspicious activity.

Source: pinterest.com

Source: pinterest.com

This study demonstrated the feasibility of detecting money laundering activities based on visualization of monetary transactions. Suspicious transaction reporting is internationally recognized as a cornerstone of any anti-money laundering regime. Following on from the success of our flagship AML training suite VinciWorks has recently released a new course on anti-money laundering. Unjustified large cash deposits or constantly large balances. In the fall of 2003 Bureau of Immigration and Customs Enforcement agents arrested the main target for violations of 18 USC.

Source: bi.go.id

FIs are expected to conduct strict and effective control processes ensuring their internal validation procedures work properly and their alert mechanisms run smoothly in detecting any suspicious activity. 1960 Unlicensed Money Service Business and 18 USC. The investigation and Suspicious Activity Reports showed the target structured 500000 in third-party and payroll checks into two of his personal accounts and subsequently wire transferred. A prototype application AML 2 ink was developed to explore visualization techniques for identifying suspicious money transactions. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the financial intelligence gathered from SARs.

Source: researchgate.net

Source: researchgate.net

What is reasonable is an objective test but it is understood as being the standard behaviour expected of someone with their qualifications experience and expertise. Unusual transactions or activity compared to their normal dealings. The intention was to provide an investigator with a series of predetermined tests or analyses that visualize a subset of transactions. Suspicious transaction reports are an invaluable source of financial intelligence and law enforcement encourages the submission of well considered reports. Banks use a number of methods to identify potentially suspicious activity including but not limited to activity identified by employees during day-to-day operations law enforcement inquiries or requests such as those typically seen in section 314a and section 314b.

Source: researchgate.net

Source: researchgate.net

The intention was to provide an investigator with a series of predetermined tests or analyses that visualize a subset of transactions. Banks use a number of methods to identify potentially suspicious activity including but not limited to activity identified by employees during day-to-day operations law enforcement inquiries or requests such as those typically seen in section 314a and section 314b. An effective systemic approach to identify suspicious financial activity may safeguard you and your institution business or profession from the risk of being involved with terrorist financing and money laundering crimes. Following on from the success of our flagship AML training suite VinciWorks has recently released a new course on anti-money laundering. FIs are expected to conduct strict and effective control processes ensuring their internal validation procedures work properly and their alert mechanisms run smoothly in detecting any suspicious activity.

Source: bi.go.id

Source: bi.go.id

Download Citation Anti-Money Laundering. A SAR is required when there is knowledge or suspicion of money laundering or there are reasonable grounds to know or suspect that money laundering activities are taking place. Unusual transactions or activity compared to their normal dealings. The new course takes the user on a scenario-based journey to learning to identify suspicious activity. Request to borrow against assets held by the institution or a third party where the origin of the assets in not known or the assets are inconsistent with the customers standing.

Source: chaussureslouboutin-soldes.fr

Source: chaussureslouboutin-soldes.fr

The course is compliant with the recently implemented Fourth Money Laundering Directive and allows users to track their progress via. Using data visualization to identify suspicious activity Annually money laundering activities threaten the global economy. FIs are expected to conduct strict and effective control processes ensuring their internal validation procedures work properly and their alert mechanisms run smoothly in detecting any suspicious activity. Money Laundering by secured and unsecured lending customers who repay problem loans unexpectedly. The intention was to provide an investigator with a series of predetermined tests or analyses that visualize a subset of transactions.

Source: piranirisk.com

Source: piranirisk.com

A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. The nominated officer must normally suspend the transaction if they suspect money laundering or terrorist financing. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. Banks use a number of methods to identify potentially suspicious activity including but not limited to activity identified by employees during day-to-day operations law enforcement inquiries or requests such as those typically seen in section 314a and section 314b. A SAR is required when there is knowledge or suspicion of money laundering or there are reasonable grounds to know or suspect that money laundering activities are taking place.

Source: researchgate.net

Source: researchgate.net

This study demonstrated the feasibility of detecting money laundering activities based on visualization of monetary transactions. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the financial intelligence gathered from SARs. FIs are expected to conduct strict and effective control processes ensuring their internal validation procedures work properly and their alert mechanisms run smoothly in detecting any suspicious activity. Suspicious transaction reporting is internationally recognized as a cornerstone of any anti-money laundering regime. In monitoring and detecting any suspicious money laundering activities FIs are benefitting from data analytics technology.

Source: bi.go.id

Source: bi.go.id

The investigation and Suspicious Activity Reports showed the target structured 500000 in third-party and payroll checks into two of his personal accounts and subsequently wire transferred. Suspicious transaction reports are an invaluable source of financial intelligence and law enforcement encourages the submission of well considered reports. Anti-money laundering is a way for banks and other financial institutions to detect suspicious activity. Identifying suspicious account activity and submitting suspicious transaction reports are valuable tools in identifying and bringing human trafficking schemes to law enforcements attention. The investigation and Suspicious Activity Reports showed the target structured 500000 in third-party and payroll checks into two of his personal accounts and subsequently wire transferred.

Source: researchgate.net

Source: researchgate.net

Identifying suspicious account activity and submitting suspicious transaction reports are valuable tools in identifying and bringing human trafficking schemes to law enforcements attention. An effective systemic approach to identify suspicious financial activity may safeguard you and your institution business or profession from the risk of being involved with terrorist financing and money laundering crimes. FIs are expected to conduct strict and effective control processes ensuring their internal validation procedures work properly and their alert mechanisms run smoothly in detecting any suspicious activity. Following on from the success of our flagship AML training suite VinciWorks has recently released a new course on anti-money laundering. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing.

Source: gov.si

Source: gov.si

Banks use a number of methods to identify potentially suspicious activity including but not limited to activity identified by employees during day-to-day operations law enforcement inquiries or requests such as those typically seen in section 314a and section 314b. 1960 Unlicensed Money Service Business and 18 USC. This study demonstrated the feasibility of detecting money laundering activities based on visualization of monetary transactions. Download Citation Anti-Money Laundering. The investigation and Suspicious Activity Reports showed the target structured 500000 in third-party and payroll checks into two of his personal accounts and subsequently wire transferred.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to identify suspicious activity money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information