20+ How to settle a reverse mortgage info

Home » money laundering idea » 20+ How to settle a reverse mortgage infoYour How to settle a reverse mortgage images are available. How to settle a reverse mortgage are a topic that is being searched for and liked by netizens now. You can Find and Download the How to settle a reverse mortgage files here. Download all free vectors.

If you’re looking for how to settle a reverse mortgage pictures information connected with to the how to settle a reverse mortgage keyword, you have visit the right site. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

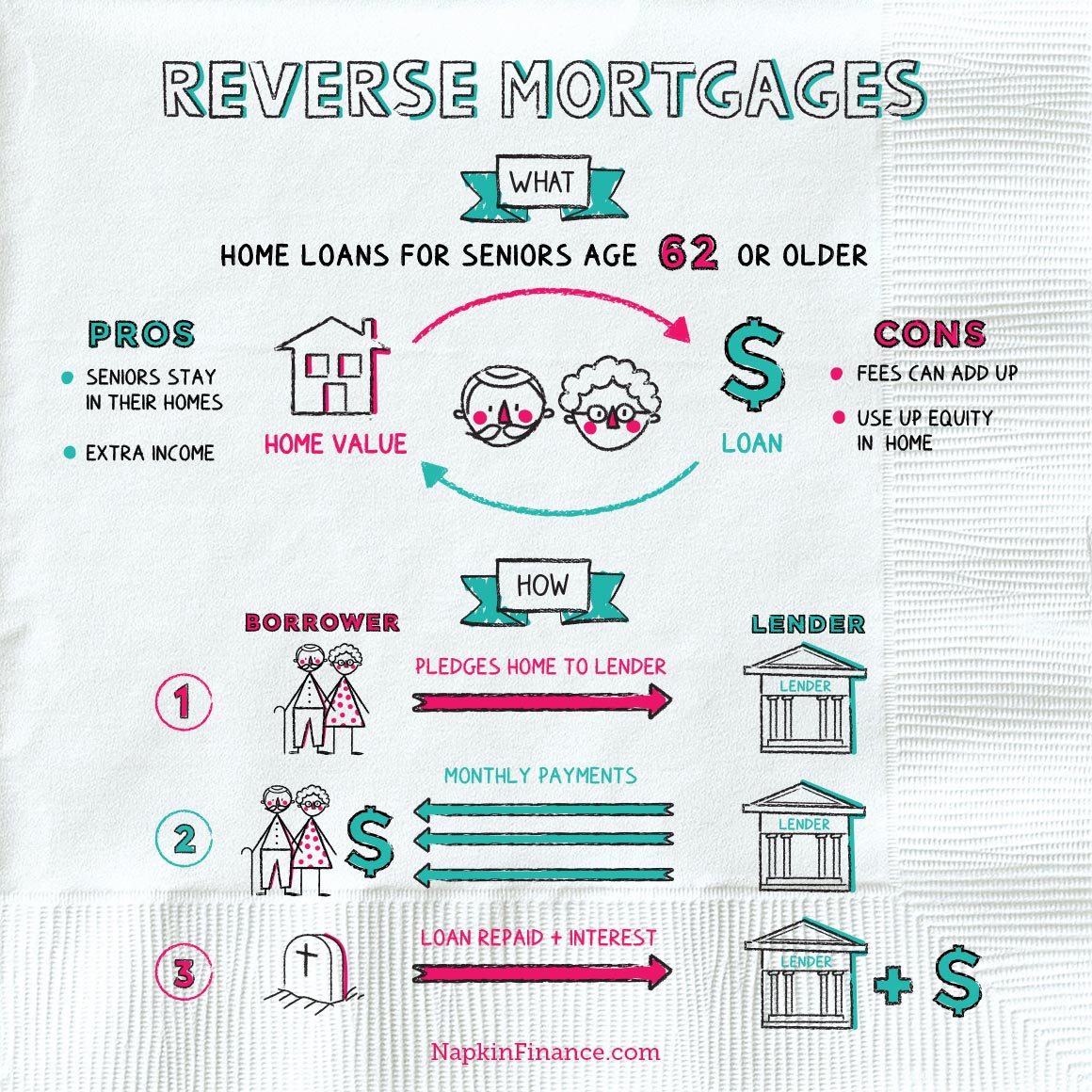

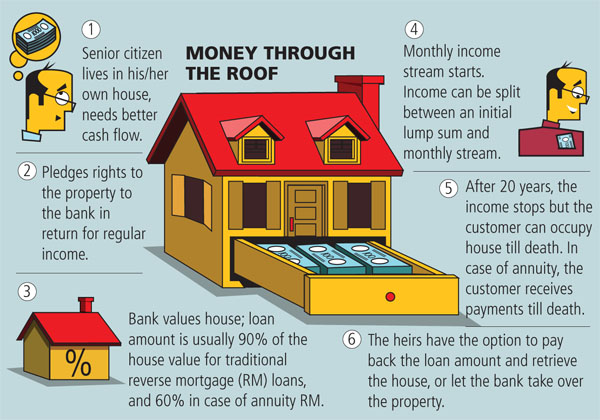

How To Settle A Reverse Mortgage. Certainly a divorce in progress makes reverse mortgage counseling a bit more complex. 1 settle the mortgage with their own funds and keep the house 2 sell the house and use the proceeds to settle the mortgage or. Prospective borrowers carrying delinquent tax debt also have the option to repay the debt out. Second mortgage debt can often be settled for as little as 5 percent to.

How Does A Reverse Mortgage Loan Work For Seniors Reverse Mortgage Fha Loans Mortgage Loans From pinterest.com

How Does A Reverse Mortgage Loan Work For Seniors Reverse Mortgage Fha Loans Mortgage Loans From pinterest.com

This can be done using the funds you get from the reverse mortgage. How the loan balance may change as time passes. Explain the situation and try to reduce the debt. 24 Refinance Your Reverse Mortgage. 25 Use Savings or Other Assets to Pay Off the Reverse Mortgage. 23 Take Out a Conventional Loan to Pay Off the Reverse Mortgage.

Certainly a divorce in progress makes reverse mortgage counseling a bit more complex.

How the loan balance may change as time passes. To ensure peace of mind for both you and your spouse reach out to your reverse mortgage. 24 Refinance Your Reverse Mortgage. How the loan balance may change as time passes. As you can see from the examples above it is fairly simple to use a reverse mortgage to settle a divorce when one has a free and clear home. To keep your reverse mortgage in good standing you must maintain property taxes homeowners insurance and occupy your home as your primary residence.

Source: money.com

Source: money.com

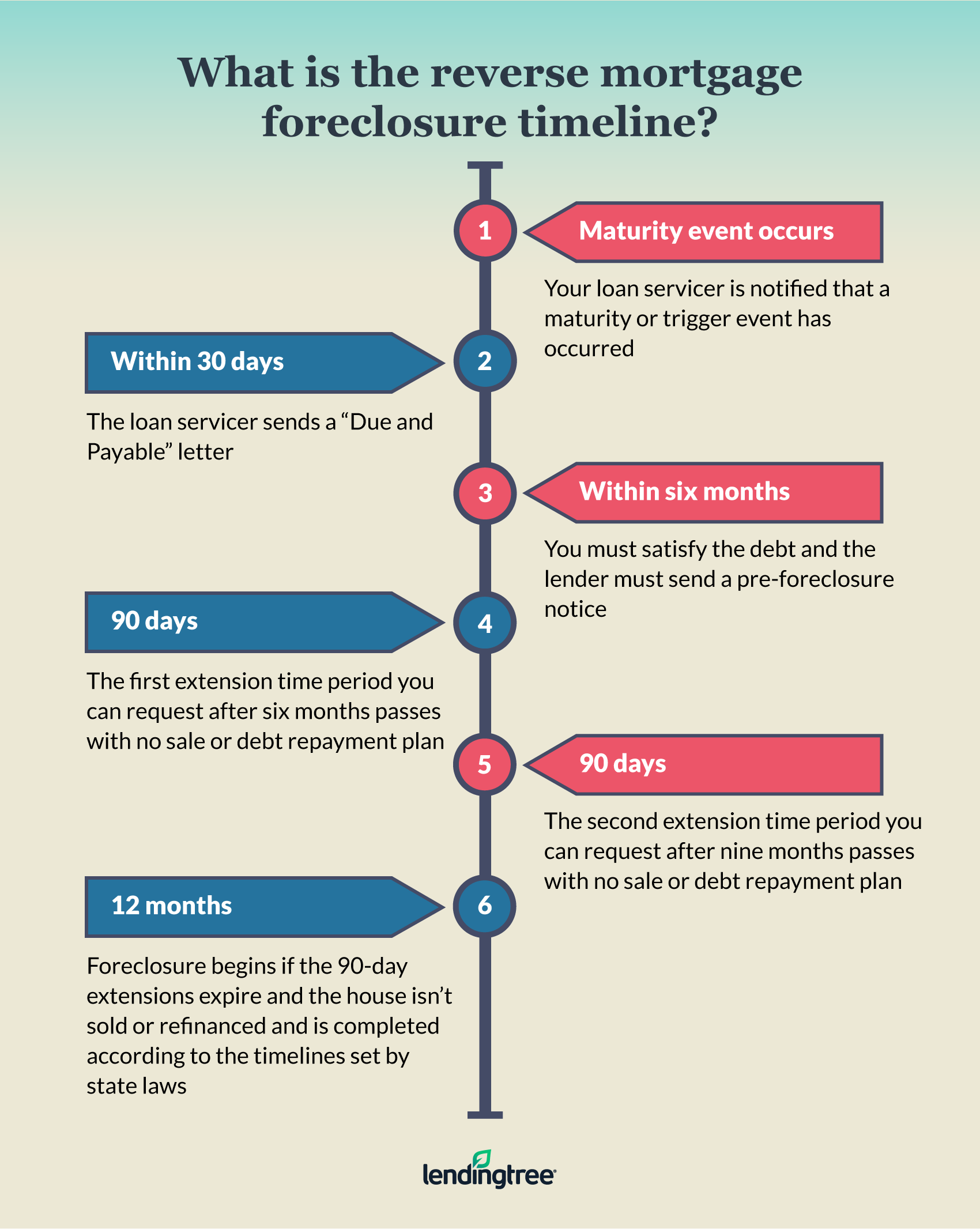

23 Take Out a Conventional Loan to Pay Off the Reverse Mortgage. Pay the loan balance in full this could be done thru refinancing existing assets or selling the property and keeping any remaining home equity Walk away from the home which would result in a foreclosure action by the servicer. Second mortgage debt can often be settled for as little as 5 percent to. Origination fees which cannot exceed 6000 and are paid to the lender Real estate closing costs paid to third-parties that can include an appraisal title search surveys. Reverse mortgages allow elderly homeowners to consume their housing wealth without having to sell or move out of their.

Source: pinterest.com

Source: pinterest.com

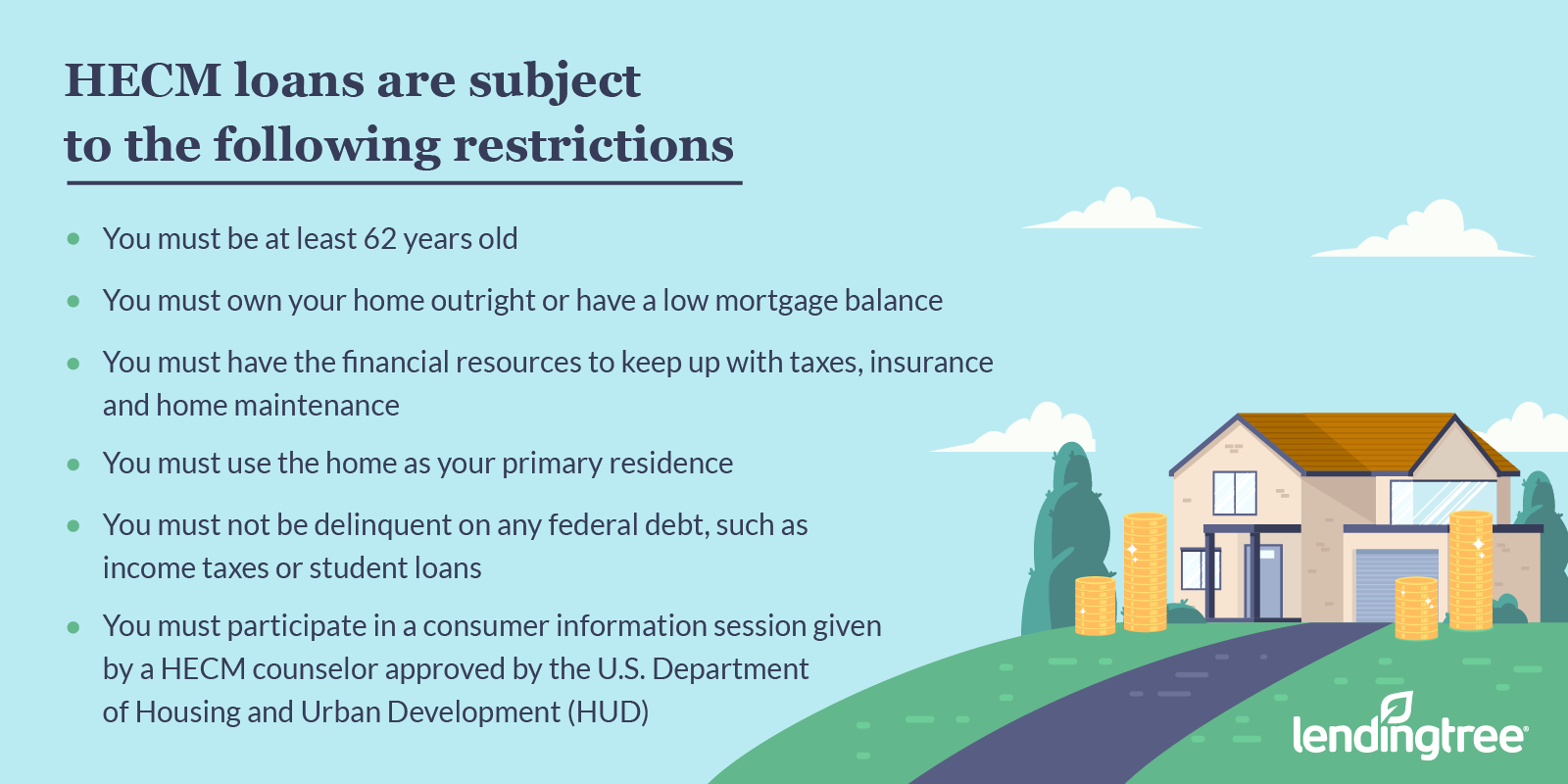

Settling the Loan Account. 2 How to Get Out of a Reverse Mortgage. In order to get a reverse mortgage youll have to close any other outstanding credit thats secured by your home like a mortgage or a home equity line of credit HELOC. Some borrowers choose to repay the interest each month to keep the mortgage balance from amortizing negatively. In order to obtain a reverse home mortgage you need to go to the really the very least 62 years old remaining in the a home that you have without premium residence mortgage or occasionally with a percent of house mortgage remaining to be that can be exercised with the cash money acquired from the reverse financing.

Source: ashleyyuht.hatenablog.com

Source: ashleyyuht.hatenablog.com

Certainly a divorce in progress makes reverse mortgage counseling a bit more complex. As you can see from the examples above it is fairly simple to use a reverse mortgage to settle a divorce when one has a free and clear home. To ensure peace of mind for both you and your spouse reach out to your reverse mortgage. If your goal is to add a spouse to an existing reverse mortgage so they can continue living in the home you would need to refinance into a new reverse mortgage in both of your names. In order to obtain a reverse home mortgage you need to go to the really the very least 62 years old remaining in the a home that you have without premium residence mortgage or occasionally with a percent of house mortgage remaining to be that can be exercised with the cash money acquired from the reverse financing.

Source: silverleafwealth.com

Source: silverleafwealth.com

If your goal is to add a spouse to an existing reverse mortgage so they can continue living in the home you would need to refinance into a new reverse mortgage in both of your names. To be eligible for a reverse mortgage these prospective borrowers will be required to make timely payments on that repayment plan for at least three months. 1 settle the mortgage with their own funds and keep the house 2 sell the house and use the proceeds to settle the mortgage or. As the debt level rises the settlement will need to contain asset provisions for the person leaving the residence to be divided 5050. Once thats done the money you get can be used for anything you want.

Source: forbesindia.com

Source: forbesindia.com

Certainly a divorce in progress makes reverse mortgage counseling a bit more complex. Second mortgage debt can often be settled for as little as 5 percent to. A deed in lieu of foreclosure is sufficient to extinguish the debt on the reverse mortgage and the mortgage insurance from the government will compensate the lender for the difference. 1 settle the mortgage with their own funds and keep the house 2 sell the house and use the proceeds to settle the mortgage or. 21 Sell Your Home and Repay the Lender.

Source: pinterest.com

Source: pinterest.com

22 Take Out a Conventional Mortgage to Pay Off the Reverse Mortgage. The best initial step is for heirs to take the most recent reverse mortgage statement the borrower received from the lender and review the outstanding balance on the statement hence why we talked. If your goal is to add a spouse to an existing reverse mortgage so they can continue living in the home you would need to refinance into a new reverse mortgage in both of your names. If the owner passes away the heirs have three options. Reverse mortgages allow elderly homeowners to consume their housing wealth without having to sell or move out of their.

Source: lendingtree.com

Source: lendingtree.com

Explain the situation and try to reduce the debt. Pay the loan balance in full this could be done thru refinancing existing assets or selling the property and keeping any remaining home equity Walk away from the home which would result in a foreclosure action by the servicer. 23 Take Out a Conventional Loan to Pay Off the Reverse Mortgage. Prospective borrowers carrying delinquent tax debt also have the option to repay the debt out. Explain the situation and try to reduce the debt.

Source: investopedia.com

Source: investopedia.com

Pay the loan balance in full this could be done thru refinancing existing assets or selling the property and keeping any remaining home equity Walk away from the home which would result in a foreclosure action by the servicer. So if you wish to pay off the loan early one method of doing this is to sell the home and use the proceeds from the sale to settle your reverse mortgage debt. Reverse mortgages allow elderly homeowners to consume their housing wealth without having to sell or move out of their. As you can see from the examples above it is fairly simple to use a reverse mortgage to settle a divorce when one has a free and clear home. In order to get a reverse mortgage youll have to close any other outstanding credit thats secured by your home like a mortgage or a home equity line of credit HELOC.

Source: lendingtree.com

Source: lendingtree.com

Like with a traditional mortgage borrowers will typically have to pay one-time upfront costs at the beginning of the reverse mortgage loan. Explain the situation and try to reduce the debt. Like with a traditional mortgage borrowers will typically have to pay one-time upfront costs at the beginning of the reverse mortgage loan. To keep your reverse mortgage in good standing you must maintain property taxes homeowners insurance and occupy your home as your primary residence. As the debt level rises the settlement will need to contain asset provisions for the person leaving the residence to be divided 5050.

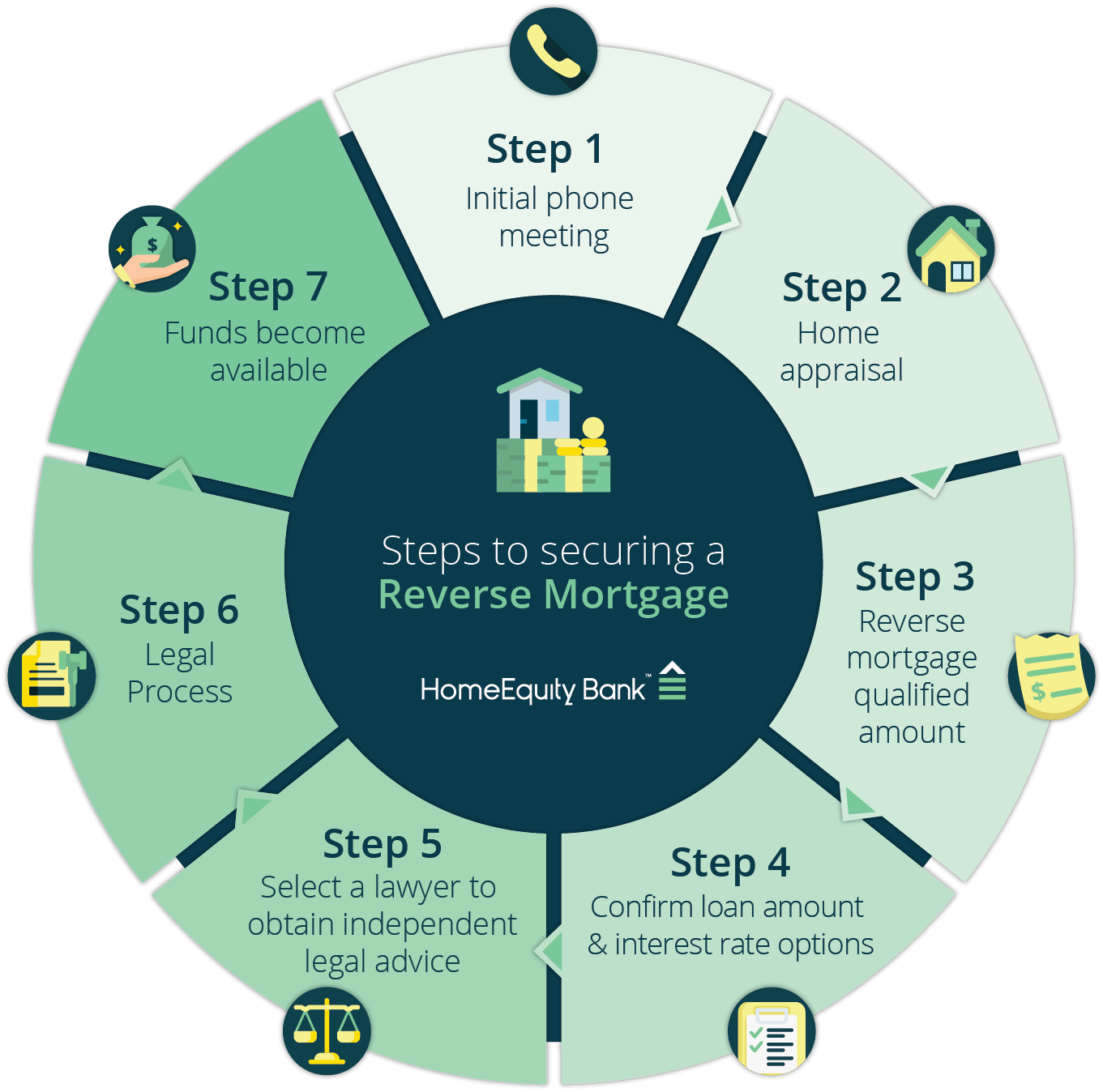

Source: chip.ca

Source: chip.ca

2 How to Get Out of a Reverse Mortgage. In order to obtain a reverse home mortgage you need to go to the really the very least 62 years old remaining in the a home that you have without premium residence mortgage or occasionally with a percent of house mortgage remaining to be that can be exercised with the cash money acquired from the reverse financing. In other cases the proceeds from the reverse mortgage will be used to settle the divorce between the two parties and generally this couple is prepared to complete counseling together she says. Prospective borrowers carrying delinquent tax debt also have the option to repay the debt out. Like with a traditional mortgage borrowers will typically have to pay one-time upfront costs at the beginning of the reverse mortgage loan.

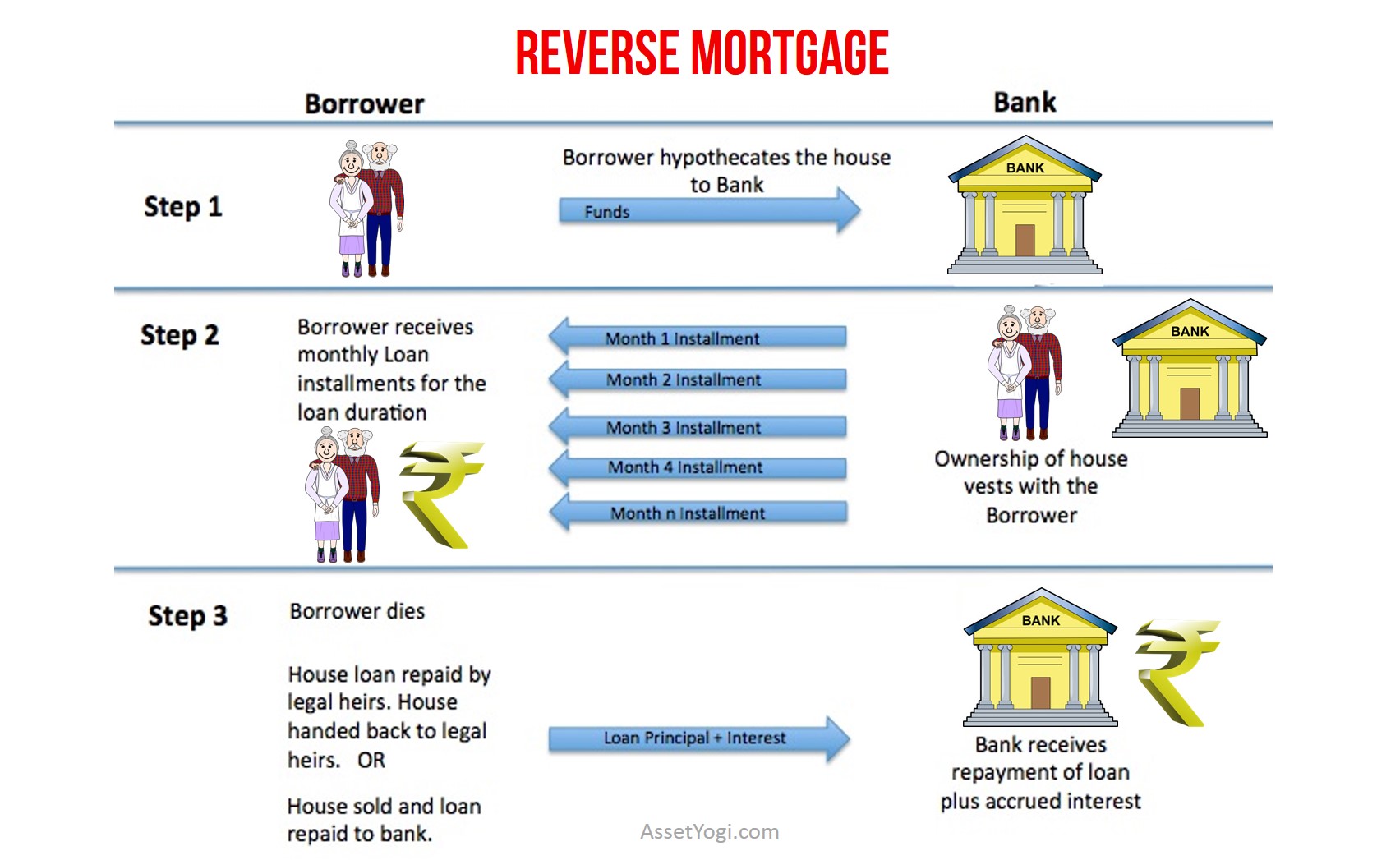

Source: assetyogi.com

Source: assetyogi.com

Settling the Loan Account - Reverse Mortgage. In other cases the proceeds from the reverse mortgage will be used to settle the divorce between the two parties and generally this couple is prepared to complete counseling together she says. As the debt level rises the settlement will need to contain asset provisions for the person leaving the residence to be divided 5050. Once thats done the money you get can be used for anything you want. Settling the Loan Account - Reverse Mortgage.

Source:

Source:

24 Refinance Your Reverse Mortgage. If your goal is to add a spouse to an existing reverse mortgage so they can continue living in the home you would need to refinance into a new reverse mortgage in both of your names. Prospective borrowers carrying delinquent tax debt also have the option to repay the debt out. If the owner passes away the heirs have three options. A way to do this is to calculate the interest plus the mortgage insurance for the year and divide the amount by 12 months.

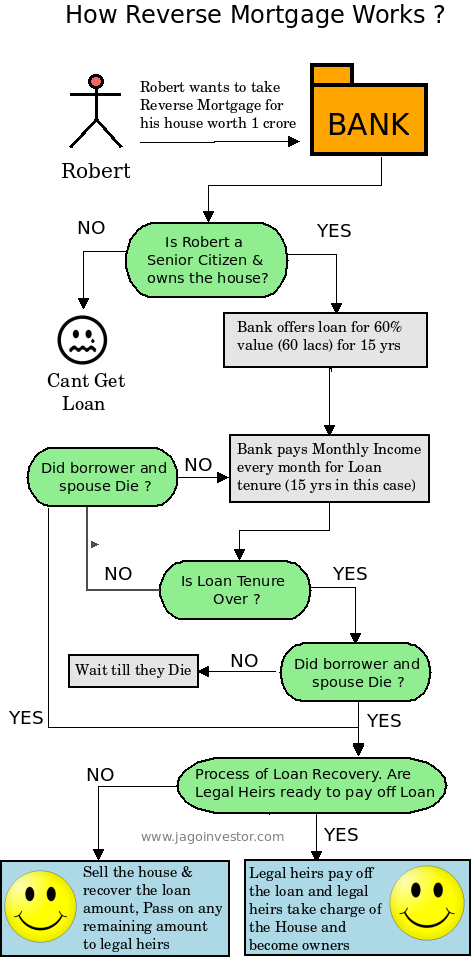

Source: jagoinvestor.com

Source: jagoinvestor.com

Like with a traditional mortgage borrowers will typically have to pay one-time upfront costs at the beginning of the reverse mortgage loan. So if you wish to pay off the loan early one method of doing this is to sell the home and use the proceeds from the sale to settle your reverse mortgage debt. Explain the situation and try to reduce the debt. If your goal is to add a spouse to an existing reverse mortgage so they can continue living in the home you would need to refinance into a new reverse mortgage in both of your names. Lenders are aware of this and often willing to settle the debt for less.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to settle a reverse mortgage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information