10+ Industries with high risk of money laundering ideas in 2021

Home » money laundering idea » 10+ Industries with high risk of money laundering ideas in 2021Your Industries with high risk of money laundering images are ready in this website. Industries with high risk of money laundering are a topic that is being searched for and liked by netizens today. You can Download the Industries with high risk of money laundering files here. Download all royalty-free images.

If you’re searching for industries with high risk of money laundering images information linked to the industries with high risk of money laundering interest, you have come to the right site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Industries With High Risk Of Money Laundering. Because of the high ticket size this industry is a well-known high-risk industry. Internationally by a third party money laundering syndicate. May be susceptible to money laundering or terrorist financing. According to the Report from the Commission to the European Parliament and to the Council on the assessment.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

What are considered higher risk customer types for money laundering. Money Transfer Services. Customers in these categories can pose an inherently high risk for money laundering. Vending machine operators. Because of the high ticket size this industry is a well-known high-risk industry. As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie.

Vending machine operators.

Estate agents are an industry where there is a high risk of money laundering. As a result of this diversity some NBFIs may be lower risk and some may be higher risk for money laundering. What are considered higher risk customer types for money laundering. Money Transfer Services. Anti-money laundering AML was the number one cause of FINRA fines in 2016 2017 and 2018. MLB duly covered the catalogue of elementary failings with a headline Incredible indifference to credible deterrence then the watchword of FSA director of enforcement Margaret Cole.

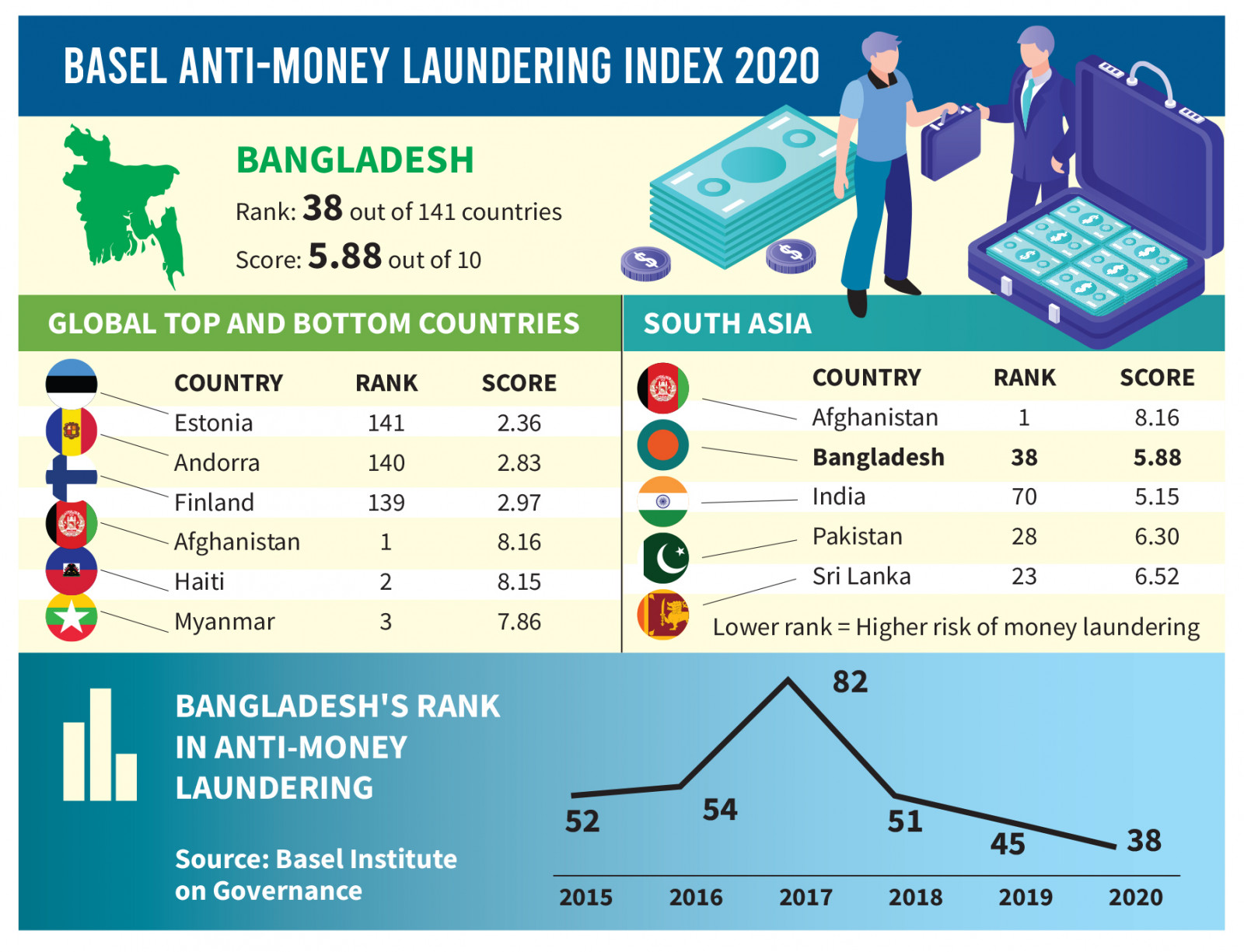

Source: tbsnews.net

Source: tbsnews.net

Your firm where there might be high risk of money laundering or terrorist financing. Unsurprising ly a nagging challenge for most firms is detecting and assessing the ir money laundering risks and designing. According to the Report from the Commission to the European Parliament and to the Council on the assessment. Customers that might pose a risk. Your business might be at risk of money laundering from.

Source: ar.pinterest.com

Source: ar.pinterest.com

Money Laundering Risk By Industry pada tanggal Agustus 10 2021. Recommendation 12 where there is a higher-risk business relationship. While most Cash Intensive Businesses CIBs are conducting legitimate business some aspects of these businesses may be susceptible to money laundering or terrorist financing. A PEP presents a higher risk for potential involvement in bribery and corruption by virtue of their position and the influence that they may hold. Money Laundering Risk By Industry pada tanggal Agustus 10 2021.

Source: bi.go.id

Source: bi.go.id

It is almost impossible to get a merchant account for this industry type. It concluded that the size and complexity. Customers in these categories can pose an inherently high risk for money laundering. May be susceptible to money laundering or terrorist financing. This scrutiny stands at the forefront of the effort to detect and deter the laundering of proceeds of corruption and is certainly necessary.

Source: ec.europa.eu

Source: ec.europa.eu

Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. Privately owned automated teller machines ATM. Ten years ago the UK Financial Services Authority FSA published a woeful report on UK banks management of high money laundering risk situations. Internationally by a third party money laundering syndicate. Because of the high ticket size this industry is a well-known high-risk industry.

Source: bi.go.id

Source: bi.go.id

Vending machine operators. Customers in these categories can pose an inherently high risk for money laundering. Background and current high risk countries. The National Risk Assessment NRA which is the first of its kind in the UK draws on data from UK law enforcement and intelligence agencies anti-money laundering supervisory agencies government departments industry bodies and private sector firms. According to the Report from the Commission to the European Parliament and to the Council on the assessment.

Source: bi.go.id

Cash Intensive Businesses Managing Their Money Laundering Risks. As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. A PEP presents a higher risk for potential involvement in bribery and corruption by virtue of their position and the influence that they may hold. What are considered higher risk customer types for money laundering.

Source: acamstoday.org

Source: acamstoday.org

Your firm where there might be high risk of money laundering or terrorist financing. What are considered higher risk customer types for money laundering. Unsurprising ly a nagging challenge for most firms is detecting and assessing the ir money laundering risks and designing. Common examples include but are not limited to the following. Your firm where there might be high risk of money laundering or terrorist financing.

Source: pinterest.com

Source: pinterest.com

It concluded that the size and complexity. Banks that maintain account relationships with NBFIs may be exposed to a higher risk for potential money laundering activities because many NBFIs. A PEP presents a higher risk for potential involvement in bribery and corruption by virtue of their position and the influence that they may hold. Your business might be at risk of money laundering from. Unsurprising ly a nagging challenge for most firms is detecting and assessing the ir money laundering risks and designing.

Source: tbsnews.net

Source: tbsnews.net

In the first assessment of its type the government branded the banking law and accountancy industries as posing a high risk of money-laundering. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. It is almost impossible to get a merchant account for this industry type. Privately owned automated teller machines ATM. A PEP presents a higher risk for potential involvement in bribery and corruption by virtue of their position and the influence that they may hold.

Source: ft.lk

Source: ft.lk

Background and current high risk countries. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. Money Laundering Risk By Industry pada tanggal Agustus 10 2021. As the number and value of enforcement actions increase worldwide knowledge around money laundering through securities product s is starting to e merge. It is almost impossible to get a merchant account for this industry type.

Source: pinterest.com

Source: pinterest.com

This scrutiny stands at the forefront of the effort to detect and deter the laundering of proceeds of corruption and is certainly necessary. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. Privately owned automated teller machines ATM. Lack ongoing customer relationships and require minimal or no identification from customers. Vending machine operators.

Source: bi.go.id

Source: bi.go.id

Ten years ago the UK Financial Services Authority FSA published a woeful report on UK banks management of high money laundering risk situations. Customers The following may suggest a high risk of money laundering or terrorist financing. Customers in these categories can pose an inherently high risk for money laundering. In the first assessment of its type the government branded the banking law and accountancy industries as posing a high risk of money-laundering. New customers carrying out large one-off transactions.

Source: complyadvantage.com

Source: complyadvantage.com

Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen. Recommendation 12 where there is a higher-risk business relationship. Money Laundering Risk By Industry pada tanggal Agustus 10 2021. As the number and value of enforcement actions increase worldwide knowledge around money laundering through securities product s is starting to e merge. Common examples include but are not limited to the following.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title industries with high risk of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information