11++ Institutional money laundering risk assessment ideas in 2021

Home » money laundering Info » 11++ Institutional money laundering risk assessment ideas in 2021Your Institutional money laundering risk assessment images are ready in this website. Institutional money laundering risk assessment are a topic that is being searched for and liked by netizens now. You can Find and Download the Institutional money laundering risk assessment files here. Find and Download all free photos.

If you’re searching for institutional money laundering risk assessment pictures information linked to the institutional money laundering risk assessment interest, you have come to the right blog. Our site always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Institutional Money Laundering Risk Assessment. The Anti-Money Laundering and Countering the Financing of Terrorism Institutional Risk Assessment Guidelines is issued by the FIU pursuant to section 57 2 of the AMLCFT Act to provide guidance to its reporting entities on how to conduct and document their AMLCFT risk assessment in line with the requirements of the AMLCFT Act. Objective of National Risk Assessment 11. Money Laundering Terrorist Financing Proliferation Financing MLTFPF risk assessment. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Regulators have been advocating a Risk Based Approach RBA in combatting money laundering and terrorist financing for several years MLTF 1. As a means and target for money laundering and terrorism financing. The key purpose of a money laundering risk assessment is to drive improvements in financial crime risk management through identifying the general and specific money laundering risks a FI is facing. The money laundering and terrorist financing threats are activities which could result in money laundering or terrorist financing offences whether on the national level or cross-border. Money Laundering Risk. Institutional Risk Assessment Observations and Common Deficiencies AML Seminars Hong Kong Central Library 3rd th 5 November 2015 Maggie Wong Anti-Money Laundering and Financial Crime Risk.

Input into the overall money laundering risk assessment.

In this regard sectoral risk assessments play an important role so that Financial Institutions will be able to understand identify and measure the risks of money laundering and terrorism financing focusing on four risk. A summation of the numbers indicates a Risk Assessment Score of 223 and hence the ompanys. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. The money laundering and terrorist financing threats are activities which could result in money laundering or terrorist financing offences whether on the national level or cross-border. ML TF risk on an enterprise-wide basis is high b Results of Assessment. Institutional money laundering and terrorism financing risk assessment Konformitas Consulting can assist your business prepare a money laundering and terrorist financing risk assessment.

Source: nbb.be

Source: nbb.be

Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. The risk-based approach RBA to AMLCFT is central to the effective implementation of the. Money Laundering Terrorist Financing Proliferation Financing MLTFPF risk assessment. In the money laundering ML and terrorist financing TF literature the concept of risk is traditionally defined as the combination of two factors. This is Irelands first money laundering and terrorist financing MLTF national risk assessment NRA and the aim of this process was to identify understand and assess the money laundering and terrorist financing risks faced by Ireland.

Source: pideeco.be

Source: pideeco.be

Risk Assessments-Institutional risk assessment IRA A comprehensive range of MLTF risk factors analyzed in both qualitative and quantitative aspects was considered for IRA purposes Kept the IRA up-to-date by reviewing the assessment on a regular basis or when specific events occurred Did not conduct any IRA or failed to maintain. The types of customer you have. A summation of the numbers indicates a Risk Assessment Score of 223 and hence the ompanys. Risk Assessments-Institutional risk assessment IRA A comprehensive range of MLTF risk factors analyzed in both qualitative and quantitative aspects was considered for IRA purposes Kept the IRA up-to-date by reviewing the assessment on a regular basis or when specific events occurred Did not conduct any IRA or failed to maintain. Regulators have been advocating a Risk Based Approach RBA in combatting money laundering and terrorist financing for several years MLTF 1.

Source: service.betterregulation.com

Source: service.betterregulation.com

Regulators have been advocating a Risk Based Approach RBA in combatting money laundering and terrorist financing for several years MLTF 1. Money Laundering Terrorist Financing Proliferation Financing MLTFPF risk assessment. This NRA is also intended to. The types of customer you have. The risk-based approach RBA to AMLCFT is central to the effective implementation of the.

Source: bi.go.id

Source: bi.go.id

The types of customer you have. Further to this when new products and services are added the risks should be evaluated prior to implementation to ensure. The types of customer you have. When you assess the risks of money laundering that apply to your business you need to consider. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1.

Source: bi.go.id

Source: bi.go.id

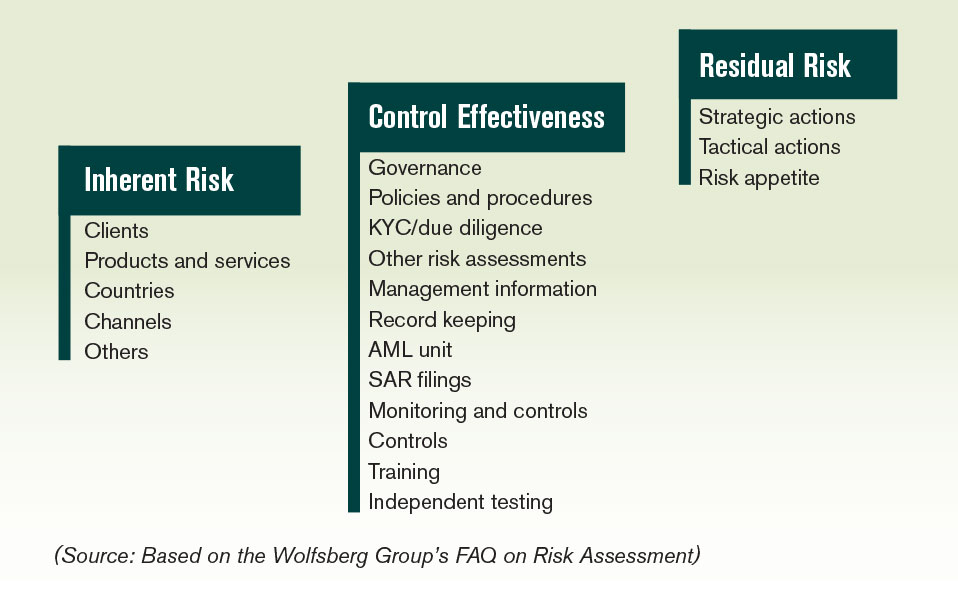

The types of customer you have. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. In this regard sectoral risk assessments play an important role so that Financial Institutions will be able to understand identify and measure the risks of money laundering and terrorism financing focusing on four risk. ML TF risk on an enterprise-wide basis is high b Results of Assessment. A the likelihood that a MLTF event will occur and b the impact or consequences that the occurrence of the MLTF event can exert directly or indirectly.

As a means and target for money laundering and terrorism financing. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. This NRA is also intended to. Money Laundering Risk. The specific risks of money laundering and terrorist.

Source: bi.go.id

Source: bi.go.id

As a means and target for money laundering and terrorism financing. The money laundering and terrorist financing threats are activities which could result in money laundering or terrorist financing offences whether on the national level or cross-border. ML TF risk on an enterprise-wide basis is moderate 30. The Anti-Money Laundering and Countering the Financing of Terrorism Institutional Risk Assessment Guidelines is issued by the FIU pursuant to section 57 2 of the AMLCFT Act to provide guidance to its reporting entities on how to conduct and document their AMLCFT risk assessment in line with the requirements of the AMLCFT Act. In this regard sectoral risk assessments play an important role so that Financial Institutions will be able to understand identify and measure the risks of money laundering and terrorism financing focusing on four risk.

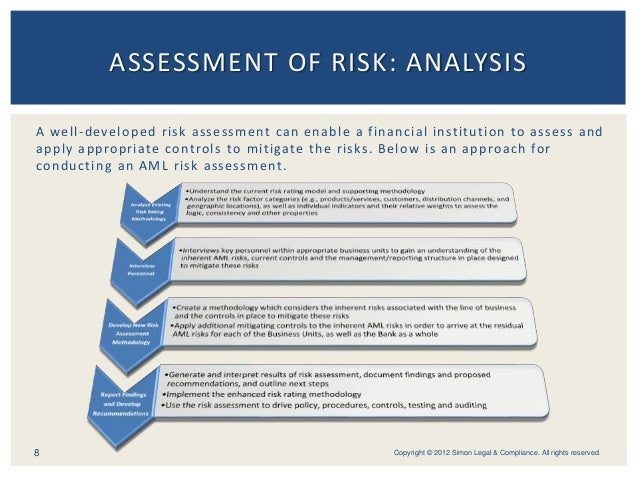

The risk assessment should identify areas of vulnerability to money laundering identify weaknesses or gaps in the existing control environment support informed decisions on risk appetite and highlight the banks AML risk and control environment for all key stakeholders including senior management and regulators. Conceptual and Institutional Framework. The risk-based approach RBA to AMLCFT is central to the effective implementation of the. A Risk Assessment score. Further to this when new products and services are added the risks should be evaluated prior to implementation to ensure.

Source: slideshare.net

Source: slideshare.net

This NRA is also intended to. Further to this when new products and services are added the risks should be evaluated prior to implementation to ensure. The risk assessment should identify areas of vulnerability to money laundering identify weaknesses or gaps in the existing control environment support informed decisions on risk appetite and highlight the banks AML risk and control environment for all key stakeholders including senior management and regulators. Institutional money laundering and terrorism financing risk assessment Konformitas Consulting can assist your business prepare a money laundering and terrorist financing risk assessment. The Guidelines outline minimum requirements in respect of the institutional MLTFPF risk assessment.

Source: researchgate.net

Source: researchgate.net

Institutional money laundering and terrorism financing risk assessment Konformitas Consulting can assist your business prepare a money laundering and terrorist financing risk assessment. A summation of the numbers indicates a Risk Assessment Score of 223 and hence the ompanys. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. Money Laundering Terrorist Financing Proliferation Financing MLTFPF risk assessment. In this regard sectoral risk assessments play an important role so that Financial Institutions will be able to understand identify and measure the risks of money laundering and terrorism financing focusing on four risk.

The risk assessment should identify areas of vulnerability to money laundering identify weaknesses or gaps in the existing control environment support informed decisions on risk appetite and highlight the banks AML risk and control environment for all key stakeholders including senior management and regulators. Money Laundering Terrorist Financing Proliferation Financing MLTFPF risk assessment. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. The Guidelines outline minimum requirements in respect of the institutional MLTFPF risk assessment.

Source: acamstoday.org

Source: acamstoday.org

Institutional money laundering and terrorism financing risk assessment Konformitas Consulting can assist your business prepare a money laundering and terrorist financing risk assessment. This is Irelands first money laundering and terrorist financing MLTF national risk assessment NRA and the aim of this process was to identify understand and assess the money laundering and terrorist financing risks faced by Ireland. This will help ensure that your institutional risk assessment is aligned with your FIs intended risk profile. The Anti-Money Laundering and Countering the Financing of Terrorism Institutional Risk Assessment Guidelines is issued by the FIU pursuant to section 57 2 of the AMLCFT Act to provide guidance to its reporting entities on how to conduct and document their AMLCFT risk assessment in line with the requirements of the AMLCFT Act. In this regard sectoral risk assessments play an important role so that Financial Institutions will be able to understand identify and measure the risks of money laundering and terrorism financing focusing on four risk.

Source: worldbank.org

Source: worldbank.org

Money Laundering Terrorist Financing Proliferation Financing MLTFPF risk assessment. The Institutional MLTFPF Risk Assessment guidelines are structured to help reporting entities identify their risks by products. The view is that in order to implement effective AMLCTF systems and controls Authorized Institutions AIs should identify assess and understand the MLTF risks to which they are exposed. Money Laundering Terrorist Financing Proliferation Financing MLTFPF risk assessment. Conceptual and Institutional Framework.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title institutional money laundering risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas