13++ Insurance companies are the most vulnerable to money laundering through ideas in 2021

Home » money laundering Info » 13++ Insurance companies are the most vulnerable to money laundering through ideas in 2021Your Insurance companies are the most vulnerable to money laundering through images are available. Insurance companies are the most vulnerable to money laundering through are a topic that is being searched for and liked by netizens today. You can Download the Insurance companies are the most vulnerable to money laundering through files here. Find and Download all royalty-free photos and vectors.

If you’re searching for insurance companies are the most vulnerable to money laundering through pictures information related to the insurance companies are the most vulnerable to money laundering through interest, you have pay a visit to the ideal site. Our website always gives you suggestions for seeing the highest quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

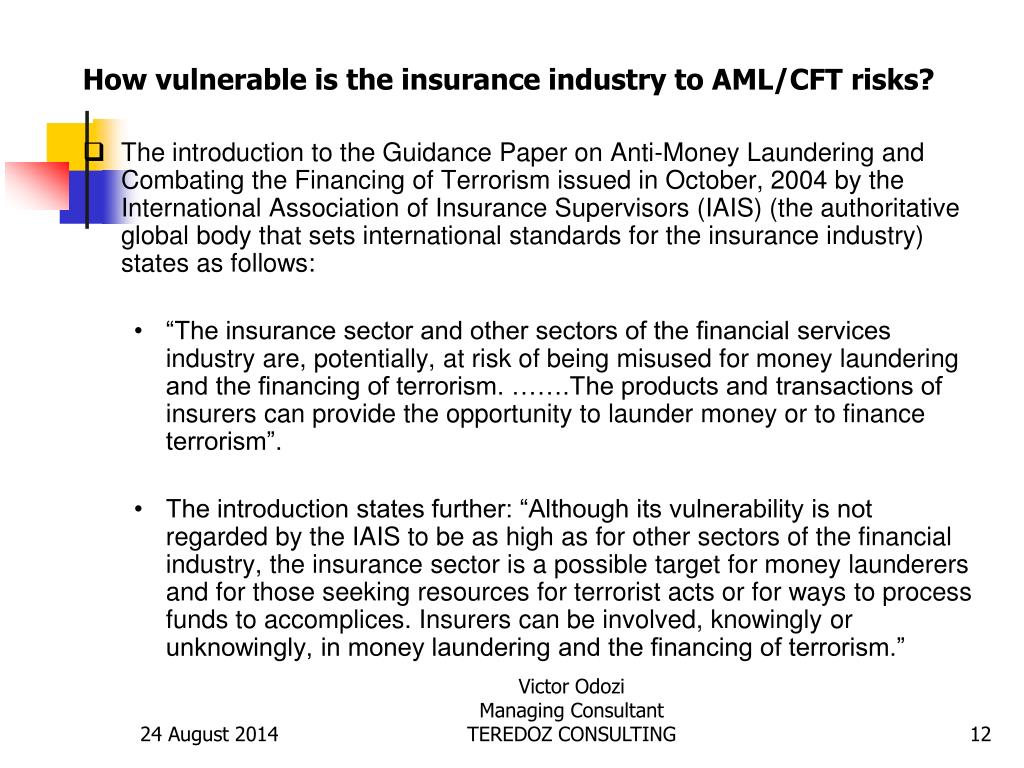

Insurance Companies Are The Most Vulnerable To Money Laundering Through. A drug trafficker purchased a life insurance policy with a value of USD 80000. Countries to permit life insurance companies and intermediaries to use a risk-based approach to discharging certain of their anti-money laundering AML and counter-terrorist financing CFT obligations. People do not realise is that insurance products particu-larly life insurance provide a very attractive and simple means of laundering money. - Placement - Layering - Intergration Placement is the first stage in money laundering where the cash proceeds of criminal activity enter into the financial system.

A Behavioral Perspective On Money Laundering Ppt Download From slideplayer.com

A Behavioral Perspective On Money Laundering Ppt Download From slideplayer.com

People do not realise is that insurance products particu-larly life insurance provide a very attractive and simple means of laundering money. A few years ago a global US Customs Service investi-gation exposed the widespread use of insurance products for laundering by international drug traffickers. A key driver of this deficiency is the difficulty in detecting money laundering typol ogies in securities products since the sector is most vulnerable to the integration stage of money laundering. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. A drug trafficker purchased a life insurance policy with a value of USD 80000. This is most critical stage for any money launderer as the criminal can effectively mask his illegal.

A few years ago a global US Customs Service investi-gation exposed the widespread use of insurance products for laundering by international drug traffickers.

True The Money Laundering Control Act. It is fairly obvious that there are a lot of them typical scenario is a non chain mom and pop style operation specialty shops that the volume of business at peak monthshours cant possibly support staffing and facilities for the entire weekyea. A drug trafficker purchased a life insurance policy with a value of USD 80000. For years the insurance industry was perceived as a lower risk for financial crime compared to the banking sector. The insurance industry is most vulnerable to money laundering during the layering and integration stages of the money laundering cycle. In particular investment type life-insurance products are vulnerable.

Source: pinterest.com

Source: pinterest.com

For years the insurance industry was perceived as a lower risk for financial crime compared to the banking sector. Under the Bank Secrecy Act BSA of 1970 the insurance companies come under the term companiesfinancial institutions. People do not realise is that insurance products particu-larly life insurance provide a very attractive and simple means of laundering money. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively minor reduction in value. It is fairly obvious that there are a lot of them typical scenario is a non chain mom and pop style operation specialty shops that the volume of business at peak monthshours cant possibly support staffing and facilities for the entire weekyea.

Source: tokeninsight.medium.com

Source: tokeninsight.medium.com

For years the insurance industry was perceived as a lower risk for financial crime compared to the banking sector. By adopting a risk-based approach competent authorities and life insurance companies and intermediaries are. A key driver of this deficiency is the difficulty in detecting money laundering typol ogies in securities products since the sector is most vulnerable to the integration stage of money laundering. As a result it was spared the intense scrutiny and heavy fines regulators imposed on financial institutions for deficiencies in anti-money laundering AML controls. The agentsbrokers working for insurance companies are mostly unaware of such false scenarios and subsequently fall prey to money laundering schemes.

Source:

As a result it was spared the intense scrutiny and heavy fines regulators imposed on financial institutions for deficiencies in anti-money laundering AML controls. The investigation showed that the client had made it known that the funds used to finance the policy were the proceeds of. The agentsbrokers working for insurance companies are mostly unaware of such false scenarios and subsequently fall prey to money laundering schemes. It is fairly obvious that there are a lot of them typical scenario is a non chain mom and pop style operation specialty shops that the volume of business at peak monthshours cant possibly support staffing and facilities for the entire weekyea. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies.

Source: getid.ee

Source: getid.ee

Microlending also known as peer-to-peer P2P lending. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. There are three stages in money laundering. - Placement - Layering - Intergration Placement is the first stage in money laundering where the cash proceeds of criminal activity enter into the financial system. The span of services includes micro loans insurance deposits and other services to villagers microentrepreneurs women and poor families.

Source: getid.ee

Source: getid.ee

The use of insurance intermediaries also makes the. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively minor reduction in value. It is fairly obvious that there are a lot of them typical scenario is a non chain mom and pop style operation specialty shops that the volume of business at peak monthshours cant possibly support staffing and facilities for the entire weekyea. In particular investment type life-insurance products are vulnerable. The FATF pointed out that between 1999 and 2003 about 65 percent of money laudering was through life-insurance products.

Source: acamstoday.org

Source: acamstoday.org

A key driver of this deficiency is the difficulty in detecting money laundering typol ogies in securities products since the sector is most vulnerable to the integration stage of money laundering. This is most critical stage for any money launderer as the criminal can effectively mask his illegal. - Placement - Layering - Intergration Placement is the first stage in money laundering where the cash proceeds of criminal activity enter into the financial system. Microfinance Institutions MFIs are financial companies that provide small loans to the unbanked sections of society or low-income groups. Money Laundering is the process of taking Illegal funds and converting it into clean funds.

Source: slideserve.com

Source: slideserve.com

The investigation showed that the client had made it known that the funds used to finance the policy were the proceeds of. The agentsbrokers working for insurance companies are mostly unaware of such false scenarios and subsequently fall prey to money laundering schemes. A drug trafficker purchased a life insurance policy with a value of USD 80000. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. As a result it was spared the intense scrutiny and heavy fines regulators imposed on financial institutions for deficiencies in anti-money laundering AML controls.

Source: slideplayer.com

Source: slideplayer.com

This is most critical stage for any money launderer as the criminal can effectively mask his illegal. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively minor reduction in value. The span of services includes micro loans insurance deposits and other services to villagers microentrepreneurs women and poor families. A drug trafficker purchased a life insurance policy with a value of USD 80000. The use of insurance intermediaries also makes the.

Source: slidetodoc.com

Source: slidetodoc.com

The agents and brokers are often unaware of the need to screen clients or to question payment methods. This is most critical stage for any money launderer as the criminal can effectively mask his illegal. The FATF pointed out that between 1999 and 2003 about 65 percent of money laudering was through life-insurance products. In particular investment type life-insurance products are vulnerable. What is Money Laundering.

Source: pinterest.com

Source: pinterest.com

A key driver of this deficiency is the difficulty in detecting money laundering typol ogies in securities products since the sector is most vulnerable to the integration stage of money laundering. - Placement - Layering - Intergration Placement is the first stage in money laundering where the cash proceeds of criminal activity enter into the financial system. The policy was purchased through an agent of a large life insurance company using a cashiers cheque. Under the Bank Secrecy Act BSA of 1970 the insurance companies come under the term companiesfinancial institutions. A few years ago a global US Customs Service investi-gation exposed the widespread use of insurance products for laundering by international drug traffickers.

Source: slideserve.com

Source: slideserve.com

As a result it was spared the intense scrutiny and heavy fines regulators imposed on financial institutions for deficiencies in anti-money laundering AML controls. The span of services includes micro loans insurance deposits and other services to villagers microentrepreneurs women and poor families. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. There are three stages in money laundering. The insurance industry is potentially vulnerable to money laundering because of its size easy availability and diversity of its products.

Source: pinterest.com

Source: pinterest.com

There are three stages in money laundering. In particular investment type life-insurance products are vulnerable. While most of the insurance and reinsurance companies in Kenya are putting efforts at establishing strong money laundering fighting programmes challenges arise from. The insurance industry is potentially vulnerable to money laundering because of its size easy availability and diversity of its products. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies.

Source: pinterest.com

Source: pinterest.com

By adopting a risk-based approach competent authorities and life insurance companies and intermediaries are. A few years ago a global US Customs Service investi-gation exposed the widespread use of insurance products for laundering by international drug traffickers. Microfinance Institutions MFIs are financial companies that provide small loans to the unbanked sections of society or low-income groups. The insurance industry is potentially vulnerable to money laundering because of its size easy availability and diversity of its products. Changing How Insurance Companies Manage Risk.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance companies are the most vulnerable to money laundering through by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas