17++ Key money laundering risk with trust and foundations information

Home » money laundering idea » 17++ Key money laundering risk with trust and foundations informationYour Key money laundering risk with trust and foundations images are available in this site. Key money laundering risk with trust and foundations are a topic that is being searched for and liked by netizens today. You can Get the Key money laundering risk with trust and foundations files here. Get all free images.

If you’re looking for key money laundering risk with trust and foundations pictures information related to the key money laundering risk with trust and foundations interest, you have visit the ideal site. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

Key Money Laundering Risk With Trust And Foundations. Consequently the Financial Action Task Force FATF and EU AMLDs concept of beneficial ownership differs materially. If any of the above are individuals their identity should be verified by obtaining the same documentation for an individual please see our Guide here. In addition there are other bodies that have done significant work in this area and have developed some key. On top of this the Law enacts the core principle of risk-based approach whereby professionals have to take appropriate steps to identify and assess the risks of money laundering and terrorist financing they are confronted to taking into account risk factors such as those related to their customers countries geographic areas products services transactions or delivery channels.

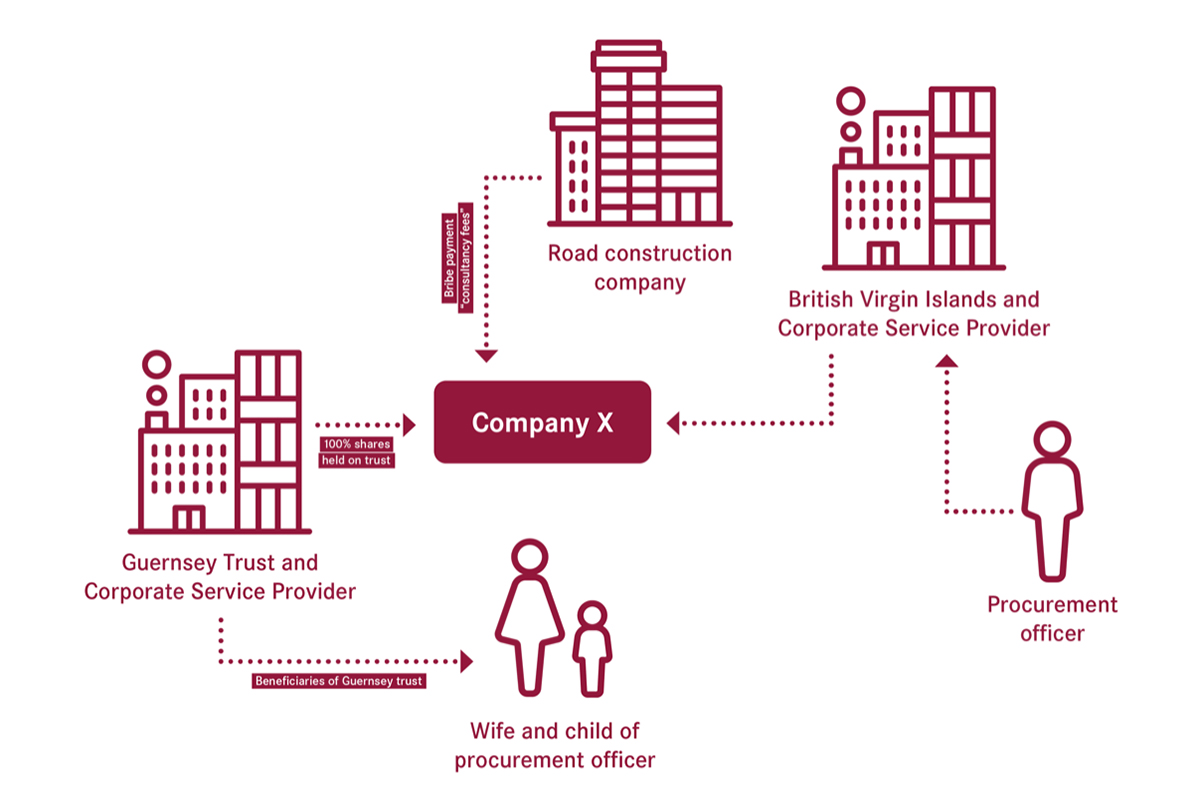

Identifying Corruption Through Financial Investigations In Indonesia From unodc.org

Identifying Corruption Through Financial Investigations In Indonesia From unodc.org

Consequently the Financial Action Task Force FATF and EU AMLDs concept of beneficial ownership differs materially. Globally governments have narrowed key risk indicators to five primary divisions of 1 Nature size and complexity of a business 2 Customer types including B2B and B2C 3 the types of products and services provided to customers 4 method of on-boarding new customers and ongoing communications with existing customers and finally 5. Identity will be verified on the basis of appropriate evidence of formation and existence or similar. The report not only provides a useful overview of the key tax evasion and money laundering issues and risks associated with the abuse of charities but also provides practical guidance to tax authorities that are seeking to implement strategies to effectively address these risks. What are the key risk indicators for money laundering. Guidance for Charities on Anti-Money Laundering Anti-Terrorist Financing Compliance A.

The report not only provides a useful overview of the key tax evasion and money laundering issues and risks associated with the abuse of charities but also provides practical guidance to tax authorities that are seeking to implement strategies to effectively address these risks.

In January 2016 a nonprofit activist group conducted an. The identity of persons having a beneficial interest in a trust where it becomes known the identified beneficiary presents a high risk. Trust given the nature of their business and the oath they take to demean themselves fairly and honorably as an attorney and practitioner at law However recent court cases have exposed an increasing number of legal professionals engaged in facilitating money laundering. The risk of money laundering and to cooperate with governments and their agencies in the detection of money laundering. In potentially important gaps in the global network to address the money laundering risks associated with this sector. Money laundering and terrorist financing because the persons who may ultimately benefit from or control the application of the trust property may not always be readily identifiable.

Source: researchgate.net

Source: researchgate.net

The Money Laundering Risk Posed by Lawyer Trust Accounts. Globally governments have narrowed key risk indicators to five primary divisions of 1 Nature size and complexity of a business 2 Customer types including B2B and B2C 3 the types of products and services provided to customers 4 method of on-boarding new customers and ongoing communications with existing customers and finally 5. The Money Laundering Risk Posed by Lawyer Trust Accounts. On top of this the Law enacts the core principle of risk-based approach whereby professionals have to take appropriate steps to identify and assess the risks of money laundering and terrorist financing they are confronted to taking into account risk factors such as those related to their customers countries geographic areas products services transactions or delivery channels. Money Laundering and Trust or Company Service Providers 2 Responsibilities of senior managers 3 Risk assessment policies controls and procedures 4 Customer due diligence 5 Reporting suspicious activity 6 Record Keeping 7 Staff awareness.

Source: piranirisk.com

Source: piranirisk.com

What are the key risk indicators for money laundering. In potentially important gaps in the global network to address the money laundering risks associated with this sector. Where the client is a foundation the private banker will understand the structure of. The identity of persons having a beneficial interest in a trust where it becomes known the identified beneficiary presents a high risk. Globally governments have narrowed key risk indicators to five primary divisions of 1 Nature size and complexity of a business 2 Customer types including B2B and B2C 3 the types of products and services provided to customers 4 method of on-boarding new customers and ongoing communications with existing customers and finally 5.

Source: unodc.org

Source: unodc.org

If any of the above are individuals their identity should be verified by obtaining the same documentation for an individual please see our Guide here. Trust given the nature of their business and the oath they take to demean themselves fairly and honorably as an attorney and practitioner at law However recent court cases have exposed an increasing number of legal professionals engaged in facilitating money laundering. Where the client is a foundation the private banker will understand the structure of. In January 2016 a nonprofit activist group conducted an. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations.

Source: unodc.org

Source: unodc.org

Trust or Company Service Providers 1 Introduction. Trust given the nature of their business and the oath they take to demean themselves fairly and honorably as an attorney and practitioner at law However recent court cases have exposed an increasing number of legal professionals engaged in facilitating money laundering. In January 2016 a nonprofit activist group conducted an. It requires an understanding of money laundering and terrorist financing risks at various levels including within Government supervisors and institutions in private sector. Trust or Company Service Providers 1 Introduction.

Source: baselgovernance.org

Source: baselgovernance.org

Recognises that the risks of money laundering and terrorist financing vary within and between sectors. Introduction These Guidance Notes aim to assist charity trustees to comply with their legal duties and responsibilities under the Charities Anti-Money Laundering Anti-Terrorist Financing and Reporting Regulations 2014 the Regulations. In January 2016 a nonprofit activist group conducted an. Trust or Company Service Providers 1 Introduction. The risk of money laundering and to cooperate with governments and their agencies in the detection of money laundering.

Source: wikiwand.com

Source: wikiwand.com

Money Laundering and Trust or Company Service Providers 2 Responsibilities of senior managers 3 Risk assessment policies controls and procedures 4 Customer due diligence 5 Reporting suspicious activity 6 Record Keeping 7 Staff awareness. The report not only provides a useful overview of the key tax evasion and money laundering issues and risks associated with the abuse of charities but also provides practical guidance to tax authorities that are seeking to implement strategies to effectively address these risks. If any of the above are individuals their identity should be verified by obtaining the same documentation for an individual please see our Guide here. Money laundering with trusts and related trustee services the separation of legal and beneficial ownership make trusts invaluable for those seeking to distance and disguise their connection with property used for or generated by crime. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations.

Source: researchgate.net

Source: researchgate.net

The risk of money laundering and to cooperate with governments and their agencies in the detection of money laundering. It means that supervisors financial institutions and trust and company service providers TCSPs identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed. The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime. In January 2016 a nonprofit activist group conducted an. The risk of money laundering and to cooperate with governments and their agencies in the detection of money laundering.

Source: ft.lk

Source: ft.lk

The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime. Trust or Company Service Providers 1 Introduction. In addition there are other bodies that have done significant work in this area and have developed some key. If any of the above are individuals their identity should be verified by obtaining the same documentation for an individual please see our Guide here. The identity of persons having a beneficial interest in a trust where it becomes known the identified beneficiary presents a high risk.

Source: unodc.org

Source: unodc.org

Consequently the Financial Action Task Force FATF and EU AMLDs concept of beneficial ownership differs materially. In potentially important gaps in the global network to address the money laundering risks associated with this sector. If any of the above are individuals their identity should be verified by obtaining the same documentation for an individual please see our Guide here. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill-gotten gains of crime. In December 2016 the Financial Action Task Force FATF an intergovernmental organization established during the 1989 G7 summit released a report on the United States efforts to combat money laundering and terrorist financing.

The FATF has already established standards which apply to this sector. Money Laundering and Trust or Company Service Providers 2 Responsibilities of senior managers 3 Risk assessment policies controls and procedures 4 Customer due diligence 5 Reporting suspicious activity 6 Record Keeping 7 Staff awareness. The risk-based approach incorporates three key elements. The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris. Trust or Company Service Providers 1 Introduction.

Source: slideplayer.com

Source: slideplayer.com

In January 2016 a nonprofit activist group conducted an. The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris. Where the client is a foundation the private banker will understand the structure of. In addition there are other bodies that have done significant work in this area and have developed some key. Trust or Company Service Providers 1 Introduction.

Source: mdpi.com

Source: mdpi.com

The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime. It means that supervisors financial institutions and trust and company service providers TCSPs identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed. Introduction These Guidance Notes aim to assist charity trustees to comply with their legal duties and responsibilities under the Charities Anti-Money Laundering Anti-Terrorist Financing and Reporting Regulations 2014 the Regulations. The risk-based approach incorporates three key elements. The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime.

Source: idmerit.com

Source: idmerit.com

What are the key risk indicators for money laundering. What are the key risk indicators for money laundering. The Money Laundering Risk Posed by Lawyer Trust Accounts. If any of the above are individuals their identity should be verified by obtaining the same documentation for an individual please see our Guide here. Consequently the Financial Action Task Force FATF and EU AMLDs concept of beneficial ownership differs materially.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title key money laundering risk with trust and foundations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information