18+ Know your customer and anti money laundering pdf ideas in 2021

Home » money laundering Info » 18+ Know your customer and anti money laundering pdf ideas in 2021Your Know your customer and anti money laundering pdf images are available. Know your customer and anti money laundering pdf are a topic that is being searched for and liked by netizens now. You can Get the Know your customer and anti money laundering pdf files here. Find and Download all free images.

If you’re looking for know your customer and anti money laundering pdf pictures information related to the know your customer and anti money laundering pdf keyword, you have visit the ideal blog. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Know Your Customer And Anti Money Laundering Pdf. This audit checklist is to assist in preparation for the anti money laundering AML process. In compliance with the Circular issued by the RBI regarding Know Your Customer guidelines Anti-Money Laundering Standards to be followed by all NBFCs the following KYC PMLA policy of the company has been adopted by the Board of Directors of the company at the board meeting. Manage your risks effectively protect your business from involvement in financial terrorist and criminal activities or being associated. On Anti-Money Laundering a FATFStyle Regional Body and an associate - member of FATF it is the duty of Nepalese bank to check and control money laundering related activities.

Kyc Sebagai Peran Perbankan Dalam Pemberantasan Tppu Pusat Pelaporan Dan Analisis Transaksi Keuangan From ppatk.go.id

Kyc Sebagai Peran Perbankan Dalam Pemberantasan Tppu Pusat Pelaporan Dan Analisis Transaksi Keuangan From ppatk.go.id

Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. This Policy also takes into account the provisions of the PMLA Act and other Rules laid down by SEBI FMC and FIU. Chapter I 1 Preamble 4 2 Objective 4 3 Definitions 4-9 Chapter II 4 Know Your Customer KYC Policy 9 5 Designated Director 10 6 Principal Officer 10 7 Compliance of KYC Policy 10 Chapter III. Version 3 October 30 2017 1 KNOW YOUR CUSTOMER KYC POLICY AS PER ANTI MONEY LAUNDERING STANDARDS IIFL WEALTH FINANCE LIMITED hereinafter referred to as IIFLW Financethe Company in compliance with the Reserve Bank of. 2008 prohibits financial Institutions to collect deposit fund from customers that have. 12 The Asset Laundering Money Laundering Prevention Act 2064 BS.

Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD.

Customer KYC Anti Money Laundering Policy originally by the Board of Directors of the Company in its Board Meeting last revised in the Board Meeting held on 27th June 2020 and this Policy shall have immediate effect to knowunderstand their customers and their financial dealings better which in turn would help them manage. AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms. Know Your Customer KYC Guidelines and Anti-Money Laundering AML Measures information as per the provisions of the Aadhaar Targeted Delivery of Financial and Other Subsidies Benefits and Services Act 2016. This Know Your Customer KYC and Anti-Money Laundering AML Policy the Policy has been prepared in accordance Prevention of Money Laundering Act 2002 PMLA Act. Since then the Policy has been reviewed and revised with the approval of the Board in line with the notifications on AML KYC issued RBI from time to time. In compliance with the Circular issued by the RBI regarding Know Your Customer guidelines Anti-Money Laundering Standards to be followed by all NBFCs the following KYC PMLA policy of the company has been adopted by the Board of Directors of the company at the board meeting.

Source: tookitaki.ai

Source: tookitaki.ai

Anti-money laundering Know our customer and curbing the Financing of Terrorism 11 Purpose This document provides a contextual background to the issues around customer registration money laundering and terrorist financing with a focus on the interna. Know your client checks KYC form part of anti money laundering checks regulations AML which govern the activities. Detailed enquiries if conducted should be able to validate documents and information provided by the customer together with substantiating claims regarding the source of funds. B Where the customer is a partnership firm the beneficial. Anti-money laundering Know our customer and curbing the Financing of Terrorism 11 Purpose This document provides a contextual background to the issues around customer registration money laundering and terrorist financing with a focus on the interna.

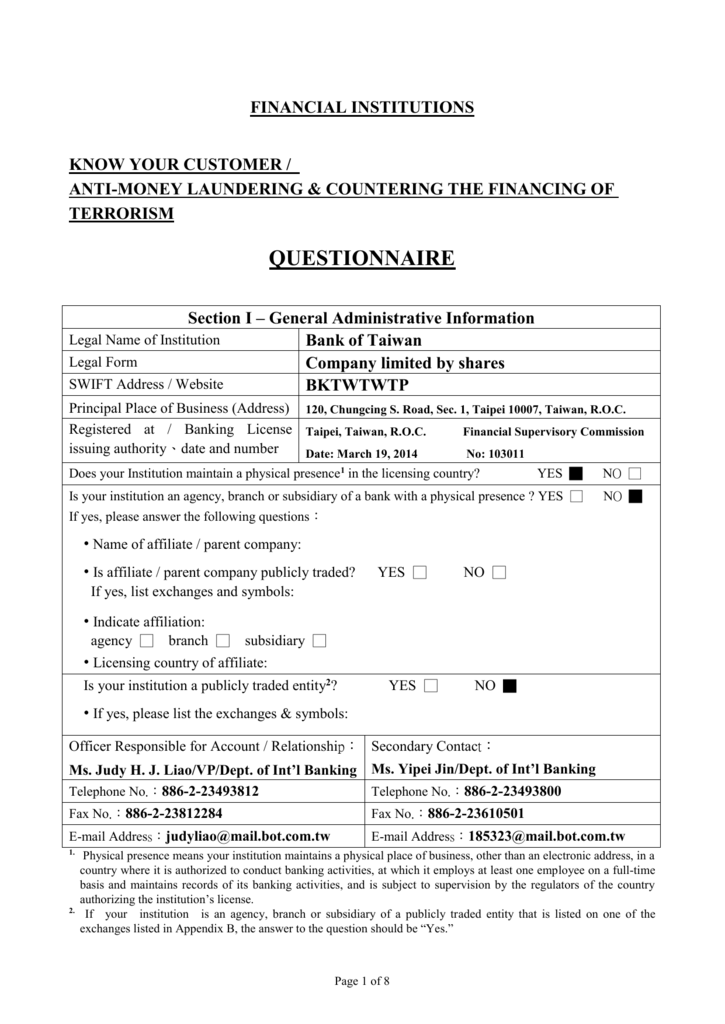

Source: studylib.net

Source: studylib.net

This Know Your Customer KYC and Anti-Money Laundering AML Policy the Policy has been prepared in accordance Prevention of Money Laundering Act 2002 PMLA Act. From the RBI a Know Your Customer and Anti Money Laundering Policy the Policy was put in place with approval of the Board on June 23 2006. As part of the battle against money laundering and terrorist financing the importance of a firm carrying out adequate KYC due diligence procedures can never be. The company shall adopt all best practises prescribed by the RBI from time to. This Know Your Customer and Anti -Money Laundering P olicy Policy has been framed by Northern Arc Capital Limited the Company in.

Source: ppatk.go.id

Source: ppatk.go.id

AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms. Anti-money laundering Know our customer and curbing the Financing of Terrorism 11 Purpose This document provides a contextual background to the issues around customer registration money laundering and terrorist financing with a focus on the interna. As part of the battle against money laundering and terrorist financing the importance of a firm carrying out adequate KYC due diligence procedures can never be. AND ANTI- MONEY LAUNDERING MEASURES PURPOSE This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and. Customer KYC Anti Money Laundering Policy originally by the Board of Directors of the Company in its Board Meeting last revised in the Board Meeting held on 27th June 2020 and this Policy shall have immediate effect to knowunderstand their customers and their financial dealings better which in turn would help them manage.

Source: bi.go.id

Source: bi.go.id

On Anti-Money Laundering a FATFStyle Regional Body and an associate - member of FATF it is the duty of Nepalese bank to check and control money laundering related activities. On Anti-Money Laundering a FATFStyle Regional Body and an associate - member of FATF it is the duty of Nepalese bank to check and control money laundering related activities. This Policy also takes into account the provisions of the PMLA Act and other Rules laid down by SEBI FMC and FIU. Know Your Customer KYC Guidelines and Anti-Money Laundering AML Measures information as per the provisions of the Aadhaar Targeted Delivery of Financial and Other Subsidies Benefits and Services Act 2016. As part of the battle against money laundering and terrorist financing the importance of a firm carrying out adequate KYC due diligence procedures can never be.

Source: yumpu.com

Source: yumpu.com

In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to. In terms of the Aadhaar Act every resident shall be eligible to obtain an Aadhaar number. Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level. From the RBI a Know Your Customer and Anti Money Laundering Policy the Policy was put in place with approval of the Board on June 23 2006. POLICY ON KNOW YOUR CUSTOMER KYC GUIDELINES AND ANTI MONEY LAUNDERING AML STANDARDS INDEX Sr.

Source: valueconsulttraining.com

Source: valueconsulttraining.com

On Anti-Money Laundering a FATFStyle Regional Body and an associate - member of FATF it is the duty of Nepalese bank to check and control money laundering related activities. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to. Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. Detailed enquiries if conducted should be able to validate documents and information provided by the customer together with substantiating claims regarding the source of funds. POLICY ON KNOW YOUR CUSTOMER KYC GUIDELINES AND ANTI MONEY LAUNDERING AML STANDARDS INDEX Sr.

Source: amazon.com

Source: amazon.com

AND ANTI- MONEY LAUNDERING MEASURES PURPOSE This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and. The company shall adopt all best practises prescribed by the RBI from time to. AND ANTI- MONEY LAUNDERING MEASURES PURPOSE This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and. Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level. Know Your Customer KYC Guidelines and Anti-Money Laundering AML Measures information as per the provisions of the Aadhaar Targeted Delivery of Financial and Other Subsidies Benefits and Services Act 2016.

Source: ing.com

Source: ing.com

Customer KYC Anti Money Laundering Policy originally by the Board of Directors of the Company in its Board Meeting last revised in the Board Meeting held on 27th June 2020 and this Policy shall have immediate effect to knowunderstand their customers and their financial dealings better which in turn would help them manage. Since then the Policy has been reviewed and revised with the approval of the Board in line with the notifications on AML KYC issued RBI from time to time. This Know Your Customer and Anti -Money Laundering P olicy Policy has been framed by Northern Arc Capital Limited the Company in. Policy on Know Your Customer KYC and Anti Money Laundering AML StandardsV20 Page 3 of 17 Control shall include the right to appoint majority of the directors or to control the management or policy decisions including by their shareholding or management rights or shareholders agreements or voting agreements. Bank customers are moderately aware of money laundering ML andterrorism financing TF and anti-money laundering AMLalong with Know Your Customer KYCHowever they.

Source: pinterest.com

Source: pinterest.com

No part of it may be circulated quoted or reproduced for distribution outside the organization without prior written approval from Fullerton India Credit Company Limited. The Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. Banks were advised tofollow certain customer identification procedure for opening of accounts and monitoring transactions of a. POLICY ON KNOW YOUR CUSTOMER KYC GUIDELINES AND ANTI MONEY LAUNDERING AML STANDARDS INDEX Sr. Know Your Customer KYC Guidelines and Anti-Money Laundering AML Measures information as per the provisions of the Aadhaar Targeted Delivery of Financial and Other Subsidies Benefits and Services Act 2016.

Source: pinterest.com

Source: pinterest.com

Know Your Customer KYC Guidelines and Anti-Money Laundering AML Measures information as per the provisions of the Aadhaar Targeted Delivery of Financial and Other Subsidies Benefits and Services Act 2016. Detailed enquiries if conducted should be able to validate documents and information provided by the customer together with substantiating claims regarding the source of funds. This audit checklist is to assist in preparation for the anti money laundering AML process. 2008 prohibits financial Institutions to collect deposit fund from customers that have. The Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers.

Source: identifai.id

Source: identifai.id

The company shall adopt all best practises prescribed by the RBI from time to. Know your client checks KYC form part of anti money laundering checks regulations AML which govern the activities. This Know Your Customer and Anti -Money Laundering P olicy Policy has been framed by Northern Arc Capital Limited the Company in. AND ANTI- MONEY LAUNDERING MEASURES PURPOSE This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and. 2008 prohibits financial Institutions to collect deposit fund from customers that have.

Source: amazon.in

Source: amazon.in

Know Your Customer KYC Guidelines Anti-Money Laundering Standards AML Policy This document is solely for internal use. Detailed enquiries if conducted should be able to validate documents and information provided by the customer together with substantiating claims regarding the source of funds. In terms of the Aadhaar Act every resident shall be eligible to obtain an Aadhaar number. Know Your Customer KYC Guidelines and Anti-Money Laundering AML Measures information as per the provisions of the Aadhaar Targeted Delivery of Financial and Other Subsidies Benefits and Services Act 2016. POLICY ON KNOW YOUR CUSTOMER KYC GUIDELINES AND ANTI MONEY LAUNDERING AML STANDARDS INDEX Sr.

Source: valueconsulttraining.com

Source: valueconsulttraining.com

This Policy also takes into account the provisions of the PMLA Act and other Rules laid down by SEBI FMC and FIU. No part of it may be circulated quoted or reproduced for distribution outside the organization without prior written approval from Fullerton India Credit Company Limited. Customer KYC Anti Money Laundering Policy originally by the Board of Directors of the Company in its Board Meeting last revised in the Board Meeting held on 27th June 2020 and this Policy shall have immediate effect to knowunderstand their customers and their financial dealings better which in turn would help them manage. Detailed enquiries if conducted should be able to validate documents and information provided by the customer together with substantiating claims regarding the source of funds. Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title know your customer and anti money laundering pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas