13+ Know your customer risk rating info

Home » money laundering idea » 13+ Know your customer risk rating infoYour Know your customer risk rating images are available in this site. Know your customer risk rating are a topic that is being searched for and liked by netizens today. You can Get the Know your customer risk rating files here. Get all free photos and vectors.

If you’re searching for know your customer risk rating images information related to the know your customer risk rating interest, you have come to the right site. Our website always gives you hints for seeking the highest quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

Know Your Customer Risk Rating. 255 rows To determine a customers overall risk rating a select list of variables are assessed and. Specifically the questions are. Further a spectrum of risks may be identifiable even within the same category of customers. Commonly referred to as the customer risk rating.

Your Quick Guide To Kyc And Aml Compliance Kyc3 From kyc3.com

Your Quick Guide To Kyc And Aml Compliance Kyc3 From kyc3.com

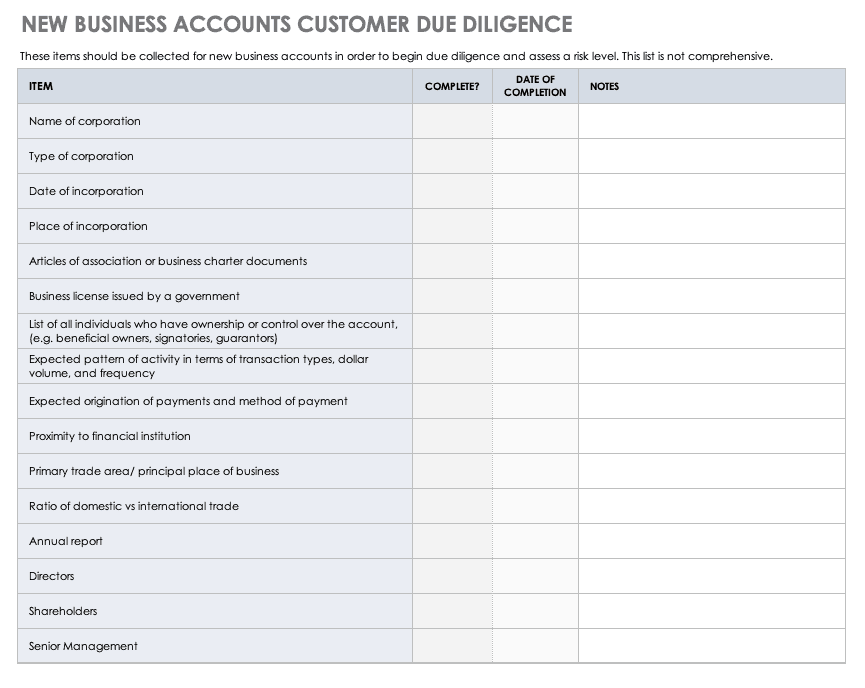

Most institutions calculate both of these risk ratings as each of them is equally important. You must document the customer identification procedures you use for different types of customers. The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score. Is it a requirement under the CDD Rule that covered financial institutions. Customers are assessed in different stages of their relationship with the bank or FI. Further a spectrum of risks may be identifiable even within the same category of customers.

Moreover the bank should assign the customer a risk rating to assess how they should watch the account and which customers pose too significant a risk to take on as new clients.

Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Commonly referred to as the customer risk rating. How KYC Risk Rating Works. Know Your Customer assesses the risk that a customer poses to a bank or FI. This study aims to provide an accurate risk assessment tool using unique KYC data and machine-learning techniques to overcome problems in existing risk detection methods. Know Your Customer KYC data can serve as a valuable risk assessment tool for banks by providing information that can identify customers who are more likely to default on a loan.

Source: pideeco.be

Source: pideeco.be

B Parameters of risk perception should be defined to classify customers as low medium and high risk keeping in view customers identity the nature of business activity location of customer social and financial status. What is KYC Risk Rating. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. Customers are assessed in different stages of their relationship with the bank or FI. Most institutions calculate both of these risk ratings as each of them is equally important.

Source: kyc3.com

Source: kyc3.com

Know Your Customer assesses the risk that a customer poses to a bank or FI. The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score. Any customer account may be used for illicit purposes including money laundering or terrorist financing. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Most institutions calculate both of these risk ratings as each of them is equally important.

Source: kyc3.com

Source: kyc3.com

Know Your Customer is the due diligence that Banks must perform to identify their clients and ascertain relevant information pertinent to doing business with them. A KYC risk rating is simply a calculation of risk. Customers are assessed in different stages of their relationship with the bank or FI. Know Your Customer KYC data can serve as a valuable risk assessment tool for banks by providing information that can identify customers who are more likely to default on a loan. Know Your Employee KYE.

Source: processmaker.com

Source: processmaker.com

Know Your Customer KYC Know Your Business KYB Know Your Customer - Risk Rating. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. What is KYC Risk Rating. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers.

Source: factly.in

Source: factly.in

Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. If warranted banks would ask consumers for more information such as their occupation a description of business operations source of funding their accounts. Know Your Customer assesses the risk that a customer poses to a bank or FI. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

Source: kyc3.com

Source: kyc3.com

Know Your Customer KYC data can serve as a valuable risk assessment tool for banks by providing information that can identify customers who are more likely to default on a loan. Specifically the questions are. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. How KYC Risk Rating Works.

Source: processmaker.com

Source: processmaker.com

How KYC Risk Rating Works. Moreover the bank should assign the customer a risk rating to assess how they should watch the account and which customers pose too significant a risk to take on as new clients. The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score. Based on the customers risk score the KYC system determines the next review date. How KYC Risk Rating Works.

Source:

The FinCEN update focuses on answering questions about information that should be gathered at account opening requirements for risk rating customers and KYC file refresh. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. Our risk ranking tool has been designed to provide a measure of the money laundering risk of countries that your organisation might have client relationships with or doing business with.

Source: kyc-chain.com

Source: kyc-chain.com

A KYC risk rating is simply a calculation of risk. Most institutions calculate both of these risk ratings as each of them is equally important. The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. A KYC risk rating is simply a calculation of risk.

Source: kyc3.com

Source: kyc3.com

Know Your Employee KYE. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Is it a requirement under the CDD Rule that covered financial institutions. Commonly referred to as the customer risk rating. KYC is a continuous process of assessment and not a one time assessment of a customer.

Source: akseleran.co.id

Source: akseleran.co.id

Effective KYC involves knowing a customers identity their financial activities and the risk they pose. Know Your Employee KYE. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between.

Source: smartsheet.com

Source: smartsheet.com

Any customer account may be used for illicit purposes including money laundering or terrorist financing. Know Your Customer KYC Know Your Business KYB Know Your Customer - Risk Rating. Know Your Customer is the due diligence that Banks must perform to identify their clients and ascertain relevant information pertinent to doing business with them. You must document the customer identification procedures you use for different types of customers. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

Source: indiaforensic.com

Source: indiaforensic.com

Based on the customers risk score the KYC system determines the next review date. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. C FIHFC should seek only such information which is relevant to the risk category of the customer. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. The ongoing monitoring of customer involves overseeing of transactions based on thresholds stated as part of a customers risk score.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title know your customer risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information