16+ Kyc and anti money laundering pdf ideas

Home » money laundering idea » 16+ Kyc and anti money laundering pdf ideasYour Kyc and anti money laundering pdf images are available. Kyc and anti money laundering pdf are a topic that is being searched for and liked by netizens today. You can Download the Kyc and anti money laundering pdf files here. Find and Download all free vectors.

If you’re looking for kyc and anti money laundering pdf images information linked to the kyc and anti money laundering pdf topic, you have come to the right blog. Our website frequently gives you hints for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

Kyc And Anti Money Laundering Pdf. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably. 2008 prohibits financial Institutions to collect deposit fund from customers that have. Anti-money Laundering KYC Booklet STAFF. However some sectors face a greater risk of coming across crime proceeds or terrorist property than others e.

Pin By Amalesh Vemula On My Imp Money Laundering Compliance Programming From pinterest.com

Pin By Amalesh Vemula On My Imp Money Laundering Compliance Programming From pinterest.com

Frequently Asked Questions on KYC Norms and Anti Money Laundering Introduction. Policy on Know Your Customer KYC and Anti Money Laundering AML StandardsV20 Page 3 of 17 Control shall include the right to appoint majority of the directors or to control the management or policy decisions including by their shareholding or management rights or shareholders agreements or voting agreements. Know Your Customer KYC Guidelines and Anti-Money Laundering AML Measures 39Digital KYC means the capturing live photo of the customer and officially valid document or the proof of possession of Aadhaar where offline verification cannot be carried out along with the latitude. No part of it may be circulated quoted or reproduced for distribution outside the organization without prior written. Guidelines to Banks on Know Your Customer KYC and Anti Money Laundering AML in November 2004. The most important roles in development implementation and.

Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably.

Financial institutions are required by regulators to help combat money laundering and have invested billions. Definitions Money Laundering Money Laundering is the participation in any transaction that attempts to conceal or disguise the nature or origin of funds derived from illegal activities such as fraud corruption tax. Chapter I 1 Preamble 4 2 Objective 4 3 Definitions 4-9 Chapter II 4 Know Your Customer KYC Policy 9 5 Designated Director 10 6 Principal Officer 10 7 Compliance of KYC Policy 10 Chapter III. This is like a boon for banking staffs as they work they get a golden opportunity of increasing their departmental knowledge. PREFACE This Know Your Customer KYC and Anti-Money Laundering AML Policy the Policy has been prepared in accordance Prevention of Money Laundering Act 2002 PMLA Act. Financial institutions are required by regulators to help combat money laundering and have invested billions.

Source: in.pinterest.com

Source: in.pinterest.com

No part of it may be circulated quoted or reproduced for distribution outside the organization without prior written. Money laundering is a serious problem for the global economy with the sums involved variously estimated at between 2 and 5 percent of global GDP. No part of it may be circulated quoted or reproduced for distribution outside the organization without prior written. Definitions Money Laundering Money Laundering is the participation in any transaction that attempts to conceal or disguise the nature or origin of funds derived from illegal activities such as fraud corruption tax. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to.

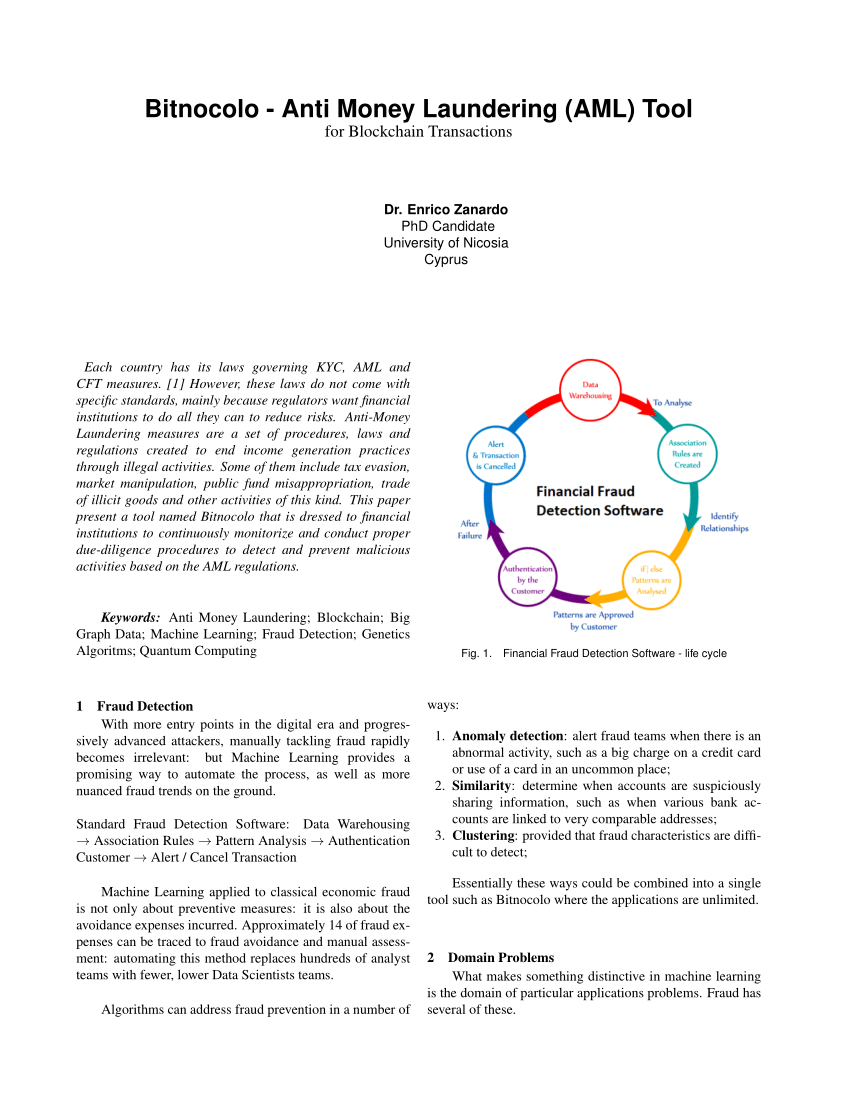

Source: researchgate.net

Source: researchgate.net

Banks were advised tofollow certain customer identification procedure for opening of accounts and monitoring transactions of a. No part of it may be circulated quoted or reproduced for distribution outside the organization without prior written. Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD. The most important roles in development implementation and. Practice Now and enrich your profile.

Source: pinterest.com

Source: pinterest.com

Kyc and anti money laundering zip Size. Kyc and anti money laundering zip Size. Money laundering has become a pertinent problem worldwide threatening the stability of various regions by actively supporting and strengthening terrorist networks and criminal organizations. Definitions Money Laundering Money Laundering is the participation in any transaction that attempts to conceal or disguise the nature or origin of funds derived from illegal activities such as fraud corruption tax. No part of it may be circulated quoted or reproduced for distribution outside the organization without prior written.

Source: semanticscholar.org

Source: semanticscholar.org

This is like a boon for banking staffs as they work they get a golden opportunity of increasing their departmental knowledge. Money laundering has become a pertinent problem worldwide threatening the stability of various regions by actively supporting and strengthening terrorist networks and criminal organizations. No part of it may be circulated quoted or reproduced for distribution outside the organization without prior written. POLICY ON KNOW YOUR CUSTOMER KYC GUIDELINES AND ANTI MONEY LAUNDERING AML STANDARDS INDEX Sr. Aml kyc book macmillan pdf.

Source: pdfcoffee.com

Source: pdfcoffee.com

Frequently Asked Questions on KYC Norms and Anti Money Laundering Introduction. KYC AML Policy Know Your Customer KYC Guidelines Anti-Money Laundering Standards AML Policy This document is solely for internal use. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. This Policy shall be known as Know Your Customer and Anti Money Laundering Policy. Practice Now and enrich your profile.

Source: pinterest.com

Source: pinterest.com

Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably. Know Your Customer KYC Guidelines and Anti-Money Laundering AML Measures 39Digital KYC means the capturing live photo of the customer and officially valid document or the proof of possession of Aadhaar where offline verification cannot be carried out along with the latitude. This is like a boon for banking staffs as they work they get a golden opportunity of increasing their departmental knowledge. Anti-Money Laundering procedures assume the involvement of all the Officers Employees and Departments of the Company assuming the clear assignment of roles and responsibilities. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions.

Source: researchgate.net

Source: researchgate.net

Frequently Asked Questions on KYC Norms and Anti Money Laundering Introduction. The Indian Parliament passed the Prevention of Money Laundering Act PMLA in 2002 to implement the Political Declaration adopted by the special session of the United Nations General Assembly held during June 8-10 1998 and the. Financial institutions are required by regulators to help combat money laundering and have invested billions. Anti-Money Laundering procedures assume the involvement of all the Officers Employees and Departments of the Company assuming the clear assignment of roles and responsibilities. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably.

Source: pinterest.com

Source: pinterest.com

Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD. Version 3 October 30 2017 1 KNOW YOUR CUSTOMER KYC POLICY AS PER ANTI MONEY LAUNDERING STANDARDS IIFL WEALTH FINANCE LIMITED hereinafter referred to as IIFLW Financethe Company in compliance with the Reserve Bank of. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. Policy on Know Your Customer KYC and Anti Money Laundering AML StandardsV20 Page 3 of 17 Control shall include the right to appoint majority of the directors or to control the management or policy decisions including by their shareholding or management rights or shareholders agreements or voting agreements. Money laundering has become a pertinent problem worldwide threatening the stability of various regions by actively supporting and strengthening terrorist networks and criminal organizations.

Source: pinterest.com

Source: pinterest.com

AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms. Anti-money Laundering KYC Booklet STAFF. Framework on Know Your Customer and Anti Money Laundering measures has been put in place with the approval of the Board of Directors on 01032006. Financial institutions are required by regulators to help combat money laundering and have invested billions. Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD.

Financial institutions are required by regulators to help combat money laundering and have invested billions. Indian Institute of Banking and Finance is a group of financial organizations and their representatives. Framework on Know Your Customer and Anti Money Laundering measures has been put in place with the approval of the Board of Directors on 01032006. Money laundering is a serious problem for the global economy with the sums involved variously estimated at between 2 and 5 percent of global GDP. Chapter I 1 Preamble 4 2 Objective 4 3 Definitions 4-9 Chapter II 4 Know Your Customer KYC Policy 9 5 Designated Director 10 6 Principal Officer 10 7 Compliance of KYC Policy 10 Chapter III.

Source: bi.go.id

Source: bi.go.id

12 The Asset Laundering Money Laundering Prevention Act 2064 BS. Money laundering is a serious problem for the global economy with the sums involved variously estimated at between 2 and 5 percent of global GDP. Indian Institute of Banking and Finance is a group of financial organizations and their representatives. Money laundering has become a pertinent problem worldwide threatening the stability of various regions by actively supporting and strengthening terrorist networks and criminal organizations. Financial institutions are required by regulators to help combat money laundering and have invested billions.

Source: tookitaki.ai

Source: tookitaki.ai

Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level. AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms. PREFACE This Know Your Customer KYC and Anti-Money Laundering AML Policy the Policy has been prepared in accordance Prevention of Money Laundering Act 2002 PMLA Act. B Where the customer is a partnership firm the beneficial. No part of it may be circulated quoted or reproduced for distribution outside the organization without prior written.

Practice Now and enrich your profile. Anti-Money Laundering procedures assume the involvement of all the Officers Employees and Departments of the Company assuming the clear assignment of roles and responsibilities. Introduction Money laundering is a way of converting the proceeds of crime into assets that appear to have a. Chapter I 1 Preamble 4 2 Objective 4 3 Definitions 4-9 Chapter II 4 Know Your Customer KYC Policy 9 5 Designated Director 10 6 Principal Officer 10 7 Compliance of KYC Policy 10 Chapter III. 2008 prohibits financial Institutions to collect deposit fund from customers that have.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title kyc and anti money laundering pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information