18+ Kyc anti money laundering exam ideas in 2021

Home » money laundering Info » 18+ Kyc anti money laundering exam ideas in 2021Your Kyc anti money laundering exam images are ready in this website. Kyc anti money laundering exam are a topic that is being searched for and liked by netizens today. You can Download the Kyc anti money laundering exam files here. Get all royalty-free photos.

If you’re searching for kyc anti money laundering exam images information connected with to the kyc anti money laundering exam keyword, you have come to the right site. Our site frequently provides you with hints for seeking the highest quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

Kyc Anti Money Laundering Exam. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. Yes IIBF AML-KYC examination is held in online mode. Enrol now on the Anti Money Laundering AML and KYC Concepts and get access to top-quality training modules which will cover the essential topics you need to excel in your chosen field and help push you towards your dream job. The candidate will get 2 hours to complete the exam.

Aml Kyc Certification Course Chapter 1 Aml Kyc Iibf Study Material Aml Kyc Case Studies Youtube From youtube.com

Aml Kyc Certification Course Chapter 1 Aml Kyc Iibf Study Material Aml Kyc Case Studies Youtube From youtube.com

We suggest you to check our free online mock tests for IIBF examinations. Initiate the AML risk assessment. To increase competition among the public sector and private sector banks. Be aware of the consequences for non-compliance. 8434 Last updated. Certified Anti Money Laundering Expert is one of the best certifications in the compliance domain.

To increase competition among the public sector and private sector banks.

This exam will be conducted by the Indian Institute of Banking and Finance IIBF. To provide advanced knowledge and understanding in AML KYC standards. This exam will be conducted by the Indian Institute of Banking and Finance IIBF. Initiate the AML risk assessment. The sources of the money in precise are criminal and the cash is invested in a way that makes it appear like clean money and hide the identity of the prison a part of the money earned. Yes IIBF AML-KYC examination is held in online mode.

Source: youtube.com

Source: youtube.com

The exam includes approx 120 questions for 100 marks. Exemplify common money laundering schemes. KYC is a very important element of the Anti Money Laundering Regime. Efficient assessment system with instant results. Check out Money laundering kyc here.

Source: bankingtides.com

Source: bankingtides.com

The sources of the money in precise are criminal and the cash is invested in a way that makes it appear like clean money and hide the identity of the prison a part of the money earned. Be aware of the consequences for non-compliance. It is a process by which soiled cash is converted into clean cash. To discourage opening of new accounts. The Federal Financial Institutions Examination Councils FFIEC Bank Secrecy ActAnti-Money Laundering examination manual updated as of April 2020 identifies six elements of an effective BSAAML compliance program including the existence of a system of internal controls to assure ongoing compliance the performance of independent testing for compliance by bank personnel or by an.

Source: amazon.in

Source: amazon.in

We suggest you to check our free online mock tests for IIBF examinations. Is it a computer based test. The Federal Financial Institutions Examination Councils FFIEC Bank Secrecy ActAnti-Money Laundering examination manual updated as of April 2020 identifies six elements of an effective BSAAML compliance program including the existence of a system of internal controls to assure ongoing compliance the performance of independent testing for compliance by bank personnel or by an. Be aware of the consequences for non-compliance. It is a professional certification exam in Anti Money Laundering and Know your customer conducted by Indian Institute of Banking and Finance.

Source: youtube.com

Source: youtube.com

This is a comprehensive course that captures. You can try the simulated tests before taking the admissions for the certification exams. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. It is a professional certification exam in Anti Money Laundering and Know your customer conducted by Indian Institute of Banking and Finance. Welcome to the course on Anti-Money Laundering AML where you will learn about the key issues faced by financial institutions today.

Source: slideshare.net

Source: slideshare.net

Welcome to the course on Anti-Money Laundering AML where you will learn about the key issues faced by financial institutions today. Understand the relevant of anti-money laundering. Is it a computer based test. The quiz below is designed to. Certified Anti Money Laundering Expert is one of the best certifications in the compliance domain.

Source: slideshare.net

Source: slideshare.net

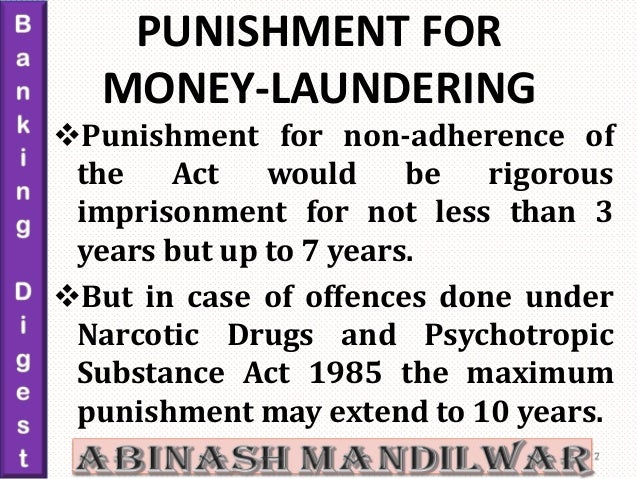

Be aware of the consequences for non-compliance. We suggest you to check our free online mock tests for IIBF examinations. 8434 Last updated. Objective of KYC guidelines issued by RBI is -. Why Choose Anti Money Laundering AML and KYC Concepts.

Explaining the format of the IIBF AML-KYC Practice Exam is the most important step. Objective of IIBF AML - KYC Exam. It is a professional certification exam in Anti Money Laundering and Know your customer conducted by Indian Institute of Banking and Finance. IIBF AML-KYC certified candidates earn academic credential that can offer career growth opportunities. To provide advanced knowledge and understanding in AML KYC standards.

The quiz below is designed to. Why Choose Anti Money Laundering AML and KYC Concepts. Is it a computer based test. Understand the relevant of anti-money laundering. It will surely help you in the effective preparation of JAIIB CAIIB AML KYC exam.

Mock KYC tests help the students to test their KYC related knowledge. To increase competition among the public sector and private sector banks. Mock KYC tests help the students to test their KYC related knowledge. This course will educate you on Money Laundering and Terrorist Financing laws Know Your Customer Customer Due Diligence Economic Sanctions and Politically Exposed Persons. This exam will be conducted by the Indian Institute of Banking and Finance IIBF.

Source: youtube.com

Source: youtube.com

8434 Last updated. Understand the relevant of anti-money laundering. CDD EDD KYC KYCC KYB and PEP. The candidate will get 2 hours to complete the exam. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions.

Source: slideshare.net

Source: slideshare.net

To develop the professional competence of employees of banks and financial institutions. The Federal Financial Institutions Examination Councils FFIEC Bank Secrecy ActAnti-Money Laundering examination manual updated as of April 2020 identifies six elements of an effective BSAAML compliance program including the existence of a system of internal controls to assure ongoing compliance the performance of independent testing for compliance by bank personnel or by an. To discourage opening of new accounts. To check control over the new accounts. Be aware of the consequences for non-compliance.

Source: siorik.com

Source: siorik.com

To discourage opening of new accounts. To check control over the new accounts. The syllabus given below is based on the latest pattern of the IIBF curriculum. CDD EDD KYC KYCC KYB and PEP. Explaining the format of the IIBF AML-KYC Practice Exam is the most important step.

Source: pdfcoffee.com

Source: pdfcoffee.com

It is a professional certification exam in Anti Money Laundering and Know your customer conducted by Indian Institute of Banking and Finance. Exemplify common money laundering schemes. Objective of KYC guidelines issued by RBI is -. Why Choose Anti Money Laundering AML and KYC Concepts. To provide a comprehensive coverage of the various guidelines standards guidance notes issued by RBI IBA International bodies etc.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title kyc anti money laundering exam by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas