15++ Kyc certification course in india info

Home » money laundering Info » 15++ Kyc certification course in india infoYour Kyc certification course in india images are available in this site. Kyc certification course in india are a topic that is being searched for and liked by netizens today. You can Find and Download the Kyc certification course in india files here. Get all free photos.

If you’re looking for kyc certification course in india pictures information linked to the kyc certification course in india topic, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly search and locate more enlightening video content and images that match your interests.

Kyc Certification Course In India. It is a term coined to underline the importance of the technology in complying with various KYC regulations. The course is suitable for new entrants compliance professionals. AML KYC certificate course in India. And finally participants will be trained to communicate their findings effectively verbally and in writing with the banks KYC stakeholders such as the client-facing personnel.

Certified Anti Money Laundering Expert Goes Global Money Laundering Global Anti From in.pinterest.com

Certified Anti Money Laundering Expert Goes Global Money Laundering Global Anti From in.pinterest.com

All exams are online now due to COVID related precautions Download the app or write to us at infovskillsin. What is video based KYC identification process in India in 3 mins Video KYC process V-CIP The Reserve Bank of India RBI on 9 Jan 2020 amended the KYC norms allowing banks and other lending institutions regulated by it to use. And finally participants will be trained to communicate their findings effectively verbally and in writing with the banks KYC stakeholders such as the client-facing personnel. Training and Awareness Part 1. Kyc Aml Certification Course In India. 22 Min 48 Sec.

Training and Awareness Part 1.

Are complicated and interconnected activities that require a comprehensive and focused study and approach. And finally participants will be trained to communicate their findings effectively verbally and in writing with the banks KYC stakeholders such as the client-facing personnel. Compliance with Know Your Customer guidelines and Anti-Money Laundering standards has become necessary for healthy financial relationships both by the banks financial institutions in India. However one of the most significant certifications that you can see in India besides ACAMS is Certified Anti Money Laundering Expert CAME This certification is one of the most exhaustive courses on the subject of AML and KYC. What is video based KYC identification process in India in 3 mins Video KYC process V-CIP The Reserve Bank of India RBI on 9 Jan 2020 amended the KYC norms allowing banks and other lending institutions regulated by it to use. AAMC Training New Delhi.

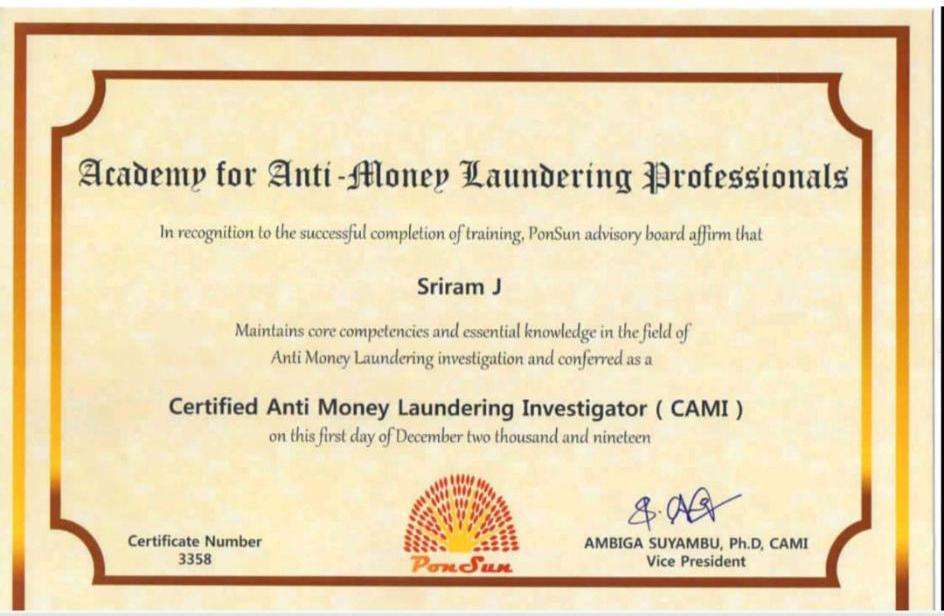

Source: ponsun-amlacademy.com

Source: ponsun-amlacademy.com

The sources of the cash in actual are prison and the money is invested in a approach that makes it look like clean money and conceal the identity of the felony part of the money earned. Join this training course if you aspire to work in banking sector. Available on desktop or mobile and most other devices Content split into sections complete these at your own pace within four weeks Pass a short assessment and you will receive the KYC Foundations Certificate. It is based in India. The sources of the cash in actual are prison and the money is invested in a approach that makes it look like clean money and conceal the identity of the felony part of the money earned.

Source: pinterest.com

Source: pinterest.com

This program emphasize on the local laws and the local terminologies. The Certificate program on Anti-money laundering aims to provide an understanding of. Acquire knowledge of the MLRONO role in practice. What is video based KYC identification process in India in 3 mins Video KYC process V-CIP The Reserve Bank of India RBI on 9 Jan 2020 amended the KYC norms allowing banks and other lending institutions regulated by it to use. Certified Anti Money Laundering Expert CAME cover various aspects in our course including the legal provisions related to Money Laundering but the focus of the course remains on the suspected transaction analysis.

Source: in.pinterest.com

Source: in.pinterest.com

Vskills certification in KYC Know Your Customer and Anti Money Laundering Operation is one of the first certifications in this area of banking sector. The ICA Certificate in KYC and CDD provides a foundation knowledge of KYC and CDD concepts. All exams are online now due to COVID related precautions Download the app or write to us at infovskillsin. However one of the most significant certifications that you can see in India besides ACAMS is Certified Anti Money Laundering Expert CAME This certification is one of the most exhaustive courses on the subject of AML and KYC. And finally participants will be trained to communicate their findings effectively verbally and in writing with the banks KYC stakeholders such as the client-facing personnel.

Source: in.pinterest.com

Source: in.pinterest.com

Regtech companies help the financial institutions and other intermediaries to solve the AML KYC. Moreover this course is designed for the Indian bankers and compliance professionals. Regtech literally means Regulatory Technologies. However one of the most significant certifications that you can see in India besides ACAMS is Certified Anti Money Laundering Expert CAME This certification is one of the most exhaustive courses on the subject of AML and KYC. The ICA Certificate in KYC and CDD provides a foundation knowledge of KYC and CDD concepts.

Source: in.pinterest.com

Source: in.pinterest.com

Certified Anti Money Laundering Expert CAME cover various aspects in our course including the legal provisions related to Money Laundering but the focus of the course remains on the suspected transaction analysis. This program offers the benefits of global certifications at the local prices. CAME pricing point is far more effective for Indian students. Money Laundering Case Studies India pada tanggal Agustus 05 2021 laundering money Studies Wallpaper. Organisational Set up for KYCAML.

Source: in.pinterest.com

Source: in.pinterest.com

Are complicated and interconnected activities that require a comprehensive and focused study and approach. Certified Anti Money Laundering Expert Program is one of the most popular programs in India. This program emphasize on the local laws and the local terminologies. Their courses connect with local audience and address the issues of the local compliance professionals. Available on desktop or mobile and most other devices Content split into sections complete these at your own pace within four weeks Pass a short assessment and you will receive the KYC Foundations Certificate.

Source: pinterest.com

Source: pinterest.com

I-KYC has developed a skills training programme for three levels of expertise. This program emphasize on the local laws and the local terminologies. Now consider ACAMS CAME. It is a term coined to underline the importance of the technology in complying with various KYC regulations. Gain essential perspective on the broader agenda of financial crime.

Source: pinterest.com

Source: pinterest.com

Starters to analysts with approximately 1 year of. Are complicated and interconnected activities that require a comprehensive and focused study and approach. Certified Anti Money Laundering Expert Program is one of the most popular programs in India. Now consider ACAMS CAME. The sources of the cash in actual are prison and the money is invested in a approach that makes it look like clean money and conceal the identity of the felony part of the money earned.

Source: in.pinterest.com

Source: in.pinterest.com

Money Laundering Case Studies India pada tanggal Agustus 05 2021 laundering money Studies Wallpaper. Acquire knowledge of the MLRONO role in practice. As regulatory expectations increase knowing your customer is essential. Their courses connect with local audience and address the issues of the local compliance professionals. We provide government certified online courses for working professionals.

Source: pinterest.com

Source: pinterest.com

The certification aims to impart training to enhance knowledge and skills in financial crime prevention and detection that is important to protect oneself and the organization from fraudsters. It is popular because of the innovative courses it launched such as KYC Certification TBML Certification. What is video based KYC identification process in India in 3 mins Video KYC process V-CIP The Reserve Bank of India RBI on 9 Jan 2020 amended the KYC norms allowing banks and other lending institutions regulated by it to use. CAME pricing point is far more effective for Indian students. This program emphasize on the local laws and the local terminologies.

Source: pinterest.com

Source: pinterest.com

Certificate Examination in AMLKYC Course is Offered by Academy Of Trade Finance. As regulatory expectations increase knowing your customer is essential. The ICA Certificate in KYC and CDD provides a foundation knowledge of KYC and CDD concepts. I-KYC has developed a skills training programme for three levels of expertise. 22 Min 48 Sec.

Source: pinterest.com

Source: pinterest.com

Issues like money laundering fraud corruption bribery sanctions data security cyber fraud etc. Legal and regulatory obligations. Its a course of by which dirty money is converted into clean cash. 22 Min 48 Sec. The Certificate program on Anti-money laundering aims to provide an understanding of.

Source: youtube.com

Source: youtube.com

And finally participants will be trained to communicate their findings effectively verbally and in writing with the banks KYC stakeholders such as the client-facing personnel. We provide government certified online courses for working professionals. It is popular because of the innovative courses it launched such as KYC Certification TBML Certification. Regtech companies help the financial institutions and other intermediaries to solve the AML KYC. Vskills certification in KYC Know Your Customer and Anti Money Laundering Operation is one of the first certifications in this area of banking sector.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kyc certification course in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas