11+ Kyc money laundering regulations information

Home » money laundering Info » 11+ Kyc money laundering regulations informationYour Kyc money laundering regulations images are ready. Kyc money laundering regulations are a topic that is being searched for and liked by netizens today. You can Download the Kyc money laundering regulations files here. Get all free vectors.

If you’re searching for kyc money laundering regulations pictures information linked to the kyc money laundering regulations topic, you have come to the right blog. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Kyc Money Laundering Regulations. ZealiD allows finance service providers to meet so called know your customer regulations KYC in the jurisdiction in which service providers are licensed. EU Legislation Information Accompanying Transfers of Funds Jersey Regulations 2017. Regulatory legislation relating to AML CFT. Money Laundering and Weapons Development Directions Jersey Law 2012.

Difference Between Kyc And Aml Tookitaki Tookitaki From tookitaki.ai

Difference Between Kyc And Aml Tookitaki Tookitaki From tookitaki.ai

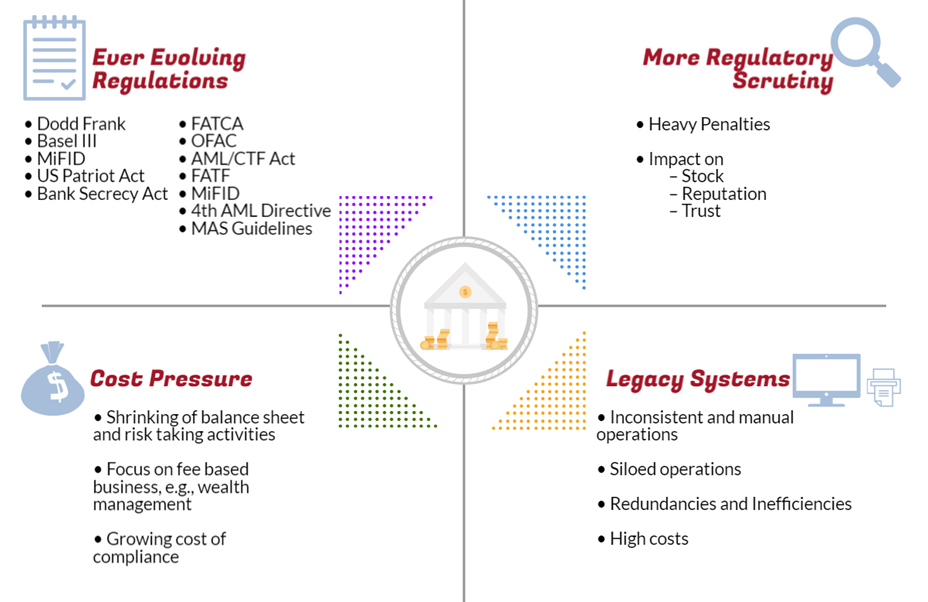

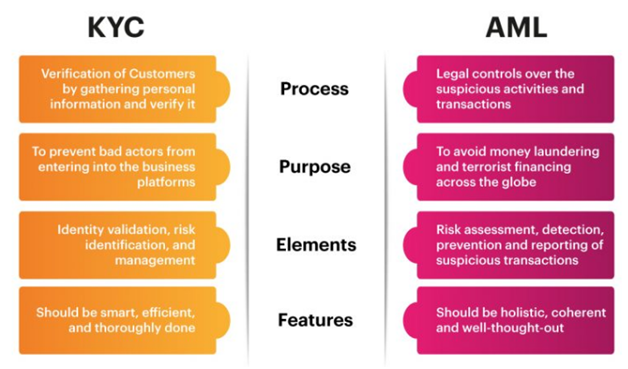

It is important to understand the magnitude of the risks associated with money launderingThese criminal practices are a really considerable offence for society companies and individuals and therefore compliance with the practices of prevention of money. The KYC process entails identifying and verifying the identity of clients through documents and gathering of information. Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level. With our platform you can be confident that your digital workflow meets the online Know Your Customer KYC requirements across Europe and beyond whether youre a bank or a car-sharing service. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to assist firms operating. ZealiD allows finance service providers to meet so called know your customer regulations KYC in the jurisdiction in which service providers are licensed.

Regulatory legislation relating to AML CFT.

In addition they play an essential function in blockchain-based crypto shares and BTC too. Most of all these procedures are critical functions to access and monitor customer risk and legal requirement to also comply with Anti-money laundering AML laws. Money Laundering and Weapons Development Directions Jersey Law 2012. On paper the objectives of KYC guidelines are to prevent ICO projects from being exploited by criminal elements that are involved in money laundering activitiesSo KYC. KYC is one of several anti money laundering. With our platform you can be confident that your digital workflow meets the online Know Your Customer KYC requirements across Europe and beyond whether youre a bank or a car-sharing service.

Source: medium.com

Source: medium.com

KYC AML regulations. ZealiD allows finance service providers to meet so called know your customer regulations KYC in the jurisdiction in which service providers are licensed. Most of all these procedures are critical functions to access and monitor customer risk and legal requirement to also comply with Anti-money laundering AML laws. Satisfy yourself that the source of the customers funds is legitimate. This directive would be the fourth 4 and amends Directive EU 2015849 which already.

Source: medium.com

Source: medium.com

KYC involves collection and analysis of identity information to determine a prediction of future client transaction behavior and the likelihood of the client to commit money laundering. KYC and AML obligations are nothing new to the legal sector. KYC AML regulations. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to assist firms operating. These include carrying out customer due diligence measures to check that your.

Source: masterthecrypto.com

Source: masterthecrypto.com

Regulatory legislation relating to AML CFT. This directive would be the fourth 4 and amends Directive EU 2015849 which already. The Anti-Money Laundering Directive requires obliged entities eg financial institutions to carry out Customer Due Diligence CDD in order to prevent the holding of anonymous accounts as well as in circumstances that meet certain monetary thresholds or where there is suspicion that activity may be related to money laundering or terrorist financing. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. KYC is one of several anti money laundering.

Source: argoskyc.medium.com

Source: argoskyc.medium.com

KYC is one of several anti money laundering. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs. AML Anti-Money Laundering also known as Prevention of Money Laundering is closely related to the KYC Know Your Customer process. Satisfy yourself that the source of the customers funds is legitimate. It is now more crucial than ever for firms to have.

Source: sfl.global

Source: sfl.global

It is important to understand the magnitude of the risks associated with money launderingThese criminal practices are a really considerable offence for society companies and individuals and therefore compliance with the practices of prevention of money. As a second step in combating MLTF organizations that are at risk for being misused for MLTF must observe national anti-money laundering regulations by a implementing internal compliance programs and policies that b make use of automated systems contain clear processes to identify potential risks and c has internal control systems that are independent and avoid conflicts of. Among the different regulations we have in Europe the Directive EU 2018843 regarding the prevention of money laundering or the financing of terrorism. Anti-Money Laundering AML and Know Your Customer KYC regulations are shared over the world. The KYC process entails identifying and verifying the identity of clients through documents and gathering of information.

Source: mobbeel.com

Source: mobbeel.com

Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. As a second step in combating MLTF organizations that are at risk for being misused for MLTF must observe national anti-money laundering regulations by a implementing internal compliance programs and policies that b make use of automated systems contain clear processes to identify potential risks and c has internal control systems that are independent and avoid conflicts of. It is important to understand the magnitude of the risks associated with money launderingThese criminal practices are a really considerable offence for society companies and individuals and therefore compliance with the practices of prevention of money. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. Identity theft or terrorist financing.

Source: researchgate.net

Source: researchgate.net

ZealiD allows finance service providers to meet so called know your customer regulations KYC in the jurisdiction in which service providers are licensed. AML Anti-Money Laundering also known as Prevention of Money Laundering is closely related to the KYC Know Your Customer process. The fines for non-compliance with AML Know Your Customer KYC and sanctions requirements continue to be large the costs of compliance continue to increase and firms are increasingly under pressure to identify ways to manage their AML risks more effectively both from a regulatory and commercial standpoint. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably it can be difficult to understand how they differ in a regulatory. Anti-Money Laundering AML and Know Your Customer KYC regulations are shared over the world.

Source: blog.neufund.org

Regulatory legislation relating to AML CFT. This directive would be the fourth 4 and amends Directive EU 2015849 which already. KYC and AML obligations are nothing new to the legal sector. Financial Crime Guide Tool. The KYC process entails identifying and verifying the identity of clients through documents and gathering of information.

Source: tookitaki.ai

Source: tookitaki.ai

The Anti-Money Laundering Directive requires obliged entities eg financial institutions to carry out Customer Due Diligence CDD in order to prevent the holding of anonymous accounts as well as in circumstances that meet certain monetary thresholds or where there is suspicion that activity may be related to money laundering or terrorist financing. Money Laundering and Weapons Development Directions Jersey Law 2012. EU Legislation Information Accompanying Transfers of Funds Jersey Regulations 2017. How can AML and KYC regulations do the job. Regulatory legislation relating to AML CFT.

In addition they play an essential function in blockchain-based crypto shares and BTC too. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. In addition they play an essential function in blockchain-based crypto shares and BTC too. KYC involves collection and analysis of identity information to determine a prediction of future client transaction behavior and the likelihood of the client to commit money laundering. KYC AML regulations.

Source: blog.complycube.com

Source: blog.complycube.com

The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs. Money Laundering and Weapons Development Directions Jersey Law 2012. When does one must complete AMLKYC affirmation. Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level. The Anti-Money Laundering Directive requires obliged entities eg financial institutions to carry out Customer Due Diligence CDD in order to prevent the holding of anonymous accounts as well as in circumstances that meet certain monetary thresholds or where there is suspicion that activity may be related to money laundering or terrorist financing.

Source: vskills.in

Source: vskills.in

These include carrying out customer due diligence measures to check that your. ZealiD allows finance service providers to meet so called know your customer regulations KYC in the jurisdiction in which service providers are licensed. KYC AML regulations. Satisfy yourself that the source of the customers funds is legitimate. The fines for non-compliance with AML Know Your Customer KYC and sanctions requirements continue to be large the costs of compliance continue to increase and firms are increasingly under pressure to identify ways to manage their AML risks more effectively both from a regulatory and commercial standpoint.

Source: bi.go.id

Source: bi.go.id

KYC is one of several anti money laundering. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs. This directive would be the fourth 4 and amends Directive EU 2015849 which already. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. How can AML and KYC regulations do the job.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title kyc money laundering regulations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas