17++ Kyc norms ppt info

Home » money laundering Info » 17++ Kyc norms ppt infoYour Kyc norms ppt images are ready. Kyc norms ppt are a topic that is being searched for and liked by netizens now. You can Download the Kyc norms ppt files here. Get all royalty-free vectors.

If you’re searching for kyc norms ppt images information connected with to the kyc norms ppt interest, you have pay a visit to the right site. Our site frequently gives you hints for viewing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Kyc Norms Ppt. I Attested photocopy of national identity card. KYC Know Your Customer is today a significant element in the fight against financial crime and money laundering and customer identification is the most critical aspect as it is the first step to better perform in the other stages of the process. In 2002 when the KYC guidelines were introduced their proper implementation was not made possible. Policy on KYC Norms and AML Measures 1 1.

Know Your Customer Kyc Powerpoint Template Sketchbubble From sketchbubble.com

Know Your Customer Kyc Powerpoint Template Sketchbubble From sketchbubble.com

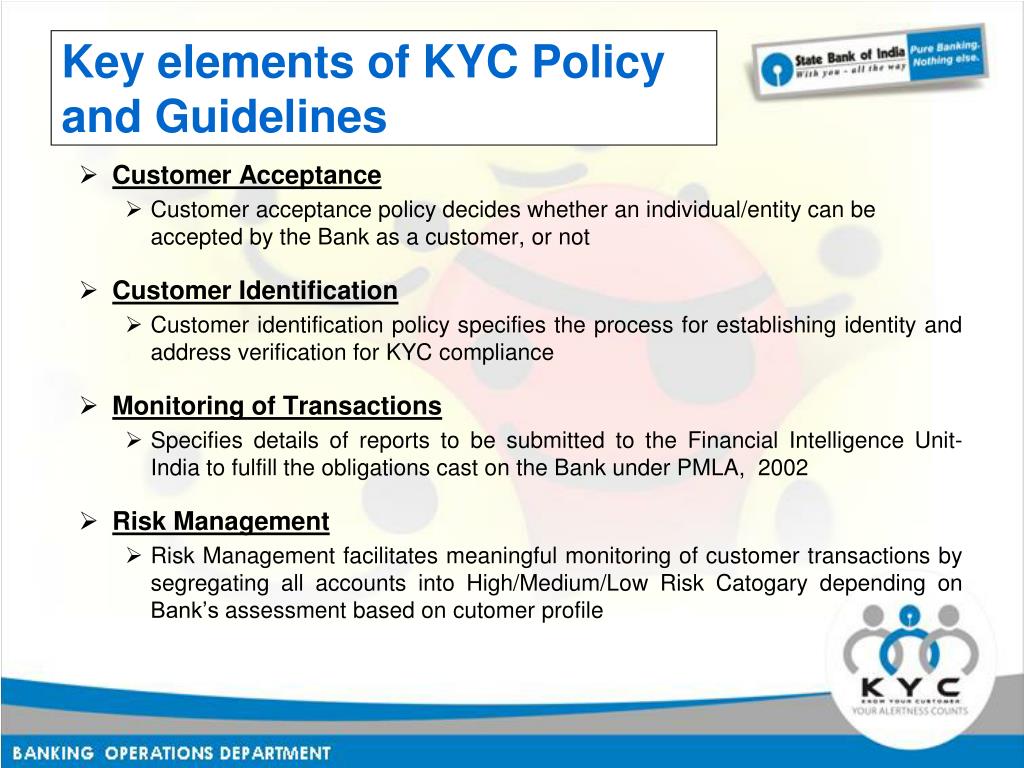

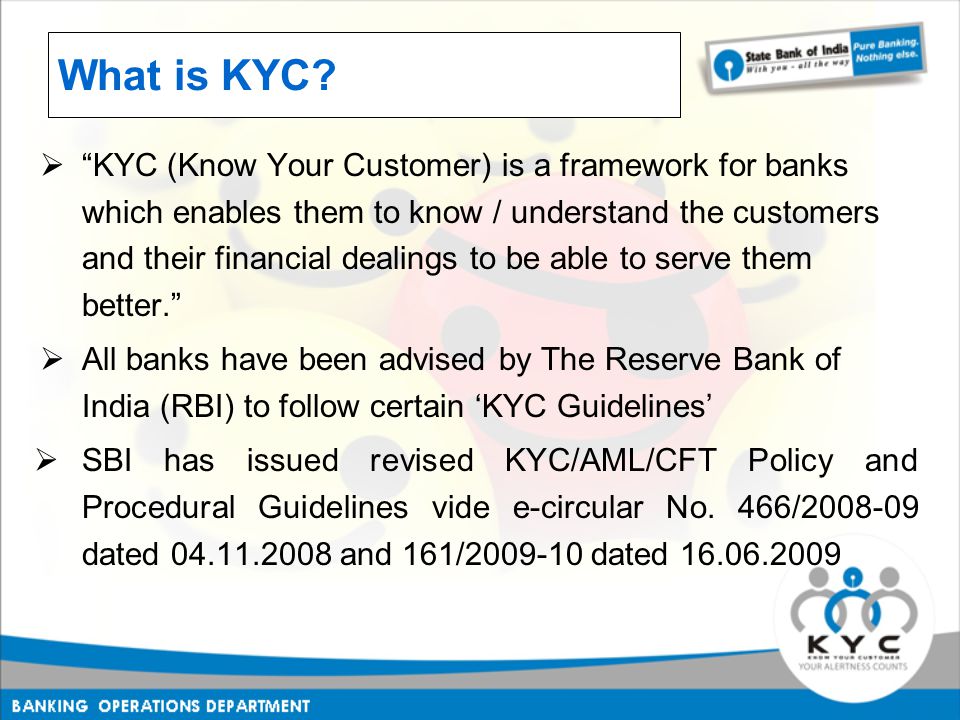

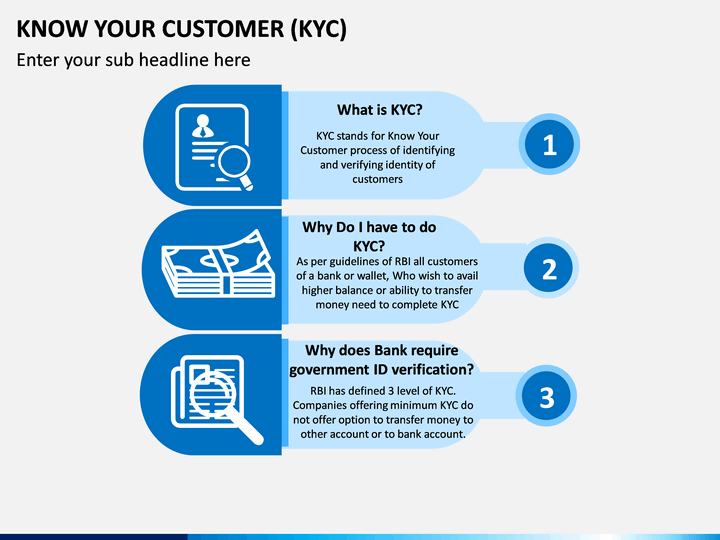

KYC stands for Know Your Customer It is a process by which banks obtain information about the identity and address of the customers and helps to ensure that banks services are not misused Banks are also required to periodically update their customers KYC details It enables banks to know understand their customers and their financial dealings so as to be able to serve them better. Banking operations are susceptible to the risks of money laundering and. Know Your Customer KYC NormsAnti-Money Laundering AML MeasuresCombating of Financing of Terrorism CFTObligations of banks Regulatory Concerns Actions Concerns simplifying the KYC norms across its domain Portfolio Management Service Portfolio Management Fees Complaints of exorbitant fees. The new rules require directors of all private public companies and LLPs designated partners to comply with the Directors KYC norms to avoid deactivation of their DIN Director. GROUP 19Heten Koli -11020241111Arjun Tamhane-11020241005Juned Parkar -11020241012. Let us get to some useful tips to get it rolling successfully.

KYC means Know Your Customer.

12 The KYC guidelines have regularly been revisited by RBI in the context of. The KYC procedure is to be completed by the banks while opening accounts and. The following minimum set of documents must be obtained from various types of customers account holder s. The new rules require directors of all private public companies and LLPs designated partners to comply with the Directors KYC norms to avoid deactivation of their DIN Director. PowerPoint PPT presentation free to view Briefing on KYC Norms and AML Measures for IBA Member Banks - Briefing on KYC Norms and AML Measures for IBA Member Banks Venue. I Attested photocopy of national identity card.

Source: slideserve.com

Source: slideserve.com

KYC Norms - Free download as Powerpoint Presentation ppt PDF File pdf Text File txt or view presentation slides online. GROUP 19Heten Koli -11020241111Arjun Tamhane-11020241005Juned Parkar -11020241012. The Policy on Know Your Customer KYC Norms and Anti-Money Laundering Measures Policy is approved by the Board of Directors of Motilal Oswal Finvest Limited MOFLNBFCCompany in compliance with the Master Directions issued by Reserve Bank of India RBI on KYC issued on. 12th April 2006 Presented by Sanjeev Singh PowerPoint PPT presentation free to view. It is a process by which banks obtain information about the identity and address of the customers.

They help to protect banks reputation and. In order to reach their goal RBI asked the banks to adopt some measures for the existing bank accounts also. This is in the interest of customers to keep safe their hard earned money and their reputation. KYC Guidelines All reasonable efforts shall be made to determine true identity of every prospective customer. The damage to the correlative reputation - They provide an essential part of.

Source: slideplayer.com

Source: slideplayer.com

Let us get to some useful tips to get it rolling successfully. Advantages of KYC norms Sound KYC procedures have particular relevance to the safety and soundness of banks in that. KYC Know Your Customer is today a significant element in the fight against financial crime and money laundering and customer identification is the most critical aspect as it is the first step to better perform in the other stages of the process. Kyc norms in banks. They help to protect banks reputation and.

Source: slideplayer.com

Source: slideplayer.com

The KYC procedure is to be completed by the banks while opening accounts and. Implementation of KYC norms is to prevent banks from being used intentionally or unintentionally for money laundering or other criminal activities. KYC Know Your Customer is a framework for banks which enables them to know understand the. - They help to protect the reputation of the banks and the integrity of the banking systems in reducing the likelihood of banks for becoming an instrument or a victim of financial crime and the suffering. Policy on KYC Norms and AML Measures 1 1.

Source: slideserve.com

Source: slideserve.com

Briefing on KYC Norms and AML Measures for IBA Member Banks Venue. Kyc norms in banks. INTRODUCTION 11 Bank has in place a policy on KNOW YOUR CUSTOMER KYC norms and ANTI MONEY LAUNDERING AML measures approved by the Board in February 2014. They help to protect banks reputation and. The following minimum set of documents must be obtained from various types of customers account holder s.

Source: slideserve.com

Source: slideserve.com

PowerPoint PPT presentation free to view How Lexlens aggregate bank accounts - Lexlens gives technology that empowers you to connect your financial data to apps and services. Know Your Customer KYC NormsAnti-Money Laundering AML MeasuresCombating of Financing of Terrorism CFTObligations of banks Regulatory Concerns Actions Concerns simplifying the KYC norms across its domain Portfolio Management Service Portfolio Management Fees Complaints of exorbitant fees. Reserve Bank of India has advised banks to make the Know Your Customer KYC procedures mandatory while opening and operating the accounts. KYC Guidelines All reasonable efforts shall be made to determine true identity of every prospective customer. PowerPoint PPT presentation free to view How Lexlens aggregate bank accounts - Lexlens gives technology that empowers you to connect your financial data to apps and services.

Source: sketchbubble.com

Source: sketchbubble.com

GROUP 19Heten Koli -11020241111Arjun Tamhane-11020241005Juned Parkar -11020241012. I Attested photocopy of national identity card. KYC Know Your Customer is a framework for banks which enables them to know understand the. The damage to the correlative reputation - They provide an essential part of. KYC means Know Your Customer.

Source: slideplayer.com

Source: slideplayer.com

Know Your Customer norms were made mandatory with the objective to restrict money laundering and to stop terrorist financing. Know your customer KYC. This PPT talk about need and implication of Know Your Customers norms in Indian Banking Sector. KYC Norms - Free download as Powerpoint Presentation ppt PDF File pdf Text File txt or view presentation slides online. 2wwwloanXpressco m July 2016 What is KYC.

Source: slideplayer.com

Source: slideplayer.com

Reserve Bank of India has advised banks to make the Know Your Customer KYC procedures mandatory while opening and operating the accounts. GROUP 19Heten Koli -11020241111Arjun Tamhane-11020241005Juned Parkar -11020241012. In 2002 when the KYC guidelines were introduced their proper implementation was not made possible. Know Your Customer norms were made mandatory with the objective to restrict money laundering and to stop terrorist financing. KYC stands for Know Your Customer It is a process by which banks obtain information about the identity and address of the customers and helps to ensure that banks services are not misused Banks are also required to periodically update their customers KYC details It enables banks to know understand their customers and their financial dealings so as to be able to serve them better.

Source: vdocument.in

Source: vdocument.in

INTRODUCTION 11 Bank has in place a policy on KNOW YOUR CUSTOMER KYC norms and ANTI MONEY LAUNDERING AML measures approved by the Board in February 2014. Advantages of KYC norms Sound KYC procedures have particular relevance to the safety and soundness of banks in that. KYC means Know Your Customer. This is in the interest of customers to keep safe their hard earned money and their reputation. 12 The KYC guidelines have regularly been revisited by RBI in the context of.

Source: sketchbubble.com

Source: sketchbubble.com

In order to reach their goal RBI asked the banks to adopt some measures for the existing bank accounts also. PowerPoint PPT presentation free to view How Lexlens aggregate bank accounts - Lexlens gives technology that empowers you to connect your financial data to apps and services. Kyc norms in banks. KYC means Know Your Customer. This PPT talk about need and implication of Know Your Customers norms in Indian Banking Sector.

Source: slideserve.com

Source: slideserve.com

Reserve Bank of India has advised banks to make the Know Your Customer KYC procedures mandatory while opening and operating the accounts. Know Your Customer norms were made mandatory with the objective to restrict money laundering and to stop terrorist financing. 12th April 2006 Presented by Sanjeev Singh PowerPoint PPT presentation free to view. Reserve Bank of India has advised banks to make the Know Your Customer KYC procedures mandatory while opening and operating the accounts. Kyc norms in banks.

Source: slideserve.com

Source: slideserve.com

KYC Know Your Customer is today a significant element in the fight against financial crime and money laundering and customer identification is the most critical aspect as it is the first step to better perform in the other stages of the process. This PPT talk about need and implication of Know Your Customers norms in Indian Banking Sector. Reserve Bank of India has advised banks to make the Know Your Customer KYC procedures mandatory while opening and operating the accounts. This process helps to ensure that banks services are not misused. Know Your Customer norms were made mandatory with the objective to restrict money laundering and to stop terrorist financing.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title kyc norms ppt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas