12+ Kyc onboarding process flow chart ideas in 2021

Home » money laundering idea » 12+ Kyc onboarding process flow chart ideas in 2021Your Kyc onboarding process flow chart images are ready. Kyc onboarding process flow chart are a topic that is being searched for and liked by netizens today. You can Find and Download the Kyc onboarding process flow chart files here. Find and Download all royalty-free photos and vectors.

If you’re searching for kyc onboarding process flow chart images information connected with to the kyc onboarding process flow chart interest, you have come to the right site. Our site always gives you hints for seeing the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

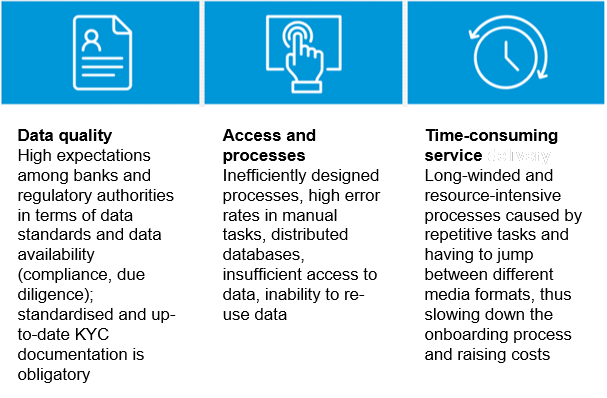

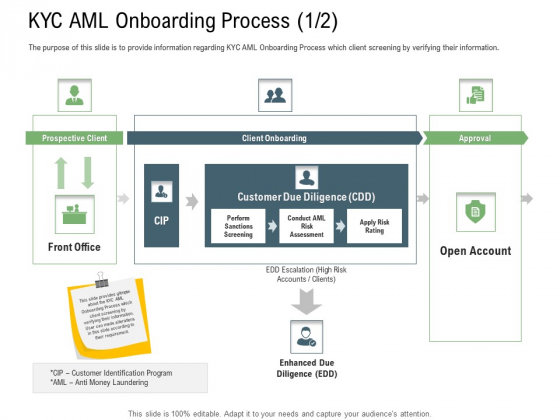

Kyc Onboarding Process Flow Chart. At each point in the process acquirers must aggregate analyze and manage extensive amounts of data before allowing a merchant to start transacting payments. These client-onboarding processes help prevent and identify money laundering terrorism financing and other illegal corruption schemes. Just like the way traditional banking institutions were used to verify an identity online KYC verification is performed. CDD Know Your Customer Rules and Guidelines.

Banking Client Onboarding Process Kyc Aml Onboarding Process Ppt Gallery Presentation Graphics Presentation Powerpoint Example Slide Templates From slideteam.net

Banking Client Onboarding Process Kyc Aml Onboarding Process Ppt Gallery Presentation Graphics Presentation Powerpoint Example Slide Templates From slideteam.net

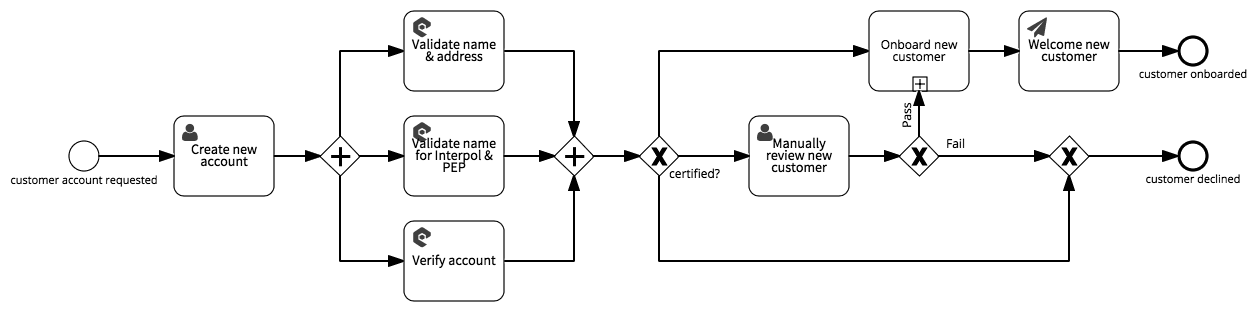

This has changed the flow-chart to look as below. The first step in KYC verification involves the collection of personal information from an online user. In general most companies see onboarding as a cyclical process with continuous effort across multiple employee touchpoints from recruitment to employee appreciation. Customers wanting to open a bank account are obliged to fulfill the KYC. A major element of the onboarding process for banks is verifying the identity of customers using KYC Know Your Customer to gather information about the potential customer. KYC Verification Process Steps.

Use this template to develop a customized onboarding process that aligns with your business goals.

CDD Know Your Customer Rules and Guidelines. At each point in the process acquirers must aggregate analyze and manage extensive amounts of data before allowing a merchant to start transacting payments. KYC as a sub-process of customer onboarding. KYC process includes ID card verification face verification document verification such as utility bills as proof of address and biometric verification. The first step in KYC verification involves the collection of personal information from an online user. A complete onboarding process template and checklist.

Source: slideteam.net

Source: slideteam.net

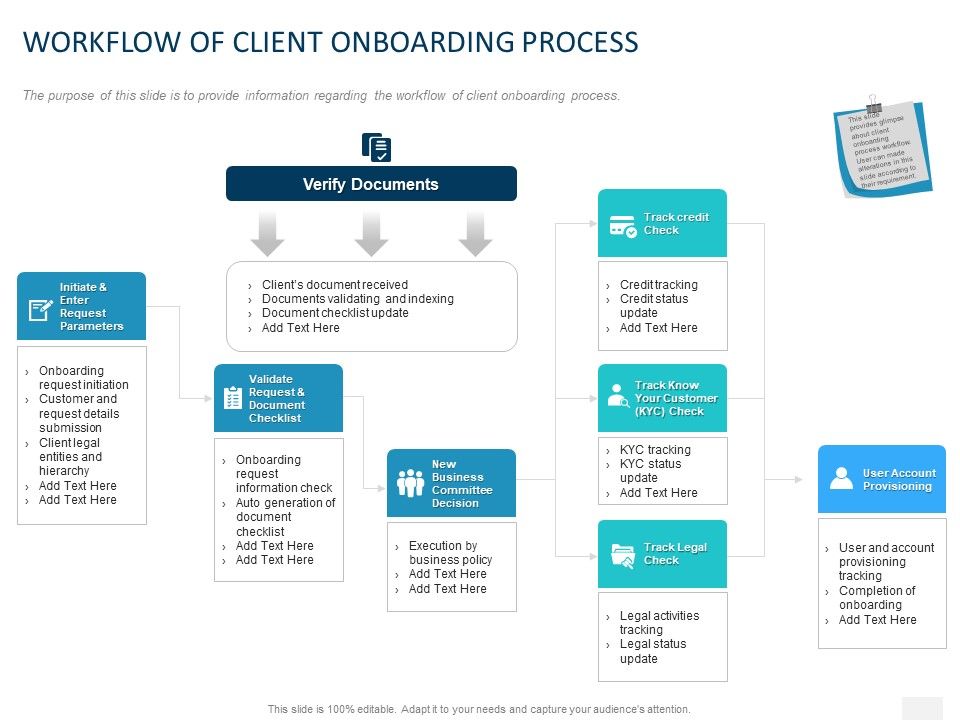

As we can see from the above chart we have now added on top of requesting required documents and validating them Know Your Customer due diligence and Money Laundering Reporting Officer before reaching the same end point. Updating your customer onboarding processes reduces costs by digitising slow paper-based processes. Download Vendor Onboarding Process Document with Flowchart - Excel. Client Onboarding Process Flow Chart When brands deliver the experiences consumers want consumers reciprocate with ongoing fruitful relationships. Streamlining KYC onboarding improves efficiency and helps to speed up the process meaning banks can successfully onboard more customers in a shorter space of time.

![]() Source: slidegeeks.com

Source: slidegeeks.com

Client Onboarding Process Flow Chart When brands deliver the experiences consumers want consumers reciprocate with ongoing fruitful relationships. KYC verification process steps include. Merchant onboarding is an underwriting review to ensure merchants meet Know Your Customer KYC requirements before bringing them onto your platform. Best practices for Anti-Money Laundering Digital identity creating. The first step in KYC verification involves the collection of personal information from an online user.

Source: blog.gft.com

Source: blog.gft.com

In general most companies see onboarding as a cyclical process with continuous effort across multiple employee touchpoints from recruitment to employee appreciation. AML KYC Onboarding Lifecycle Process Flow. Best practices for Anti-Money Laundering Digital identity creating. Review of KYC Documents by Compliance Department. As we can see from the above chart we have now added on top of requesting required documents and validating them Know Your Customer due diligence and Money Laundering Reporting Officer before reaching the same end point.

Source: signavio.com

Source: signavio.com

As we can see from the above chart we have now added on top of requesting required documents and validating them Know Your Customer due diligence and Money Laundering Reporting Officer before reaching the same end point. Account opening is the final phase in the KYC onboarding lifecycle process flow. Once youve identified the client journey for your types of client its important to put systems and process in place to guarantee consistency for you your team and your client. We certainly do agree that KYC is a key element but it is important to note that KYC is a single element that makes up no more than 20 of the end-to-end client onboarding process. The specifics depend upon the types of merchants we plan to board the regions in which they operate and the requirements of the acquiring relationship.

Source: slidegeeks.com

Source: slidegeeks.com

A complete onboarding process template and checklist. Review of KYC Documents by Compliance Department. Sample Customer Identification Program Checklist. As we can see from the above chart we have now added on top of requesting required documents and validating them Know Your Customer due diligence and Money Laundering Reporting Officer before reaching the same end point. The specifics depend upon the types of merchants we plan to board the regions in which they operate and the requirements of the acquiring relationship.

Source: talitaferraz.com.br

Source: talitaferraz.com.br

KYC AML Process Flowchart Use Createlys easy online diagram editor to edit this diagram collaborate with others and export results to multiple image formats. It is comprehensive and vital in banking compliance checks. This template includes both a simple written document and a flowchart that you can use to visualize the steps. A complete onboarding process template and checklist. Onboarding processes vary from industry to industry but the main objective is to help an employee acquire the necessary knowledge and behaviors to perform effectively.

Source: slideteam.net

Source: slideteam.net

Use this template to develop a customized onboarding process that aligns with your business goals. Streamlining KYC onboarding improves efficiency and helps to speed up the process meaning banks can successfully onboard more customers in a shorter space of time. Account opening is the final phase in the KYC onboarding lifecycle process flow. If after completing the process of KYC and AMI evaluation of the customer the application poses too much of a risk then the next process is for the chief AML lead or compliance lead. Manual processes visiting bank branches awaiting approval and passing information through a series of systems.

Source:

At each point in the process acquirers must aggregate analyze and manage extensive amounts of data before allowing a merchant to start transacting payments. A complete onboarding process template and checklist. 3 steps to effective Know Your Customer compliance AML compliance checklist. The first step in KYC verification involves the collection of personal information from an online user. Customers wanting to open a bank account are obliged to fulfill the KYC.

Source: slideteam.net

Source: slideteam.net

Streamlining KYC onboarding improves efficiency and helps to speed up the process meaning banks can successfully onboard more customers in a shorter space of time. Review of KYC Documents by Compliance Department. Adopting a transparent and customer-centric client onboarding process provides an enhanced user experience which helps to boost customer satisfaction and ensure that customers do not switch to another bank. KYC as a sub-process of customer onboarding. At each point in the process acquirers must aggregate analyze and manage extensive amounts of data before allowing a merchant to start transacting payments.

Source: advisoryhq.com

Source: advisoryhq.com

A complete onboarding process template and checklist. KYC as a sub-process of customer onboarding. Client Onboarding Process Flow Chart When brands deliver the experiences consumers want consumers reciprocate with ongoing fruitful relationships. In general most companies see onboarding as a cyclical process with continuous effort across multiple employee touchpoints from recruitment to employee appreciation. Once youve identified the client journey for your types of client its important to put systems and process in place to guarantee consistency for you your team and your client.

Source: slideteam.net

Source: slideteam.net

KYC AML Process Flowchart Use Createlys easy online diagram editor to edit this diagram collaborate with others and export results to multiple image formats. Review of KYC Documents by Compliance Department. Barriers are created from the outset which seriously impact on conversion rates and the cost of acquisition. The Employee Onboarding Process is the practice of integrating a new employee into an organization. AML KYC Onboarding Lifecycle Process Flow.

Source: advisoryhq.com

Source: advisoryhq.com

The first step in KYC verification involves the collection of personal information from an online user. At each point in the process acquirers must aggregate analyze and manage extensive amounts of data before allowing a merchant to start transacting payments. Once youve identified the client journey for your types of client its important to put systems and process in place to guarantee consistency for you your team and your client. Onboarding or new product origination is traditionally a challenging and time consuming process. Barriers are created from the outset which seriously impact on conversion rates and the cost of acquisition.

![]() Source: slideteam.net

Source: slideteam.net

Onboarding processes vary from industry to industry but the main objective is to help an employee acquire the necessary knowledge and behaviors to perform effectively. Use this template to develop a customized onboarding process that aligns with your business goals. Customers wanting to open a bank account are obliged to fulfill the KYC. We certainly do agree that KYC is a key element but it is important to note that KYC is a single element that makes up no more than 20 of the end-to-end client onboarding process. Once youve identified the client journey for your types of client its important to put systems and process in place to guarantee consistency for you your team and your client.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kyc onboarding process flow chart by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information