20+ Kyc process flow ppt info

Home » money laundering idea » 20+ Kyc process flow ppt infoYour Kyc process flow ppt images are ready in this website. Kyc process flow ppt are a topic that is being searched for and liked by netizens now. You can Download the Kyc process flow ppt files here. Download all royalty-free photos.

If you’re searching for kyc process flow ppt pictures information connected with to the kyc process flow ppt topic, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for seeking the highest quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

Kyc Process Flow Ppt. 11 34 PRICING OF E-KYC TRANSACTIONS. Upload Bulk KYC Text File - select the text file by choosing a radio button Browse and press submit. The details in brief are given below. The CERSAIs CKYC is not integrated with other KYC repositories which in turn requires customers to provide KYC documents again.

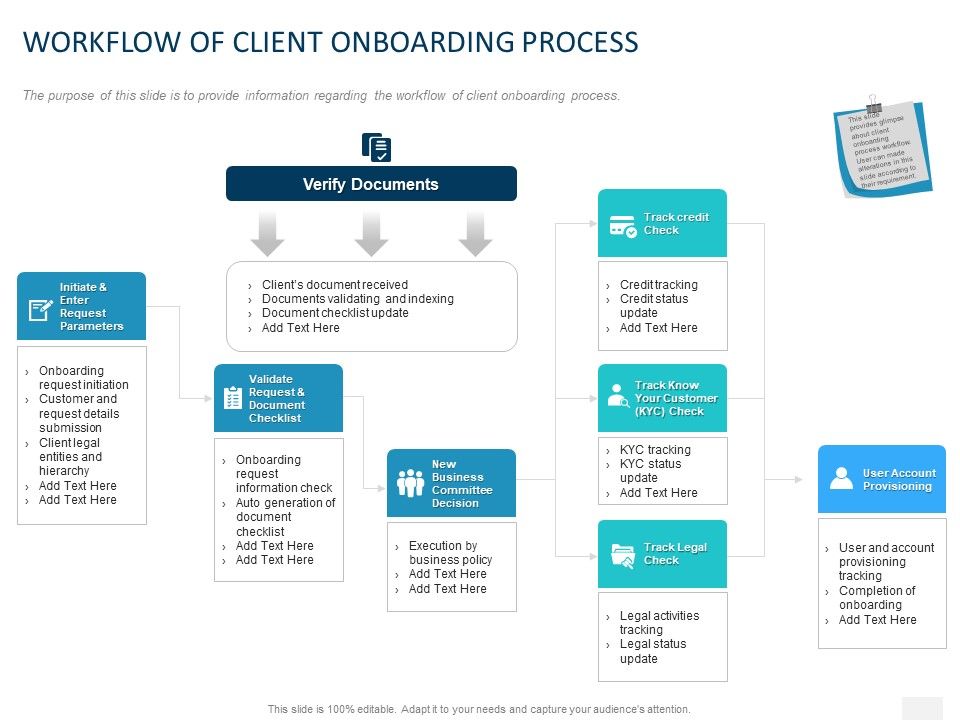

Workflow Of Client Onboarding Process Kyc Status Update Ppt Slides Presentation Graphics Presentation Powerpoint Example Slide Templates From slideteam.net

Workflow Of Client Onboarding Process Kyc Status Update Ppt Slides Presentation Graphics Presentation Powerpoint Example Slide Templates From slideteam.net

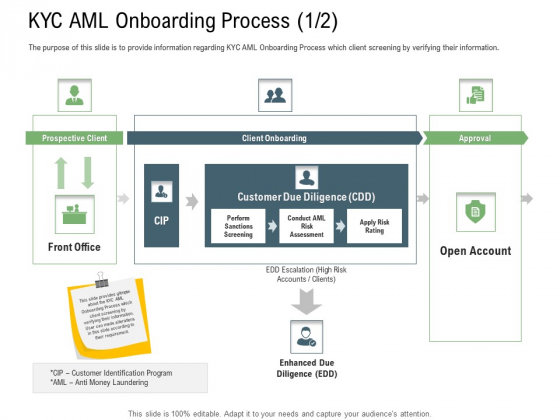

Use Lucidchart to visualize ideas make charts diagrams more. Account opening is the final phase in the KYC onboarding lifecycle process flow. Although CKYC is a one-stop solution for KYC requirements of all FIs it is marred by some fallacies. This proposed document explains the workprocess flow to use the e-KYC services for opening of accounts through branches and BC locations. E-KYC Process Step 3 Click on Tatkal Aadhar Based Process E-KYC Process Step 4 Enter AADHAR Number and click on Submit E-KYC Process Step 5 Read Terms Conditions and Click on I Accept E-KYC Process Step 6 Enter OTP received from UIDAI and click on Submit E-KYC Process Step 7 Enter Complete details Mandatory fields are marks with. Use Lucidchart to visualize ideas make charts diagrams more.

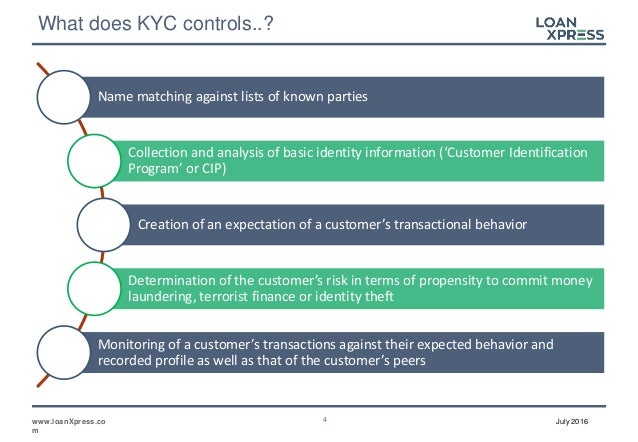

A fundamental building block for service delivery is the KYC Know Your Customer process which establishes the identity of the resident their address and other basic.

Account opening is the final phase in the KYC onboarding lifecycle process flow. Ad Lucidcharts process diagram software is quick easy to use. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. Using this service we conduct electronic identity verification using biometrics of the prospective customers. Know Your Client KYC Form. E-KYC online KYC Account Opening.

Source: slideteam.net

Source: slideteam.net

To provide basic information of the new investor. O Opening a Locker facility where these documents are not available with the bank for all the Locker facility holders. A Business Process Management showing KYC process final. Although CKYC is a one-stop solution for KYC requirements of all FIs it is marred by some fallacies. 11 34 PRICING OF E-KYC TRANSACTIONS.

Source: slideshare.net

Source: slideshare.net

A Business Process Management showing KYC process final. Automation are streamlining resource intensive KYC processes and bringing them into the digital age. UAN_CorrectMethod_TxtFile Sample Excel File- The screenshot of Excel File containing all the specified 13 columns is as under- Now to create the text file use the same process as used while creating the ECR file for PF. If after completing the process of KYC and AMI evaluation of the customer the application poses too much of a risk then the next process is for the chief AML lead or compliance lead. O Opening a Locker facility where these documents are not available with the bank for all the Locker facility holders.

Source: slideteam.net

Source: slideteam.net

Whenever a KYC status changes by an Agent Auditor or by the system a message will be added to the KYC Queue Queue Service 2. As KYC Know-Your-Customer is regulatory-required and vitally important in the fight against money laundering and terrorist financing and mitigating reputation risk. Using this service we conduct electronic identity verification using biometrics of the prospective customers. Retail Loan Origination Process Flow. Effective KYC involves knowing a customers identity their financial activities and the risk they pose.

Source: slideshare.net

Source: slideshare.net

Long KYC and onboarding. 11 34 PRICING OF E-KYC TRANSACTIONS. E-KYC online KYC Account Opening. To provide basic information of the new investor. BPEL Process Flow Support.

Source: slideteam.net

Source: slideteam.net

E-KYC Process Step 3 Click on Tatkal Aadhar Based Process E-KYC Process Step 4 Enter AADHAR Number and click on Submit E-KYC Process Step 5 Read Terms Conditions and Click on I Accept E-KYC Process Step 6 Enter OTP received from UIDAI and click on Submit E-KYC Process Step 7 Enter Complete details Mandatory fields are marks with. A Business Process Management showing KYC process final. The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification process. Using this service we conduct electronic identity verification using biometrics of the prospective customers. The details in brief are given below.

Source: slideserve.com

Source: slideserve.com

KYC will be carried out at the following stages. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. KYC documents have to be submitted in paper format as there is no digital or paperless onboarding process. Unable Data Packet 1. Details of various services and charges being applied on the new investor.

Source: slideplayer.com

Source: slideplayer.com

Process Flow Document for e-KYC and account opening at BC locations Branches Purpose. O Opening a new account. Its origin stems from the 2001 Title III of the Patriot Act to provide various tools to prevent terrorist activities. O Opening a Locker facility where these documents are not available with the bank for all the Locker facility holders. E-KYC Process Step 3 Click on Tatkal Aadhar Based Process E-KYC Process Step 4 Enter AADHAR Number and click on Submit E-KYC Process Step 5 Read Terms Conditions and Click on I Accept E-KYC Process Step 6 Enter OTP received from UIDAI and click on Submit E-KYC Process Step 7 Enter Complete details Mandatory fields are marks with.

Source: slidegeeks.com

Source: slidegeeks.com

BPEL Process Flow Support. Use Lucidchart to visualize ideas make charts diagrams more. Know Your Client KYC Form. Account opening is the final phase in the KYC onboarding lifecycle process flow. The loan origination is supported for Retail and Corporate product categories in Loans module.

Source: sketchbubble.com

Source: sketchbubble.com

Ad Lucidcharts process diagram software is quick easy to use. Upload Bulk KYC Text File - select the text file by choosing a radio button Browse and press submit. Using this service we conduct electronic identity verification using biometrics of the prospective customers. O Opening a Locker facility where these documents are not available with the bank for all the Locker facility holders. Retail Loan Origination Process Flow.

Source: slideteam.net

Source: slideteam.net

The details in brief are given below. The details in brief are given below. If after completing the process of KYC and AMI evaluation of the customer the application poses too much of a risk then the next process is for the chief AML lead or compliance lead. This proposed document explains the workprocess flow to use the e-KYC services for opening of accounts through branches and BC locations. Account opening is the final phase in the KYC onboarding lifecycle process flow.

Source: slideteam.net

Source: slideteam.net

O Opening a new account. The costs associated with KYC are largely due to the necessary manual analysis checks that are usually performed in-house by banks and other such regulated institutions. Process Flow Document for e-KYC and account opening at BC locations Branches Purpose. Use Lucidchart to visualize ideas make charts diagrams more. Long KYC and onboarding.

Source:

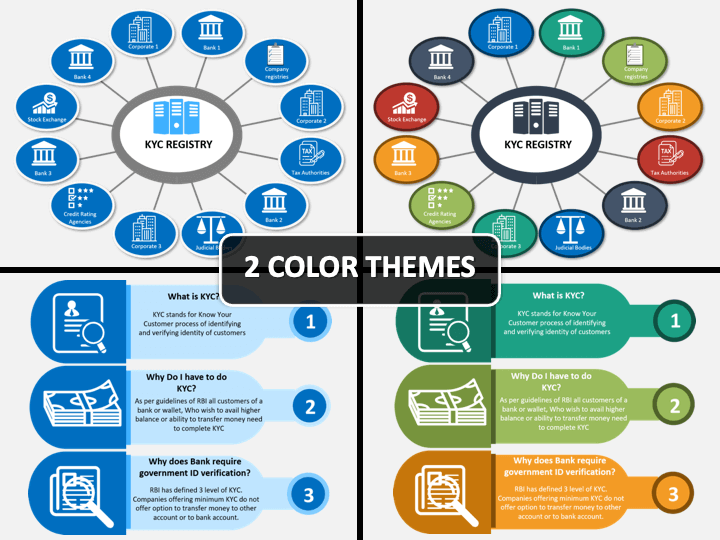

The loan origination is supported for Retail and Corporate product categories in Loans module. Financial institutions and other organizations are seeking new technologies to support modern AML compliance paradigms including holistic AML risk-based customer segmentation perpetual KYC and KYC for digital services. Although CKYC is a one-stop solution for KYC requirements of all FIs it is marred by some fallacies. For more details just read the PPT. To provide basic information of the new investor.

Source: slideteam.net

Source: slideteam.net

The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification process. Ad Lucidcharts process diagram software is quick easy to use. If a KYC is marked Successful or Rejected then the Message will carry. Using this service we conduct electronic identity verification using biometrics of the prospective customers. The costs associated with KYC are largely due to the necessary manual analysis checks that are usually performed in-house by banks and other such regulated institutions.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title kyc process flow ppt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information