15+ Kyc to prevent money laundering information

Home » money laundering Info » 15+ Kyc to prevent money laundering informationYour Kyc to prevent money laundering images are available. Kyc to prevent money laundering are a topic that is being searched for and liked by netizens now. You can Get the Kyc to prevent money laundering files here. Download all free images.

If you’re searching for kyc to prevent money laundering pictures information linked to the kyc to prevent money laundering keyword, you have visit the right site. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

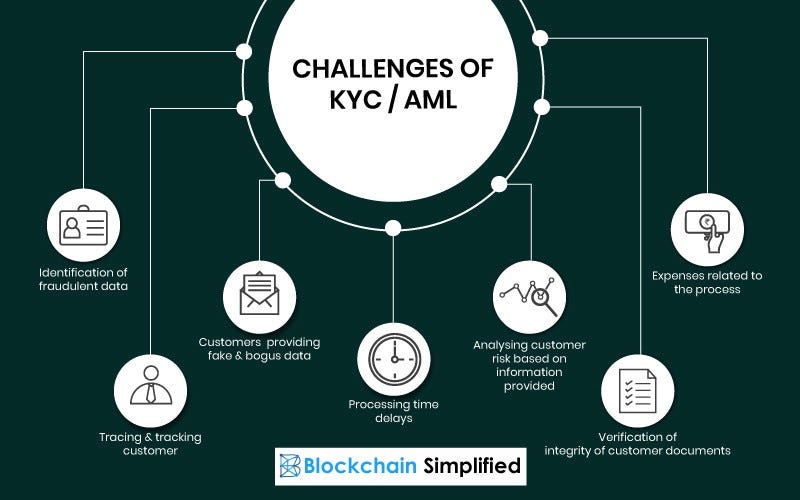

Kyc To Prevent Money Laundering. Its all about Knowing Your Customer KYC. It has been put in place to help prevent any sort of criminal activities like money laundering via transactions. Set of recommendations for prevention of money laundering and financing of terrorism. AML Anti-Money Laundering also known as Prevention of Money Laundering is closely related to the KYC Know Your Customer process.

Kyc Vs Aml What Is The Difference From blog.complycube.com

Kyc Vs Aml What Is The Difference From blog.complycube.com

It has been put in place to help prevent any sort of criminal activities like money laundering via transactions. This act was formed in 2002 by the Act of the Parliament. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. The Banks Account Opening Procedures Identity Verification Procedures and Customer Risk Assessment Procedures. The goal of the action plan is to adapt the existing regulatory framework to the specific threats and vulnerabilities that the EU faces. Anti-Money Laundering KYC and Data Protection.

It is important to understand the magnitude of the risks associated with money launderingThese criminal practices are a really considerable offence for society companies and individuals and therefore compliance with the practices of prevention of money.

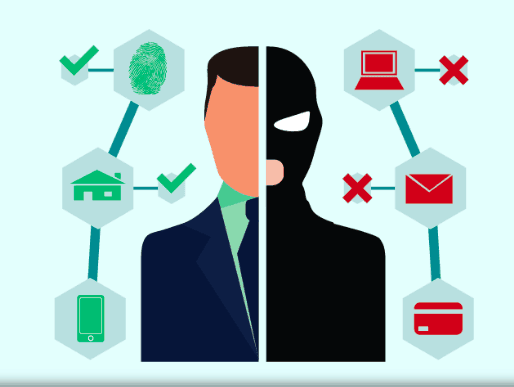

Ii Central KYC Records Registry CKYCR means an entity defined under Rule 21 of the Prevention of Money-Laundering Maintenance of Records Rules 2005 to receive store safeguard and retrieve the KYC records in digital form of a customer. Identity theft fraud and money laundering have all become prevalent in the trading world. One of the best ways for a network economy business to avoid being an unknowing participant in money laundering schemes or TFOs terrorist financing offenses is to properly verify the identity of their partners eg. In May 2020 the European Commission issued a communication on an action plan for a comprehensive Union policy on preventing money laundering and terrorist financing. Within the FATF standards KYC had been emerged as one of the main preventive measures or tools to protect financial institutions abusing from criminal activities. It is important to understand the magnitude of the risks associated with money launderingThese criminal practices are a really considerable offence for society companies and individuals and therefore compliance with the practices of prevention of money.

Source: paytah.com

Source: paytah.com

The Banks Account Opening Procedures Identity Verification Procedures and Customer Risk Assessment Procedures. Know Your Customer KYC Policy. This is where machine learning and artificial intelligence can step to the fore with a truly pragmatic real-world use case to secure financial transactions ensure the reputation of a business and significantly reduce any chance of fraudulent activities. Omni-Channel KYC Fraud Prevention and Anti-Money Laundering Solutions. In order to work against the money laundering and terrorist financing activities Financial Information Unit FIU was established on April 21 2008 pursuant to section 9 of the Assets Money Laundering Prevention Act 2008 within Nepal Rastra Bank the Central bank as an independent unit.

Source: researchgate.net

Source: researchgate.net

Because of this most brokers have set multiple KYC regulations into place also called anti-money laundering regulations or AML regulations. The FATF Recommendation no. In May 2020 the European Commission issued a communication on an action plan for a comprehensive Union policy on preventing money laundering and terrorist financing. When an investor wants to make a withdrawal their identity will have to be confirmed. This is where machine learning and artificial intelligence can step to the fore with a truly pragmatic real-world use case to secure financial transactions ensure the reputation of a business and significantly reduce any chance of fraudulent activities.

Source: ing.com

Source: ing.com

Set of recommendations for prevention of money laundering and financing of terrorism. The updated directive extends anti-money laundering law to cover art market deals and requires galleries auction houses dealers and individual artists all those involved in selling work valued at more than 8500 directly to clients to conduct due. You agree to submit the required information and documentation immediately after your registration with Uptos. In compliance with the Money-Laundering Prevention may also be referred to as Anti-Money Laundering or AML all Clients must adhere to our KYC Process to verify the identity of each individual and to avoid any financial crime. To Prevention of Money-Laundering Maintenance of Records Amendment Rules 2013 dated December 1 2014 and Obligation of NBFCs under Prevention of Money laundering Act PMLA 2002 - Client Due Diligence dated January 2 2015 advised all NBFCs to revise their KYC policies to.

Source: blog.neufund.org

Laundering Act 2002 read with the Prevention of Money-laundering Maintenance of Records Rules 2005 with any further amendments re-enactments thereof issued from time to time is adopting the Know Your Customer Policy KYC Policy with the following guidelines on KYC process and documentation. One of the best ways for a network economy business to avoid being an unknowing participant in money laundering schemes or TFOs terrorist financing offenses is to properly verify the identity of their partners eg. KYC in bankingsector allows them to understand their customers financial dealings allowing them to. It is Nepals financial intelligence unit. KYC and AML are acronyms for Know Your Customer and Anti-money Laundering and refer to the set of activities that both financial institutions and regulated businesses must perform to verify the identity of their customers and obtain sensitive information from them as well as prevent money laundering from illegal activities.

Source: medium.com

Source: medium.com

AML KYC Tutorial Prevention of Money -Laundering Act PML Act Prevention of Money-Laundering Act PML Act is to prevent the laundering of money and to provide for confiscation of property derived from or involved in laundering and for matters connected therewith or incidental thereto. The Banks Account Opening Procedures Identity Verification Procedures and Customer Risk Assessment Procedures. In order to work against the money laundering and terrorist financing activities Financial Information Unit FIU was established on April 21 2008 pursuant to section 9 of the Assets Money Laundering Prevention Act 2008 within Nepal Rastra Bank the Central bank as an independent unit. KYC and AML are acronyms for Know Your Customer and Anti-money Laundering and refer to the set of activities that both financial institutions and regulated businesses must perform to verify the identity of their customers and obtain sensitive information from them as well as prevent money laundering from illegal activities. Know Your Customer KYC Policy.

Source: bi.go.id

Source: bi.go.id

In compliance with the Money-Laundering Prevention may also be referred to as Anti-Money Laundering or AML all Clients must adhere to our KYC Process to verify the identity of each individual and to avoid any financial crime. The Banks Account Opening Procedures Identity Verification Procedures and Customer Risk Assessment Procedures. KYC in bankingsector allows them to understand their customers financial dealings allowing them to. It is important to understand the magnitude of the risks associated with money launderingThese criminal practices are a really considerable offence for society companies and individuals and therefore compliance with the practices of prevention of money. Set of recommendations for prevention of money laundering and financing of terrorism.

Source: medium.com

Source: medium.com

This act was formed in 2002 by the Act of the Parliament. The goal of the action plan is to adapt the existing regulatory framework to the specific threats and vulnerabilities that the EU faces. It is Nepals financial intelligence unit. With an international perspective the reader gains a broad understanding of the anti-money laundering controls that are in place worldwide with certain country-specific details discussed in-depth. The updated directive extends anti-money laundering law to cover art market deals and requires galleries auction houses dealers and individual artists all those involved in selling work valued at more than 8500 directly to clients to conduct due.

Source: blog.complycube.com

Source: blog.complycube.com

A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. It is Nepals financial intelligence unit. KYC is the process through which your customers identity can be verified. Omni-Channel KYC Fraud Prevention and Anti-Money Laundering Solutions. Within the FATF standards KYC had been emerged as one of the main preventive measures or tools to protect financial institutions abusing from criminal activities.

Source: slideserve.com

Source: slideserve.com

When an investor wants to make a withdrawal their identity will have to be confirmed. Suppliers affiliates vendors etc when their account is opened and subsequently throughout the business relationship. AML KYC Tutorial Prevention of Money -Laundering Act PML Act Prevention of Money-Laundering Act PML Act is to prevent the laundering of money and to provide for confiscation of property derived from or involved in laundering and for matters connected therewith or incidental thereto. KYC and AML are acronyms for Know Your Customer and Anti-money Laundering and refer to the set of activities that both financial institutions and regulated businesses must perform to verify the identity of their customers and obtain sensitive information from them as well as prevent money laundering from illegal activities. KYC is the process through which your customers identity can be verified.

Source: youtube.com

Source: youtube.com

The FATF Recommendation no. To Prevention of Money-Laundering Maintenance of Records Amendment Rules 2013 dated December 1 2014 and Obligation of NBFCs under Prevention of Money laundering Act PMLA 2002 - Client Due Diligence dated January 2 2015 advised all NBFCs to revise their KYC policies to. It is Nepals financial intelligence unit. Suppliers affiliates vendors etc when their account is opened and subsequently throughout the business relationship. The document provides a.

Source: crowdfundinsider.com

Source: crowdfundinsider.com

With an international perspective the reader gains a broad understanding of the anti-money laundering controls that are in place worldwide with certain country-specific details discussed in-depth. Within the FATF standards KYC had been emerged as one of the main preventive measures or tools to protect financial institutions abusing from criminal activities. KYC in bankingsector allows them to understand their customers financial dealings allowing them to. The updated directive extends anti-money laundering law to cover art market deals and requires galleries auction houses dealers and individual artists all those involved in selling work valued at more than 8500 directly to clients to conduct due. KYC is the process through which your customers identity can be verified.

When an investor wants to make a withdrawal their identity will have to be confirmed. Ii Central KYC Records Registry CKYCR means an entity defined under Rule 21 of the Prevention of Money-Laundering Maintenance of Records Rules 2005 to receive store safeguard and retrieve the KYC records in digital form of a customer. Know Your Customer Anti Money Laundering Policy Guidelines The objective of Know Your Customer KYC Guidelines is for SALASAR STRATEGIC ADVISORS PVT LTD SSAPL to know understand its customers and their financial dealings and help the company. Suppliers affiliates vendors etc when their account is opened and subsequently throughout the business relationship. 10 requires financial institutions to conduct.

Source: blog.neufund.org

Laundering Act 2002 read with the Prevention of Money-laundering Maintenance of Records Rules 2005 with any further amendments re-enactments thereof issued from time to time is adopting the Know Your Customer Policy KYC Policy with the following guidelines on KYC process and documentation. 10 requires financial institutions to conduct. One of the best ways for a network economy business to avoid being an unknowing participant in money laundering schemes or TFOs terrorist financing offenses is to properly verify the identity of their partners eg. This is where machine learning and artificial intelligence can step to the fore with a truly pragmatic real-world use case to secure financial transactions ensure the reputation of a business and significantly reduce any chance of fraudulent activities. Anti-Money Laundering KYC and Data Protection.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kyc to prevent money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas