15++ Kycaml legal requirements ideas

Home » money laundering Info » 15++ Kycaml legal requirements ideasYour Kycaml legal requirements images are ready. Kycaml legal requirements are a topic that is being searched for and liked by netizens today. You can Get the Kycaml legal requirements files here. Download all royalty-free vectors.

If you’re looking for kycaml legal requirements pictures information linked to the kycaml legal requirements interest, you have visit the ideal site. Our site always provides you with hints for seeking the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Kycaml Legal Requirements. AMLKYC regulations require banks and other financial institutions such as trust companies insurance companies and brokerage firms to understand who their customers are and what type of transactions they perform. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. KYC and AML obligations are nothing new to the legal sector. When banks and certain other financial institutions open accounts for entities among other anti-money laundering AML customer identification requirements they must obtain beneficial ownership information on individuals owning 25 or more of the entity and a person with significant control over the entity such as a president or chief executive officer.

Important Feature Update Kyc Aml Verifications By Elena Skliar Primablock Medium From medium.com

Important Feature Update Kyc Aml Verifications By Elena Skliar Primablock Medium From medium.com

Ad AML coverage from every angle. KYC and AML obligations are nothing new to the legal sector. It is not intended to be legal analysis or advice nor does it purport to address except in a few instances state or international money laundering requirements that may affect US. Latest news reports from the medical literature videos from the experts and more. Latest news reports from the medical literature videos from the experts and more. The Anti Money Laundering Directive AMLD is established to fight against money laundering typologies terrorist financing across EU regions.

This requirement has now been extended to Corporations like HowToPay that handle Payments and Financial services.

When banks and certain other financial institutions open accounts for entities among other anti-money laundering AML customer identification requirements they must obtain beneficial ownership information on individuals owning 25 or more of the entity and a person with significant control over the entity such as a president or chief executive officer. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose. It is not intended to be legal analysis or advice nor does it purport to address except in a few instances state or international money laundering requirements that may affect US. The Anti Money Laundering Directive AMLD is established to fight against money laundering typologies terrorist financing across EU regions. AMLKYC regulations require banks and other financial institutions such as trust companies insurance companies and brokerage firms to understand who their customers are and what type of transactions they perform. KYC and AML obligations are nothing new to the legal sector.

Source: getmati.com

Source: getmati.com

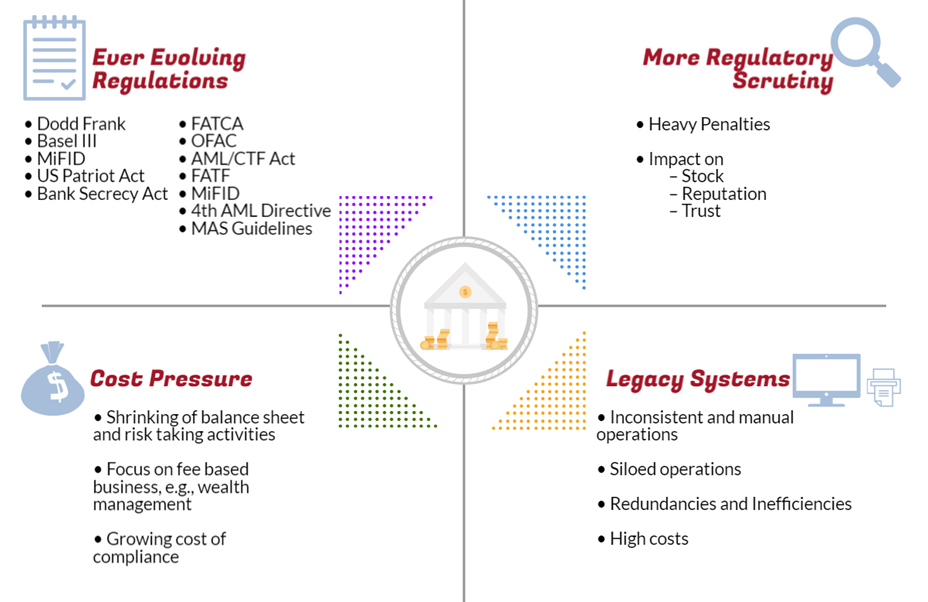

All BaFins AML requirements as well as administrative fines for non-compliance come from this primary AML law in Germany. This covers such pursuits as trading illegal goods evading tax manipulating markets and laundering ill-gotten funds. In the United States KYCAML requirements are dictated by the Bank Secrecy Act BSA the PATRIOT Act and the Office of Foreign Assets Control OFAC. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. AMLKYC regulations require banks and other financial institutions such as trust companies insurance companies and brokerage firms to understand who their customers are and what type of transactions they perform.

The Act aligns with the 4th and 5th Anti-Money Laundering Directives that regulate AML compliance in all spheres throughout the European Union. The responses to the questions have been drawn from myriad regulatory publications issuances and guidance from other. It is not intended to be legal analysis or advice nor does it purport to address except in a few instances state or international money laundering requirements that may affect US. This covers such pursuits as trading illegal goods evading tax manipulating markets and laundering ill-gotten funds. The Bank Secrecy Act requires financial institutions to provide internal controls ensuring compliance provide independent compliance testing designate an individual responsible for ensuring compliance and provide compliance training.

Source: tookitaki.ai

Source: tookitaki.ai

KYC and AML obligations are nothing new to the legal sector. This requirement has now been extended to Corporations like HowToPay that handle Payments and Financial services. Bad actors tend to pretend someone else. AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. The Banking Act supervises financial institutions in the country.

Source: bi.go.id

Source: bi.go.id

The term Anti-Money Laundering or AML refers to a set of procedures and legal regulations that are in place to identify and prevent profit from illegal activities. The term Anti-Money Laundering or AML refers to a set of procedures and legal regulations that are in place to identify and prevent profit from illegal activities. In the United States KYCAML requirements are dictated by the Bank Secrecy Act BSA the PATRIOT Act and the Office of Foreign Assets Control OFAC. No KYC requirements have always been an industry standard. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose.

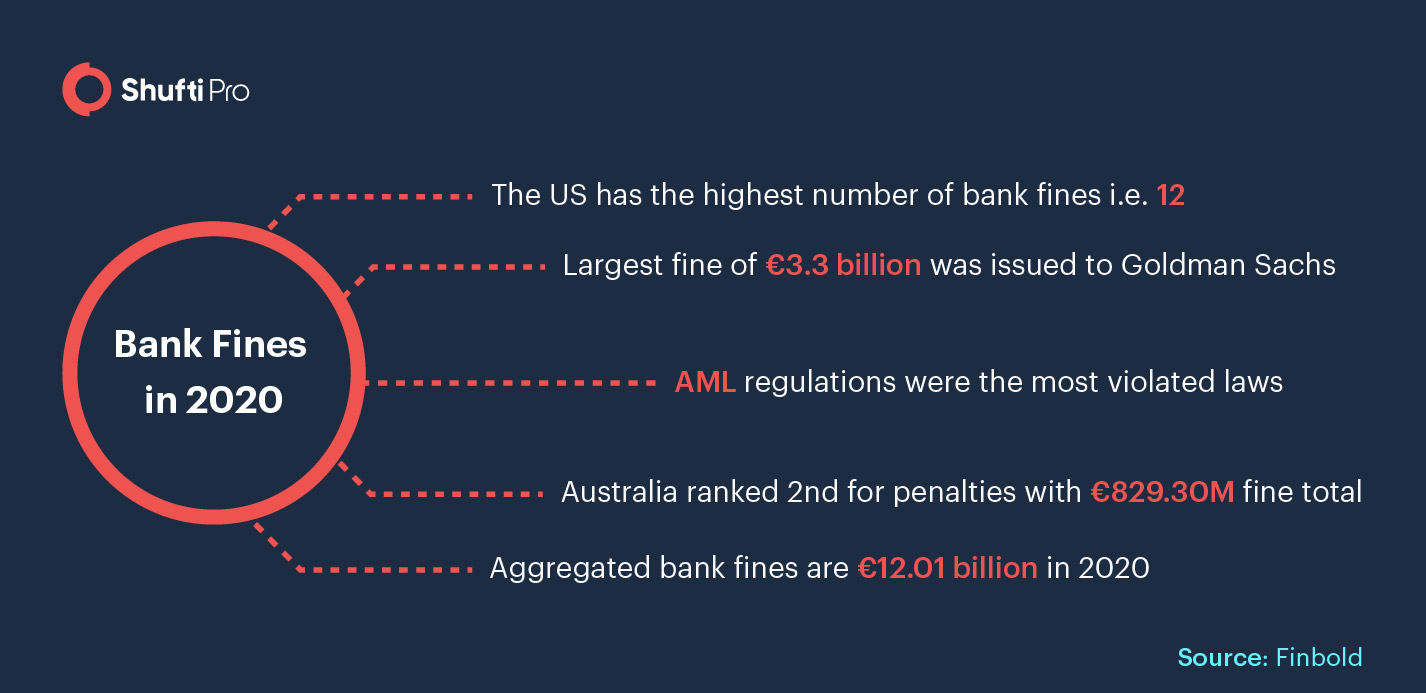

Source: shuftipro.com

Source: shuftipro.com

Bad actors tend to pretend someone else. The reason why mobile KYC is coming in handy for banks to authentic transactions and account opening. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. KYC and AML obligations are nothing new to the legal sector. Latest news reports from the medical literature videos from the experts and more.

Source: sdk.finance

Source: sdk.finance

Law firms need to up their game with regards to Know Your Customer KYC and Anti-Money Laundering AML requirements as the Solicitors Regulation Authority announced that it would be checking in on all 7000 firms that come under the scope of the regulations. The term Anti-Money Laundering or AML refers to a set of procedures and legal regulations that are in place to identify and prevent profit from illegal activities. All BaFins AML requirements as well as administrative fines for non-compliance come from this primary AML law in Germany. It is not intended to be legal analysis or advice nor does it purport to address except in a few instances state or international money laundering requirements that may affect US. Ad AML coverage from every angle.

Source: medium.com

Source: medium.com

Ad AML coverage from every angle. The Anti Money Laundering Directive AMLD is established to fight against money laundering typologies terrorist financing across EU regions. You must document the customer identification procedures you use for different types of customers. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose. The Banking Act supervises financial institutions in the country.

Source: shuftipro.com

Source: shuftipro.com

AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. The directive is regularly updated in order to cope with the latest compliance landscape. Ad AML coverage from every angle. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. KYC and AML obligations are nothing new to the legal sector.

Source: processmaker.com

Source: processmaker.com

In the United States KYCAML requirements are dictated by the Bank Secrecy Act BSA the PATRIOT Act and the Office of Foreign Assets Control OFAC. It is not intended to be legal analysis or advice nor does it purport to address except in a few instances state or international money laundering requirements that may affect US. No KYC requirements have always been an industry standard. The term Anti-Money Laundering or AML refers to a set of procedures and legal regulations that are in place to identify and prevent profit from illegal activities. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures.

Source: bi.go.id

Source: bi.go.id

AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. The Bank Secrecy Act requires financial institutions to provide internal controls ensuring compliance provide independent compliance testing designate an individual responsible for ensuring compliance and provide compliance training. The directive is regularly updated in order to cope with the latest compliance landscape. It is not intended to be legal analysis or advice nor does it purport to address except in a few instances state or international money laundering requirements that may affect US. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures.

Source: shuftipro.com

Source: shuftipro.com

This requirement has now been extended to Corporations like HowToPay that handle Payments and Financial services. All BaFins AML requirements as well as administrative fines for non-compliance come from this primary AML law in Germany. The Banking Act supervises financial institutions in the country. Banks and financial service providers have been taking KYC Identification documents documents in accordance with the guidelines issued by governments from time to time. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose.

Source: medium.com

Source: medium.com

Regulations around the globe are changing due to technological advances financial institutions are bound to follow the guidelines for AML and are required to follow Know your customer checks for remote customer identification. In the United States KYCAML requirements are dictated by the Bank Secrecy Act BSA the PATRIOT Act and the Office of Foreign Assets Control OFAC. The Anti Money Laundering Directive AMLD is established to fight against money laundering typologies terrorist financing across EU regions. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. All BaFins AML requirements as well as administrative fines for non-compliance come from this primary AML law in Germany.

Source: sfl.global

Source: sfl.global

Ad AML coverage from every angle. AMLKYC regulations require banks and other financial institutions such as trust companies insurance companies and brokerage firms to understand who their customers are and what type of transactions they perform. The Sixth Anti-Money Laundering Directive 6AMLD is being launched to replace 5AMLD and 4AMLD. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. Any time a company is established or wishes to sign a contract or work officially with another company there is a legal requirement for some form of KYC or identity verification to take place to ensure that business is being conducted in accordance with the regulations and guidelines.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kycaml legal requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas